The latest in financial #AdviserTech — November 2022

This month's highlights include the launch of a new RIA custodian, Entrustody, along with Orion's announcement of Redtail Campaigns and Riskalyze's plan to rebrand itself.

The November edition of the latest in financial #AdviserTech kicks off with the news that a new RIA custodian — Entrustody — has launched, as independent RIAs continue to clamor for more alternatives than what has now become the “Big 2” of Schwabitrade and Fidelity. As with Altruist, the other new startup RIA custodian to launch in recent years, Entrustody is pledging to have a more modern interface with a better user experience, deeper integrations and a more transparent price structure than traditional custody services.

Notably, though, the reality is that changing RIA custodians still requires the repapering of clients and retraining of staff. The latter cost is still incurred even if firms just add Entrustody as a second custodial platform without moving existing clients. This raises the question of whether Entrustody has enough efficiency improvements to actually convince advisers to switch. Concurrently, competition has already heated up for new advisers (who can pick a new custodian without repapering or retraining because they’re just getting started) with SSG, Altruist, and even Schwabitrade itself pledging no minimums. In addition, a number of new RIA custodial competitors like LPL and SEI are increasingly competing for breakaways as well. This raises the question of whether and where Entrustody may even be able to make a beachhead in a surprisingly crowded marketplace for the few advisers who are in a potential custodial transition.

From there, the latest highlights also feature a number of other interesting adviser technology announcements, including:

- Orion’s Redtail launches Redtail Campaigns in partnership with Snappy Kraken to facilitate CRM-based drip marketing emails.

- Hearsay Systems rolls out a new small-to-midsize RIA platform for social media compliance and website design.

- Riskalyze signals an intent to rebrand itself away from just risk tolerance assessments to a broader focus on helping advisers grow clients and assets.

Read the analysis about these announcements in this month’s column, and a discussion of more trends in adviser technology, including:

- Merrill Lynch launches a new Merrill Match system that downplays an adviser’s geography and focuses more on adviser fit with respect to expertise, meeting preferences and communication style.

- Ezra Group launches a new WealthTech Integration Score for major AdviserTech vendors to help advisers better assess which software has the most meaningful deep integrations.

In the meantime, we’re excited to announce several new updates to our new Kitces AdviserTech Directory, including Adviser Satisfaction scores from our Kitces AdviserTech Research, and the inclusion of WealthTech Integration scores from Ezra Group’s research.

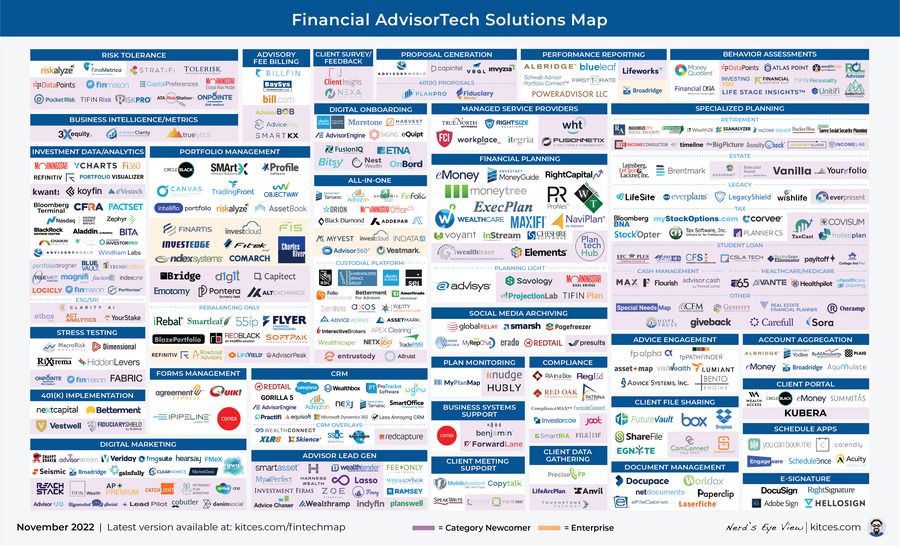

And be certain to read to the end, where we have provided an update to our popular “Financial AdviserTech Solutions Map.”

AdviserTech companies that want to submit their tech announcements for consideration in future issues, please submit to [email protected].

ENTRUSTODY DEBUTS NEW RIA CUSTODIAN; GOLDMAN’S CUSTODIAL LAUNCH FURTHER DELAYED

Nearly three years ago, Charles Schwab ushered in the new era of ZeroCom, cutting its trading commissions on stocks, ETFs and options to $0. At the time, Schwab generated less than 10% of its revenue from trading commissions, while many competitors relied on them for more than 20% of revenue, such that Schwab aptly determined that the cut would allow it both to win retail investors (attracted to zero trading costs) and have opportunities to acquire competitors that couldn’t survive in a ZeroCom era. And sure enough, within just two months, in the fall of 2019, Schwab announced that it was acquiring TD Ameritrade.

From the adviser perspective, though, the Schwabitrade merger made waves immediately. It raised concerns that it would be anti-competitive by concentrating so much of the RIA custodial market share in a single player that Schwab’s immense economies of scale would be able to dominate on pricing and services (especially recognizing that it was Schwab’s ZeroCom pricing strategy that “took out” TD Ameritrade in the first place, and, after the merger, Schwab would just be even larger with more pricing power). Yet, after conducting an antitrust investigation, the Department of Justice concluded that the Schwabitrade merger could go through, giving Schwab the majority of all independent RIA assets.

In the more than two-years since, the question from the adviser industry has been what new or existing players would arrive to take on Schwab, as what was historically the Big 3 (Schwab, Fidelity and TD Ameritrade) came down to the Big 2 (Schwabitrade and Fidelity), with two midsize competitors (Pershing and LPL’s RIA platform), and a very long tail of smaller, more niche-oriented RIA custodians like SSG and TradePMR. The number of new competitors thus far has been relatively sparse, with just Altruist entering as the sole startup competitor, and SEI expanding its existing independent-broker-dealer and trust platform into a full-fledged RIA platform.

Now, the next new entrant has appeared: Entrustody, which debuted on the FinTechX Demo platform stage at the FutureProof wealth festival. In a hyper-competitive space, Entrustody is aiming to differentiate itself on a more modern (i.e., “more intuitive and easier to use”) custodial interface, along with a virtual digital assistant tool that helps to prompt advisers about their next action items. It’s also similar to SEI’s recent offering of a more transparent fee-for-custody type of pricing structure.

The caveat, though, is that notwithstanding a general clamor from RIAs to have more options than just Schwabitrade and Fidelity, it’s not clear whether Entrustody will be able to win away custodial business from the incumbents. The irony is that it’s still so much work to repaper clients and retrain staff on new custodial systems that it will be hard for Entrustody to save advisers more time using it than they’ll lose by switching to adopt it in the first place. Most RIA custodians that have gained business in recent years either did it by having something elseto offer (e.g., historically the Big 3 dangled their custodial referral platforms as incentives to attract large firms), by differentiating with a more niche capability (e.g., SSG with its human service or Equity Advisor Solutions with its ability to support alts), or by pursuing new RIAs when they’re getting started to capture the new-RIA formation (e.g., SSG with its no-minimums platform, and more recently Altriust).

But Entrustody doesn’t appear to have a big incentive to convince existing advisers to switch (or do the additional work to add a new custodian on top of their existing), and capturing the new-adviser space is harder than ever, with Schwabitrade itself now vaunting a no-asset-minimums pledge, on top of existing no-minimums competitors.

In fact, at the same time, Goldman Sachs — which has also reportedly been working on a new RIA custodial offering ever since it acquired Folio Financial nearly two years ago, with an expectation that it would pursue wirehouse breakaways who would value Goldman’s Wall Street brand coupled with an independent RIA platform solution — recently announced that its RIA custodial offering has been even further delayed. Even with all of its resources, Goldman still appears to be struggling with the overhaul of Folio necessary to compete more broadly for larger RIAs and with building out the distribution system and service capabilities necessary to attract larger breakaway teams quickly. This just further highlights how challenging it can be to break into the RIA custody business.

Ultimately, the concentration of RIA assets at a small number of mega-players does highlight a need for greater competition, but the sheer economies of scale needed to effectively compete in the RIA custody business also highlight how difficult it is to break into a highly competitive — and highly commoditized — marketplace. In the end, the real question about having more and better competition in RIA custody is not just getting funding to launch a competitor, but whether companies like Entrustody and Goldman can establish a combination of unique capabilities and a distribution strategy that allows them to make a beachhead when so few advisers want to go through the trouble of making a change in the first place.

For most of our history as financial advisers, growing a client base was a contact sport — literally, by getting out into the community, cold-knocking or attending networking meetings, shaking hands and contacting prospects. It was, in essence, a consultative-sales approach to growth, where advisers would seek to make connections and build relationships with prospects, get to understand their needs and challenges, propose solutions to help them and then turn them into clients who would pay for help to implement those recommendations.

In the traditional sales-driven approach to adviser growth, there was no such thing as marketing. The very idea that you could spend marketing resources to “make the phone ring” was almost comical, analogous to trying to go fishing with a strategy of waiting for the fish to just jump into the boat. As the saying went, “financial services products are sold, not bought.”

However, beyond the financial services industry, “marketing for small businesses” — in particular, email marketing — has become a hot tech category, spawning unicorns like MailChimp and HubSpot that built platforms to make it easy for business owners to begin using email to drip market to their prospective customers. Over time, this expanded into building landing pages, websites and CRM systems to manage the growing base of prospects and customers in a single unified system.

In the financial adviser domain, email marketing systems have been slow to gain adoption. While financial advisers historically have used some drip marketing tactics — for instance, sending a quarterly print newsletter to the names on the business cards that were collected at networking meetings — most financial advisers don’t know how to build an email list online. As a result, the more successful adviser marketing services like White Glove and Snappy Kraken have taken a very done-for-you (or at least, very prebuilt-for-you) approach to marketing.

The challenge, though, is that as email and drip marketing systems gain more popularity, they inevitably become more and more intimately linked to CRM systems. Interactions with marketing leads turn into more involved sales processes as they become bona fide prospects and approach the point of becoming clients, and because most businesses want to be able to keep all their relationships within one system as they evolve from leads to prospects to clients. This is why most email marketing systems (outside the adviser world) end up building email marketing and CRM into a single solution.

Accordingly, it is perhaps not surprising that Orion’s Redtail CRM announced a deeply integrated solution with Snappy Kraken’s email marketing system to facilitate adviser marketing directly within Redtail. Dubbed Redtail Campaigns (powered by Snappy Kraken), the solution will not only facilitate email drip marketing to an adviser’s prospects, but ultimately be capable of bringing a prospect all the way from initial marketing emails to Orion’s planning tools in a “prospect to plan” journey. More practically, the joint venture also means that advisers using Redtail can facilitate more of their email marketing from directly within Redtail and have less burden to log in to multiple systems as often as they may have in the past.

From the companies’ perspectives, the deal makes a lot of sense. Redtail gains the ability to offer a core email marketing capability within Redtail via a partnership and Snappy Kraken benefits from Redtail’s sizable distribution potential with its existing adviser base. For advisers, the deeper integration is quite natural, given the long-standing tie-ins between email marketing and CRM systems.

From the broader industry perspective, though, the deal also highlights how Snappy Kraken and other email marketing systems still operate outside of (and must integrate back to) existing adviser CRM systems. This raises the question of whether the company will eventually build, acquire or merge itself into an adviser CRM system (as most other email marketing systems outside the financial services industry have eventually done, and similar to how Snappy Kraken solved for its website-building needs as well with its Advisor Websites acquisition earlier this year).

For the time being, though, the most significant aspect of the Redtail-Snappy Kraken deal is arguably just the validation of Snappy Kraken, and email marketing more broadly, as highlighted when a company of Redtail’s size and reach hears from its adviser users enough of a demand for modern email marketing that it’s willing to engage in such a partnership in the first place. Suggesting that, after a decade-long slow start, advisers do in fact appear to be slowly but steadily transitioning away from sales-based business development toward a more digital-marketing-centric future to growth.

When social media platforms first began to gain steam nearly 15 years ago, marketers heralded them as the next great channel for marketing, a means of communicating on a one-to-many basis by sharing relevant content that would lead prospective clients to find you, follow you and eventually do business with you.

For the financial services industry, though, the shift to social media was difficult, especially for larger enterprises — e.g., banks, broker-dealers and insurance companies — where any and all communication with prospects is deemed “marketing,” which requires compliance preapproval and archiving of all communication. In practice, this made it almost impossible for compliance teams tooversee a steady flow of social media sharing from a large base of advisers, leading to a more command-and-control approach where enterprises developed a centralized social media marketing strategy that was then implemented through their advisers, who could share the company’s preapproved marketing messages and materials.

To address the unique challenges of enterprises trying to engage with and oversee social media at scale across hundreds or thousands of advisers at once, a number of enterprise social media solutions arose, including Socialware, Actiance, Grapevine6 and Hearsay Social. Built primarily from a compliance perspective, the platforms made it possible for larger enterprises to support at least a limited level of social media engagement across their base of advisers, which over time become more flexible as compliance departments and the supporting technology developed the systems and protocols to monitor and review advisers’ social media activity on an ongoing basis.

Notably, though, because the early social media management systems in the financial services industry were built primarily as enterprise compliance tools to oversee and top-down manage their advisers’ social media activity, adoption among small-to-midsize independent firms was negligible. After all, for a smaller advisory firm, the primary buyer is not likely to be a compliance department that needs to centrally manage and oversee adviser social media activity. Instead, social media tools are more often purchased to support the actual growth marketing process of the advisory firm, or simply to fulfill the review obligation of the firm’s chief compliance officer, who, at many small firms, isthe advisers, who are responsible for overseeing themselves, such that archiving and post-review are sufficient as the adviser-owners don’t need to preapprove themselves.

To help bridge the gap, this month Hearsay announced a new offering specifically targeting small-to-midsize RIAs (i.e., firms with fewer than 50 employees), which effectively packages together Hearsay’s Social (social media compliance), Sites (adviser websites) and Relate (text message archiving) offerings into a single unified solution for RIAs, which can then deeply integrate to Salesforce CRM (for RIAs that use Salesforce).

From the Hearsay perspective, trying to move down-market from the largest enterprises (there are only so many, and the market is largely saturated now as all the enterprises have bought whatever solution they’re going to buy over the past five to 10 years) to the large mass of small-to-midsize RIAs that are still largely untapped in the respective categories that Hearsay serves (e.g., Smarsh and MessageWatcher for social media archiving, a cottage industry of adviser website providers, and MyRepChat for text message archiving).

From an adviser perspective, though, it’s not clear whether or why Hearsay will be able to gain much traction with smaller RIAs. In practice, most firms that engage in social media or text messaging already have a solution (necessary to open the door in the first place), and likewise already have some website provider. In addition, Hearsay does not appear to cover email archiving and compliance — which is typically a separate system within enterprises. This means it will be difficult to displace existing RIA social media archiving tools that advisers typically use for both social and email archiving, as RIAs using Hearsay Social would stillneed their old social media archiving tools for ongoing email archiving.

In addition, because small-to-midsize RIAs are by definition not large enterprises, they don’t tend to have the layers of staff that can utilize the layers of roles and permissions that Hearsay built for its enterprise customers. By bundling the solutions together, advisers would actually have to switch out of multiple systems at once just to consolidate into Hearsay — which doesn’t appear to offer any particular feature advantages to merit consolidation of systems for the individual RIA. Hearsay has not disclosed any kind of pricing that would create cost savings to make the switch worthwhile, which Hearsay simply states will be “competitive.”

Of course, the reality is that Hearsay wasn’t necessarily built for small-to-midsize RIAs in the first place. Hearsay launched to solve enterprise-scale problems, for which it built an enterprise-scale solution — and so it’s not necessarily surprising that its multilayer-compliance-centric feature set wouldn’t be as appealing for the under-50-employee independent channel. At the same time, it highlights that as a result, pivoting down-market with an enterprise solution isn’t just a matter of repackaging or rebundling existing solutions to offer the RIA marketplace, but a more wholesale rebuilding of the enterprise offering to better fit into the typical (and different) technology infrastructure of independent RIAs.

When Riskalyze first arrived on the AdviserTech scene more than 10 years ago, the category of risk tolerance software was a sleepy corner of the AdviserTech Map, in which the only real competitor was FinaMetrica’s risk tolerance questionnaire. Most advisory firms simply used their own compliance-built questionnaires to do a basic assessment of the client’s tolerance for risk to ensure that their investment recommendations were “not unsuitable.”

But within just a handful of years, Riskalyze became the dominant player in risk tolerance software, leading to what was at the time an eye-popping $20 million round from FTV Capital in 2016 when virtually no AdviserTech companies had ever raised any capital from a private equity firm. This spawned nearly a dozen competitors trying to take down Riskalyze by offering what they claimed was an ever better way of assessing the client’s tolerance for risk.

Yet the reality is that Riskalyze didn’t actually build its size and market share by being a risk tolerance assessment tool, per se, because a formal assessment is something that advisers do as a compliance requirement with existing clients in order to invest their assets. Riskalyze’s success was driven primarily by advisers that used Riskalyze with their prospects instead. The reality is that virtually every self-directed investor overconcentrates and under-diversifies their investments, such that nearly every prospect an adviser would ever have will see via Riskalyze that their current portfolio is taking far more risk than they can actually tolerate. For which, the adviser’s solution will inevitably score better than what the prospect currently has if only by virtue of being more appropriately diversified.

In other words, Riskalyze was never really risk tolerance software. It was an investment proposal tool for prospects that happened to use its Risk Number system as a framework to facilitate the conversation and help advisers grow (and because Riskalyze helped to generate new revenue, it was also able to charge significantly more than its competitors.). Over time, Riskalyze built even more tools to help advisers analyze their prospects’ portfolios to craft more targeted recommendations, then implement those recommendations with new clients (via Riskalyze Trading), and then monitor on an ongoing basis with Client Check-Ins and the ability for compliance to oversee and ensure that clients remained invested consistent with their risk tolerance.

In that vein, it’s perhaps not surprising that at its recent Fearless Investing Summit, Riskalyze CEO Aaron Klein announced that the company is planning a rebrand in 2023. Riskalyze will remain the product name for its risk assessment tool, but the company itself will receive a new, yet-to-be-determined name that fits its broader focus on being a “growth platform” that helps advisers add and retain clients and assets (by plugging into their CRM, investment platform and financial planning software solutions).

From the Riskalyze perspective, the rebrand makes sense. Ultimately, when the company’s value proposition — and its pricing — is built around its ability to help advisers turn prospects into clients and add revenue, being known as a “risk tolerance assessment” solution (which is only used once prospects have already become clients, and which most advisers still get, for free, from their home office/compliance departments in the first place) can become limiting. Rebranding around being a platform for prospecting, investment proposals and more generally for “growth in clients and assets” can help Riskalyze better align its messaging to what it is actually being bought for. In addition to opening new avenues for other strategic partnerships and deal-making (e.g., Riskalyze acquires Snappy Kraken to bundle its investment proposal and prospect engagement tools with Snappy Kraken’s marketing funnels and landing pages, or acquires VRGL to package its analysis of prospects’ investments with Riskalyze’s analytics).

From the broader industry perspective, Riskalyze’s rebrand to move out of the risk tolerance category simply helps to cement why its competitors were never successful in unseating Riskalyze as the dominant player. Even Riskalyze wasn’t primarily competing in the category itself. Instead, Riskalyze now becomes more squarely positioned where the bulk of new investments are going into the AdviserTech Map in the first place — proposal generation, digital marketing and adviser lead generation, all focused around helping advisers grow.

Ultimately, though, the biggest question for the Riskalyze rebrand will simply be whether the adviser marketplace allows Riskalyze to rebrand. The company is very well known for its Risk Number and the core risk assessment tools that it’s built, such that Riskalyze will have to finely thread a needle between distancing itself enough from the Riskalyze name to go beyond risk tolerance, but not so far that it loses the decade of brand equity it’s built in the first place. To its credit, Riskalyze seems committed to getting the transition right, going so far as to hire the legendary Lexicon Branding (of Swiffer, Febreze and Intel’s Pentium fame) to determine how to name Riskalyze’s future.

One of the biggest challenges of being a financial adviser is that advice is an invisible, intangible service. Consumers can’t pick it up, shake it, see how it feels in their hands or try it out first. Instead, no one knows if it will be any good until after they’ve gone through the process and received the advice. Because the quality of advice is almost entirely reliant on the knowledge and skills of the adviser — which up until that point, are also unknown to the consumer — in practice, it’s extremely hard for the typical consumer to even figure out who will be a good adviser.

The end result of this dynamic is a frustrating and time-consuming process for consumers just to pick a financial adviser in the first place. There’s no way to know upfront who’s a good adviser and who’s not. At best, consumers have to seek out, reach out to, meet with and interview multiple advisers, just to find out for themselves who feels like a good fit. This can take hours upon hours of research for consumers who by definition are typically looking to delegate rather than do all this work for themselves in the first place.

Just creating a list of advisers tovet is a challeng. Advisers are so indistinguishable to consumers, at least until they’ve met for the first time. Most consumers don’t even get their initial list of advisers based on the adviser’s capabilities. Instead, they choose advisers based on convenience. Thus, the primary criterion for adviser searches on most find-an-adviser websites is not the adviser’s expertise but their zip code. This means the primary way that consumers find a good adviser is simply based on whether the adviser’s office happens to be conveniently located relative to the consumer’s home or office, rather than based on their actual expertise to solve the consumer’s problem.

The problem is so challenging that one recent survey found that nearly half of consumers who chose not to work with an adviser didn’t do so because they dislike advisers. Instead, it was either because they couldn’t figure out how to find the right adviser (22%), they found it intimidating to have to reach out to advisers initially just to get to know them (14%), or they just couldn’t figure out how to find an adviser who actually understood their unique needs (10%).

So it was notable that Merrill Lynch announced the rollout of a new adviser-prospect matching tool to help consumers more easily find the right (Merrill) adviser. The platform, dubbed Merrill Match, deliberately eschews geography as the main criterion for searching for prospective advisers. The tool invites consumers to share their general background and situation (e.g., are you a business owner, are you reaching out because of retirement or some other life transition), meeting preferences (e.g., in person versus virtual, frequency of meetings, and whether in-person meetings would be at the adviser’s office or the consumer’s home or office), and communication and relationship style (e.g., prefer meetings to be all-business or more social, talking mostly about investments or more holistically, prefer to see lots of visuals or hear more explanations from the advisers themselves). Ultimately, the tool does ask about the consumer’s location (and whether they even wanta local adviser or are comfortable working remotely with an adviser anywhere in the country), and provides matches based on those geographic preferences, but only at the end, after going through the process of inquiring about other preferences first.

The Merrill Match tool is ultimately specific to Merrill’s business and its advisers and does have a unique dynamic because of the Merrill brand. By the time consumers arrive, they’ve likely already decided they trust Merrill and wanta Merrill adviser. So the consumer doesn’t have to be sold on a Merrill adviser. The question is simply which of the firm’s nearly 15,000 advisers is the right fit. It’s still striking that based on Merrill’s own years of research in building the Match tool, the biggest driver in determining fit to ensure a good match is a combination of the client’s expertise need (e.g., business owner, corporate executive, prospective retiree), and their communication and meeting preferences (to ensure a good interpersonal fit between the adviser and client).

From the broader industry perspective, this in turn raises the question of whether other adviser-lead-generation tools — from the third-party lead-generation tools to the various find-an-adviser website tools, to any multi-adviser firm that has different advisers with different personality types — would do better to identify client meeting and communication preferences upfront to help increase the likelihood of a personality match and not just a match based on geographic convenience. In the end, when consumers still struggle to identify who is a good adviser, in practice they’ll tend to revert back to “which adviser do I feel a personal connection and rapport with,” as Merrill’s own tool highlights.

In the long run, though, perhaps the greatest challenge is simply that matching consumers to the right adviser based on their preferences requires advisers to get clear on their own preferred style of working with their clients, and which types of clients — by expertise, and communication and meeting preference — are the best fit for them. This will require a rather fundamental shift for most advisers, away from simply trying to serve anyone and everyone they meet, to instead getting clear on who their ideal clients are, and making it easier for ideal clients to find their way to the adviser instead. Stated more simply, algorithms can’t help consumers differentiate between advisers until advisers get comfortable actually differentiating themselves first.

EZRA GROUP LAUNCHES WEALTHTECH INTEGRATION SCORING TO HIGHLIGHT ‘REAL’ IN-DEPTH INTEGRATION

One of the great boons of the internet was the rise of the application programming interface, or API. Up until that point, most software had no efficient means to integrate with other software, at best relying on multiple tools, installed on a local computer or server, to be able to share common files that would break when one software went through updates while the other had not yet mailed out disks for its own respective update. However, publishing software to the internet (where updates are instantly propagated to everyone), combined with the interconnectivity of the internet, made it possible for the first time for software tools to build connections more directly to one another through a standardized API protocol.

From an AdviserTech perspective, the rise of the API was an enormous boon to independent AdviserTech software, and more generally to the independent adviser channel. In the past, it was the largest financial services enterprises, with the largest adviser bases and the largest technology budgets (that could be amortized across all those advisers), that could produce the most comprehensive and internally integrated all-in-one solutions. However, in the era of the internet and APIs, suddenly independent software solutions could all integrate with each other directly, producing independent AdviserTech platforms with tens of thousands of users, far more than what any one individual enterprise could ever accomplish. This meant that independent advisers had access to technology tools with even moredevelopment resources than the advisers at large enterprises.

The caveat, though, is that the average independent adviser has little capacity to evaluate and vet the qualityof those API integrations, even as more advisers have clamored for more and better integrations across the adviser tech stack. The end result has been a proliferation of shallow integrations where some vendors build basic integrations from one tool to another (e.g., a single-sign-on integration that lets advisers log into one system from another but doesn’t actually doanything) to say and show that they have a “broad range of integrations.” The caveat is the integration doesn’t actually doanything meaningful to make the adviser more efficient. Most advisers don’t discover until after they’ve made the switch whether it’s really a meaningful integration or not.

To help sort out the good integrations from the shallow, AdviserTech consultant Craig Iskowitz of the Ezra Group announced the launch of new “WealthTech Integration Scores,” that for the first time will actually grade software vendors on their integrations. In practice, scores will be based on a combination of integration breadth (the number of integrations, particularly to key applications that commonly form adviser hubs such as CRM, portfolio management, planning software and major custodians and broker-dealers), on depth (how substantive the integrations actually are, from basic SSO pass-throughs to one-way data sharing, bidirectional data flows and the ability to actually trigger cross-application events and workflows based on the API), and on their overall technical capabilities (e.g., cybersecurity, quality of the API documentation, support for developers building integrations to the software). Integration scores will be available directly on the Ezra Group website, and are also now embedded directly into the individual software profiles on the Kitces AdviserTech Directory.

From an individual adviser perspective, the opportunity to see in one place the integration scores for any and all vendors the adviser may be considering should help shortcut the process of evaluating potential tech vendors. Notably, though, Ezra Group’s Integration Scores are still an average based on the breadth and depth of all the vendor’s integrations, and not any one in particular. As a result, a vendor with a high score could still have a weaker integration to a specific application the adviser uses (and vice versa for a low integration score that is still good for the adviser’s one preferred solution). Therefore, integration scores will likely be most useful for advisers picking their hub systems (e.g., CRM, portfolio management tools, planning software), who want to be certain they’re picking a hub that has a good breadth and depth of integrations (which increases the likelihood that any particular solution they want to be integrated with in the future will have a good integration).

From the broader industry perspective, Ezra Group’s WealthTech Integration Scores will arguably create some much-needed transparency regarding the quality of certain vendors’ integrations, particularly to address the broad but shallow integration phenomenon that has frustrated so many advisers. This may hopefully lead AdviserTech firms to focus on fewer, more meaningful integrations, given that integration scores have a much higher weighting to integration depth over raw breadth that both improve their integration score in the AdviserTech Directory and actually improve adviser efficiency.

At the least, though, Ezra Group’s WealthTech Integration Scores provide a new foundation by which advisers can vet their adviser technology for its integration capabilities, and express their own preferences about how important it is to have a higher integration score (versus simply being a best-in-class tool inits software category, regardless of integrations). In the end, integrations will likely be more important for some tools (e.g., CRM systems that need to integrate to almost everything) than others (such as specialized planning tools that at the most just need to integrate back to the adviser’s main financial planning software). Now advisers will have a better basis to make that choice for themselves.

Note: AdviserTech vendors that want to receive an Integration Score for their software can go here to submit their required information for evaluation by Ezra Group.

In the meantime, we’ve rolled out a beta version of our new AdviserTech Directory, along with making updates to the latest version of our Financial AdviserTech Solutions Map with several new companies (including highlights of the Category Newcomers in each area to highlight new fintech innovation.

So what do you think? Will Entrustody be able to gain market share from the existing RIA custodians? Are you a Redtail user who’s going to check out the new Redtail Campaigns partnership with Snappy Kraken? Is it useful to you to see integration scores for all the major AdviserTech providers?

Michael Kitces is the head of planning strategy at Buckingham Strategic Partners, co-founder of the XY Planning Network, AdvicePay and fpPathfinder, and publisher of the continuing education blog for financial planners, Nerd’sEye View. You can follow him on Twitter @MichaelKitces.

Learn more about reprints and licensing for this article.