The latest in financial #AdviserTech — January 2021

The big news, announcements and underlying trends emerging in the world of technology solutions for financial advisers!

This month’s edition kicks off with the big news that storied Silicon Valley venture capital investor Sequoia Capital is investing $45 million in Vise, a new tech-enabled TAMP looking to capitalize on the emerging trend of direct and, more importantly, custom indexing, in which advisory firms use technology to create portfolios for clients that are customized down to the individual stock level (eschewing mutual funds and exchange-traded funds). Vise hopes that advisers will be willing to outsource the subsequent implementation of that portfolio for a 0.50% fee. But in the end, it’s still not clear if custom indexing will ultimately be a TAMP solution — with the basis-point fees — or if the technology will eventually make it so easy and efficient that advisers can just do it themselves with the software they purchase for a flat software fee?

From there, the latest highlights also feature a number of other interesting adviser technology announcements, including:

• JPMorgan acquires 55IP’s rebalancing and model management software in the hopes that tax management overlays will be the new model marketplace differentiator.

• FMG Suite acquires Twenty Over Ten to expand into the realm of digital marketing automation for advisers.

• MassMutual acquires Flourish Cash as AdviserTech solutions increasingly become viewed as the pathway to the RIA channel.

• The SEC’s new RIA marketing rule may kick off a new wave of Adviser Review and Rating sites to capitalize on the new opportunity to leverage client testimonials.

Read the analysis of these announcements in this month’s column, as well as a discussion of other trends in adviser technology, including Advyzon’s launch of a new prospect portal, highlighting the benefits of creating simpler extensions of adviser software for specific use cases; Morningstar’s integration of FinaMetrica into its investment proposal tool as a way to at least partially compete against Riskalyze; FA Match’s raising of seed capital for a platform to help brokers find new (and better-matching) broker-dealers; and Pulse360’s launch of a new task automation tool to turn post-meeting adviser notes directly into after-meeting action items and takeaways.

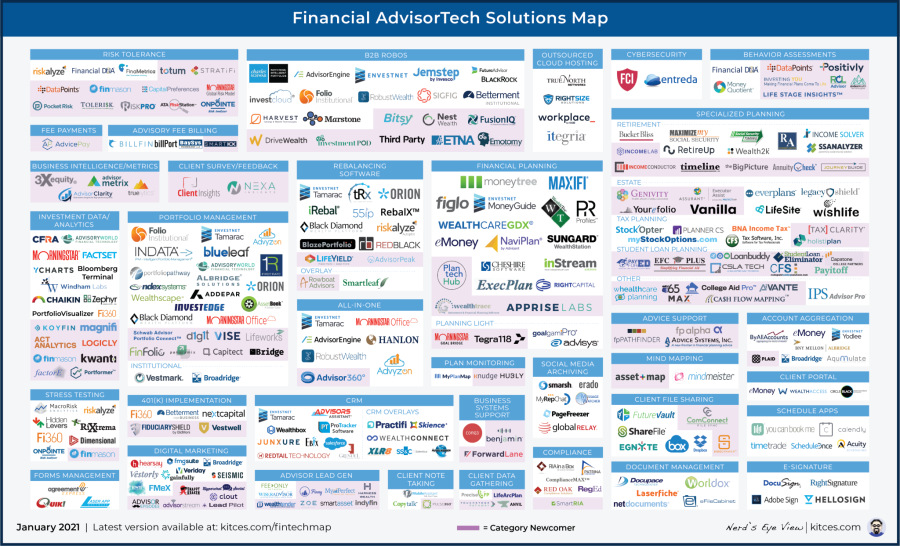

Be certain to read to the end, where we have provided an update to our popular Financial AdviserTech Solutions Map!

I hope you’re continuing to find this column on financial adviser technology to be helpful! Please share your comments at the end and let me know what you think!

#AdviserTech companies that want their tech announcements to be considered for future issues, please submit to [email protected]!

Vise raises $45 million Series B for custom indexing TAMP, but can it attract assets fast enough? Initially, the robo-adviser was envisioned as an alternative to the human financial adviser, built around the premise that financial advisers were primarily in the business of portfolio construction and that technology could automate the process at a fraction of the cost. However, the reality is that financial advisers have long leveraged technology to facilitate the portfolio design process, which today amounts to barely 10% of a financial adviser’s time, and most of what financial advisers do is about delivering additional advice beyond ‘just’ the portfolio, managing client relationships, and managing and growing the advisory business itself. The realization that robo-adviser technology wasn’t actually a competition to the adviser value proposition but, instead, was simply an alternative technology platform for the tools that advisers already used to manage portfolios led to a second stage of “robo-advisers-for-advisers,” repositioning “robo” tools as model management software (and eventually as model marketplaces with asset managers bidding to vertically integrate and get their ETFs into the advisers’ models). Yet, in the end, model software isn’t capable of just managing a model portfolio of ETFs efficiently, but any model — even and including one with positions down to the individual stock, facilitating the rise of “direct indexing” and the use of software to replace mutual funds and ETFs with a software-driven solution that buys the components of the fund directly (and disintermediates the fund provider in the process). Except once the software is managing every client portfolio down to the individual stock and bond, it’s no longer necessary to hold just the index fund, and instead becomes possible to use the software to customize the index, for situations ranging from applying factor tilts (e.g., small-cap and value), ESG preferences (e.g., screen out tobacco stocks and overweight green energy), or to build around unusual client circumstances (e.g., a completion portfolio around the client’s existing concentrated holding). Accordingly, earlier this year, Vise.ai announced a $15 million Series A to do just this — offering a technology-driven custom indexing solution in the form of a sub-advisory TAMP relationship where Vise provides the software for the adviser to specify the client’s customized portfolio (which Vise then implements). And now, just seven months later, Vise has announced a follow-up Series B round for a whopping $45 million, led by legendary Silicon Valley VC Sequoia Group (an investor in companies from Apple to Google, PayPal to LinkedIn, Instagram to WhatsApp, and more recently Airbnb and DoorDash), which appears to be making a very big bet on the future of custom indexing among financial advisers (and the RIA community in particular, where Vise is at least initially focusing). Yet while custom indexing shows real promise among advisers — notwithstanding the very real challenge that technology may make the portfolio construction process efficient, but custom portfolios for every client actually makes client review conversations especially inefficient — it’s unclear whether Vise can really grow fast enough to justify what may have been a $100 million-plus pre-money valuation (assuming a roughly one-third dilution in its latest round). After all, with a fee schedule of 0.50%, Vise would need to quickly raise $5 billion of AUM just to justify a $100 million valuation even at a multiple of 4X revenue (which would be very generous for today’s low-margin TAMP business!). And even though Vise announced over $800 million of “commitments” among advisory firms in May, it still only reports barely $10 million of total AUM on its Form ADV as of its latest October update. As ultimately, Vise’s differentiator may be its custom indexing technology capabilities, but in the end, it is functioning as a TAMP in the asset management (not the technology) distribution business, with a value proposition that would implicitly mean changing every client’s portfolio (in order to make it more customized using the Vise tools), which is challenging both administratively (as every client signs an updated Investment Policy Statement and subadvisory agreement for Vise), conversationally (as the adviser has to explain each new portfolio to every client), and tax-wise (as a 10-year bull market means most clients have substantial embedded gains). Nonetheless, the opportunity for custom indexing to disintermediate and replace the existing world of mutual funds and ETFs as the building block of client portfolios means there is a substantial opportunity ahead — which makes it easier to understand why a firm of Sequoia’s size and scope would be interested. Still, though, the key to success, in the end, may not simply be Vise’s technology… but its ability to execute the hyper-competitive last mile of asset management distribution?

JP Morgan acquires 55IP as tax management becomes the new model marketplace value-add? When BlackRock acquired then-robo-adviser FutureAdvisor in 2015 for $150 million — a whopping 50X multiple on its then-estimated $3 million of revenue — many advisers scratched their heads in wonder at how a low-fee robo-adviser could be valued so highly. The reality, though, was that BlackRock didn’t acquire FutureAdvisor for its direct-to-consumer revenue, but as an opportunity to pivot the technology to the financial adviser channel … and more importantly (for BlackRock), as a way to better ensure that the models advisers were implementing included BlackRock’s iShares ETFs (by literally embedding them into FutureAdvisor’s default models for advisers). In turn, BlackRock’s success with FutureAdvisor, and more generally in recognizing that AdviserTech was becoming a distribution channel unto itself, led to a veritable explosion of asset managers acquiring technology solutions to facilitate model marketplaces (and the potential for the asset manager’s funds to be placed into those models), including Invesco buying JemStep, Principal acquiring RobustWealth, WisdomTree buying AdvisorEngine (nee Vanare) and more. Yet the irony is that, in the end, the sudden ubiquity of technology to facilitate model marketplaces created a distribution challenge unto itself, as advisers suddenly couldn’t distribute one platform from another, and most simply chose whatever was already available and convenient, including the OG model marketplace Envestnet (which BlackRock itself took a subsequent stake in, in 2018), and leading to the demise of upstarts like Oranj that struggled to gain market adoption in a competitive marketplace. But now JPMorgan has announced the acquisition of 55IP, throwing its hat into the ring of asset managers that buy trading and rebalancing tools that facilitate the implementation of model portfolios for advisers (and the distribution of the asset manager’s own funds, as JPMorgan partnered with 55IP to distribute JPM Asset Management models back in October). In the competitive marketplace, JPMorgan appears to be betting that 55IP’s positioning as a particularly “tax-savvy” model management tool, which included not just tax-loss harvesting capabilities but also “tax-aware withdrawals” and “tax-aware transitions” (for clients that come to the table with existing investments that have significant embedded capital gains), will allow it to gain adoption and market share, both in the RIA community (where 55IP is currently focused) and in the broker-dealer community (as JPMorgan has indicated a plan to go beyond just 55IP’s existing RIA channel exposure). From the adviser perspective, the question will still be whether 55IP’s tax-aware tools are really differentiated enough from the rest to be worth making a change given the sheer switching costs of changing trading and model management solutions (and perhaps making it even more appealing for JPM to pivot 55IP into the broker-dealer channel where rebalancing software has a lower existing adoption rate and therefore more opportunity to gain new market share instead of trying to draw advisers from existing solutions). From the JPMorgan perspective, the challenge will similarly remain that — as Oranj itself demonstrated — model marketplaces are not an “if you build it, they will come” solution, and distribution will remain a challenge (even if in the form of AdviserTech and not traditional asset management distribution). Still, though, the cost of even acquiring an entire technology firm can still pale in comparison to the existing costs of distribution — including and especially to the existing model marketplaces, and Envestnet itself — which means if JP Morgan can be successful, there is likely still room for it to generate an ample return on investment to vertically integrate its own model marketplace instead of paying to be distributed through others. Nonetheless, in the end, it will still come down to adviser adoption of the platform, otherwise known as adviser distribution… which means JP Morgan’s asset management team may simply be trading one kind of (asset management) distribution challenge for another (AdviserTech-based) one instead. Time will tell which is the easier nut to crack.

Franklin Templeton’s AdvisorEngine partners with Apex to launch white-labeled robo for advisers, but it takes two to tango. After BlackRock acquired FutureAdvisor in 2015 and signaled to other asset managers the opportunities in using a robo-adviser as a vertically integrated distribution channel to advisers (by offering advisory firms the technology and having the robo models by default map to the asset manager’s own ETFs), it set off a flurry of similar acquisitions, including Invesco buying JemStep, Principal acquiring RobustWealth and WisdomTree buying AdvisorEngine (nee Vanare). Yet the challenge was that most advisers — already affiliated with and using their RIA custodian or broker-dealer’s investment platform — didn’t necessarily want yet another piece of technology in their investment management stack, and as a result, adoption was often lackluster. In the case of AdvisorEngine, this led to the company ultimately taking additional capital from WisdomTree to acquire adviser CRM provider Junxure in 2018, in the hopes of converting Junxure users to AdvisorEngine users. After two more years of struggling adoption, WisdomTree eventually threw in the towel, taking a nearly $20 million write-down on AdvisorEngine, and selling it to Franklin Templeton earlier this year. Now Franklin Templeton has announced its initial relaunch of AdvisorEngine, now packaged into the form of a continuously recalibrating client-specific asset allocation glidepath that it has dubbed its Goals Optimization Engine, and partnered with Apex to offer a new all-in-one-including-onboarding-and-custody white-labeled robo solution for advisers called Tango. On the one hand, Franklin’s partnership with Apex allows it not just to operate as an overlay software but actually facilitate the entire end-to-end implementation for the adviser’s client, from onboarding to ongoing management. On the other hand, the reality is still that most financial advisers — at least and especially those with existing assets under management that Franklin would want to target for their asset-gathering potential — typically already have an existing broker-dealer or RIA custodian and won’t necessarily want to switch or create yet another custody/clearing arrangement, especially if it’s being used for just a segment of their smaller robo-style clients. In fact, the irony is that AdvisorEngine itself had partnered early on with Apex in its original strategy back in 2016 … and struggled to gain adoption, in part because advisers didn’t want to introduce another custody relationship. Which raises the question of whether Franklin Templeton has a yet-unrevealed idea about how to suddenly succeed in an Apex partnership where AdvisorEngine previously failed, or if it simply hasn’t studied the lessons of the past and is about to repeat it. In the end, even if Tango is otherwise an efficient stand-alone solution to help advisers easily automate the process of managing portfolios for their smaller clients robo style, it takes two to Tango, and it’s not clear whether or why advisers will suddenly want to introduce a new multicustodial relationship, particularly if Franklin is targeting the subset of an adviser’s clients who are already a lower priority for the advisory firm (such that they’re looking to implement a simplified robo solution for those clients in the first place).

MassMutual acquires Flourish Cash as insurers try to sidle closer to RIAs. A near-decade of near-zero interest rates has, for most investors, doubled down on the view that “cash is trash,” something to be minimized to the extent possible in order to remain “fully invested” (for a better-than-zero return potential). Yet the reality is that historically cash has, in fact, been both an asset class unto itself, and something providing at least reasonable yield, though today it seems hard to remember that just 20 years ago, savings accounts yielded upward of 5% (and the 10-year Treasury yield was over 6%!), leading to a world where investors would “shop for yield” by moving their cash from one bank to another in search of better rates. In the decades since, though, we’ve witnessed the rise of the internet and a world where shopping for yield is no longer about beating the streets to move cash from one bank to the next but instead just electronically transferring it around in seconds … leading to a veritable explosion of digital cash management solutions for consumers in 2019, from a controversial initial foray from Robinhood, to Wealthfront, (which nearly doubled its assets under advisement in a year with its new Wealthfront Cash offering), Personal Capital and Betterment EveryDay. In turn, the growth in demand (and astonishing flow of assets) for those providing a barely better-than-zero cash management offering led to an uptick in demand from RIAs as well, driving growth in the niche of “cash management” platforms for RIAs that facilitated and even automated the process of moving RIA client cash from one bank program to another in search of higher yields. Such platforms included early pioneer MaxMyInterest, followed by Galileo Cash (until SoFi acquired it), Stonecastle’s FICA For Advisors, and the more recent entrant Flourish Cash. Now Flourish has announced that it is being acquired by insurer MassMutual. Nominally, the acquisition should allow Flourish access to greater resources from MassMutual, from the company’s financial capital to build more integrations to its clout and bargaining power to strike more and better deals with banks to get even better yields for its RIA clients. From MassMutual’s perspective, though, the deal represents an opportunity for the old-line life insurance company to get closer to the RIA channel … the most rapidly growing segment of the adviser ecosystem, and a particularly tough nut for legacy insurers to crack, given their roots in distributing their insurance products through their own (competing) captive agents, and the RIA channel’s aversion to commission-based insurance products. Which in turn makes it all the more appealing for MassMutual to have an initial connection to RIAs not directly through the insurance channel, but through the fintech platform they use to manage client cash via Flourish, as AdviserTech increasingly becomes a distribution channel unto itself for financial services product manufacturers. In the long run, it’s still hard to see how a 170-year-old insurance company can change its stripes and not eventually try to use Flourish to distribute the life insurance and annuity products that it manufactures. It has already announced that it plans to deliver “exciting new Flourish modules to advisers in the coming months,” although given the reality that MassMutual is one of the few remaining mutual insurance companies and not subject to the same pressures from Wall Street, it has more ability to play the slow/long game (i.e.., allowing Flourish itself to flourish in the RIA channel with other noninsurance solutions before pivoting to insurance). And with last year’s IRS private letter ruling allowing the creation of fee-based annuities where RIAs bill their own advisory fees directly from the annuity (without triggering a taxable event), perhaps it simply means that MassMutual is preparing to work with Flourish to create an entirely new version of (tech-enabled) fee-based insurance and annuity products that may be more appealing to the RIA community and their clients?

Advyzon creates ‘simplified’ prospect portal to digitize initial data gathering and expedite document sharing. The “client vault” was one of the most promising, and the most frustrating, technological advances of the past decade. On the one hand, the appeal of advisory firms offering clients their own digital vault to store documents was that it could both facilitate document sharing — for the advisory firm delivering reports to clients, for clients providing documents (e.g., updated tax returns) to their advisers, and more generally for clients to use the vault as a repository (and in the process, making the client more dependent on the adviser’s services and thus more sticky for retention purposes). Yet in practice, most advisory firms have struggled with lackluster adoption of their client vaults, in some cases due to clients not being so tech-savvy in the first place, but more often simply because most clients already have their own document storage solution in the first place, that they don’t necessarily want to leave and replace. And because client vaults support so many different functions and use cases, in practice they tend to be a bit cumbersome, which in turn just further reduces adoption by clients, and can make them especially burdensome for prospects (who haven’t yet committed to the adviser, and therefore will only go so far to acquiesce to the adviser’s systems). Which makes it notable that this month, Advyzon (which makes an all-in-one combination of portfolio performance reporting and adviser CRM solution) announced a new version of its portal, specifically designed to work with prospects. At its core, Advyzon’s new prospect portal is still just a system for sharing personal information and key documents, but is designed specifically for prospects (as distinct from its existing secure digital vault for existing clients), with initial fact-finder questions and then an easy way to upload requested documents, all enabled from a simple custom link that advisers can email or even text to their prospects. In essence, then, the Advyzon Prospect Portal is a form of single-use case portal… albeit for a particular use case that is both valuable (tools to facilitate bringing in new clients and new revenue are always high-value to advisers), especially in need of a good user experience (as existing clients may be at least somewhat tolerant of technology hiccups once they’re already clients, but for prospects it’s essential to have a good first impression), and one where integration to the adviser’s CRM (which Advyzon provides) is especially appealing (effectively allowing prospects to directly enter their own data into the CRM, rather than compelling a double-data-entry process by the adviser themselves, or requiring advisers to use a third-party solution like PreciseFP to facilitate the data-gathering-to-CRM process). In a world where adviser technology in particular suffers mightily from feature bloat as more advisers ask for more features — and it all gets crammed into one system — Advyzon deserves kudos for recognizing that sometimes, less is more when it comes to building solutions to solve for a particular adviser use case?

Digital marketing for advisers heats up as FMG Suite acquires Twenty Over Ten and its Lead Pilot marketing automation tool. The Putnam Social Media survey has shown a slow but very steady rise in the adoption of social media among financial advisers as marketing increasingly shifts from its historical analog roots of networking meetings and in-person events to websites and the digital realm. Yet in practice, stories of financial advisers who actually successfully built and scaled their firms in the realm of digital marketing are still few and far between, in large part because digital marketing success is ultimately not just a matter of showing up on social media or having a website as a digital storefront, but actually engaging in the process of marketing digitally… by capturing information from leads, and nurturing them over time until they’re ready to engage. And in practice, while there are many website providers for financial advisers and a plethora of social media platforms, the entire category of marketing automation tools for financial advisers (the industry-specific versions of generic alternatives like MailChimp, ActiveCampaign, Marketo or Pardot, to actually facilitate that lead-capture-and-lead-nurture process) have been largely nonexistent… a gap that in just the past few years, a new wave of marketing automation startups for financial advisers, from Snappy Kraken to AdvisorStream, have been looking to solve. However, in the end, a stand-alone marketing automation tool — even one specific to advisers — still isn’t necessarily helpful until the advisory firm also has a strong adviser website (or some other means to generate new prospects into the top of that funnel). Accordingly, earlier this year adviser website provider Twenty Over Ten announced the launch of Lead Pilot, which nominally was available as a stand-alone solution but primarily represented an extension of Twenty Over Ten from “just” adviser websites more squarely into the realm of marketing automation tools (a form of adviser-industry-specific MailChimp). And now FMG Suite, one of the largest providers of adviser websites in the independent broker-dealer channel and fresh off a new round of private equity with Aurora Capital Partners, has announced that it is swallowing up Twenty Over Ten (and Leadpilot) whole. To some extent, the merger simply represents an expansion of FMG Suite’s market share for adviser websites, including a new deeper reach into the independent RIA (where Twenty Over Ten was better known, but FMG has limited adoption). In addition, FMG gains a new Content Management System (CMS) for building adviser websites — one that is built for more adviser-by-adviser customization (given Twenty Over Ten’s work in the RIA channel that doesn’t have the need/desire for a more standardized look as many independent broker-dealers require). But perhaps most significantly, FMG gains Leadpilot and an opportunity to extend its existing adviser website base horizontally into the realm of digital marketing automation tools and complement its Curator social media tool. Notably, though, the evolution of marketing automation tools themselves has been to expand further and further into CRM systems, from Hubspot building its own CRM tools to Salesforce acquiring ExactTarget/Pardot… raising the question of whether FMG Suite’s next acquisition will be a major adviser CRM system (from Redtail to Wealthbox, or perhaps Junxure which Franklin Templeton acquired alongside its AdvisorEngine purchase) to complete the FMG digital marketing ecosystem, or if instead it will be content to build deep integrations to Salesforce (which dominates the enterprise broker-dealer market where it already has the most penetration)?

FA Match raises $1 million pre-seed to help brokers select among the sea of broker-dealer sameness. According to Finra, there are more than 3,500 different broker-dealers, with a wide range of specialties from local to regional to national firms, those focused in particular areas from municipal securities to IPOs and private transactions to broad investment platforms, and an overall trend toward increasingly open architecture among independent broker-dealer that allows a broker to do almost anything with almost any major firm, which in practice makes it almost impossible for any particular broker looking to change broker-dealers to figure out which one is best for them in a sea of sameness. In reality, though, broker-dealers do have more variability, from providing the ability to be a hybrid adviser with an outside RIA (or the requirement to use the broker-dealer’s own corporate RIA instead), to their flexibility in accommodating rep-as-PM preferences (for brokers who prefer to self-manage) to those that offer (or require the use of) in-house model portfolios, firms that offer alternative investments to those that skew toward more traditional offerings, those that offer (or require the use of) particular technology solutions versus those that allow advisers more flexibility, and those that already house at Pershing or NFS or not (which impacts the extent to which clients may be disrupted by the change)… not to mention the typical type of broker they serve (and the depth of practice management support they provide for that particular model), and of course, differences in payouts (which themselves may vary depending on the broker’s product mix), various technology or platform fees, forgivable notes and other recruiting incentives, and more. To help navigate this landscape, a crop of “independent” recruiters have emerged in recent years to help brokers select from among the various options and try to find the best fit. The caveat, though, is that broker-dealer recruiters are typically funded by the broker-dealers, which pay a commission upon ultimately winning the broker’s business … potentially leading to situations where the recruiters themselves have an incentive to recommend one broker-dealer over another based on the recruiter bonuses they pay. In this context, it’s notable that Ryan Shanks, the founder of Finetooth Consulting (a long-standing broker-dealer recruiter) two years ago launched FA Match with the goal of broadening and leveling the broker-dealer recruiting field by charging a single flat fee to help brokers find and select the right new broker-dealer, utilizing Shanks’ experience in how to slice and dice the more nuanced differences between broker-dealers to allow FA Match to differentiate among them. Now FA Match has announced that it has formally raised a $1 million pre-seed round from a group of investors that includes notable industry insiders from Redtail’s Brian McLaughlin to AdvicePeriod’s Steve Lockshin, Altruist’s Jason Wenk, and Carson Wealth CEO Ron Carson. To some extent, FA Match is a natural bet in a world where brokers themselves are reinventing their businesses (often necessitating a switch to a new broker-dealer that’s a better match), broker-dealers are reinventing their businesses as well (potentially necessitating a broker to switch as they find they’re no longer a fit for their current platform), and broker-dealer consolidation continues unabated, leading to brokers switching from often-underresourced broker-dealers to larger ones, and larger broker-dealers acquire smaller ones (sometimes leading to their brokers looking to make a change). The fact that FA Match will charge a flat fee to broker-dealers (of $200/month to participate, plus a one-time $10,000 fee upon hiring the new broker) means that it has the opportunity to work with not just a subset of the top-paying broker-dealers but all those that wish to grow (and may be attracted to the fact that they can’t be outbid on a recruiting platform that charges a single flat fee, allowing them to compete on their merits instead). Still, though, in the end the challenge is that it’s still incredibly difficult to differentiate among broker-dealers that often won’t differentiate among themselves (in the desperate competition to grow by saying they can be everything to every broker), and FA Match will succeed (or fail) by its ability to attract brokers and convince them that its matching algorithm really will produce better fits for brokers to grow their businesses than what the existing recruiter community (or just taking a reasonable bet) can accomplish.

Morningstar finally connects the dots from FinaMetrica’s Risk Tolerance Questionnaire To (Morningstar) asset allocation models. While Riskalyze has been one of the most visible growth stories in AdviserTech over the past 10 years, spawning an explosion of Risk Tolerance software competitors seeking to emulate its success, the reality is that FinaMetrica originated the category of risk tolerance software nearly 15 years prior. However, in the 1990s — when the internet was just emerging, APIs and integrations were not yet a thing, and software was primary used behind the scenes to create reports for clients (not as a client-facing tool itself) — FinaMetrica’s primary selling point was not its capabilities as a technology firm, but the intellectual property value of having created one of the few psychometrically designed and validated risk tolerance questionnaires, at a time when most risk tolerance questionnaires were poorly written homemade creations of whoever in the broker-dealer’s compliance department happened to be tasked with making something that would reasonably align to Finra (then NASD) suitability obligations. In practice, though, when advisory firms were sued for unsuitable investments, it was rarely because the adviser’s risk tolerance software was deemed not up to snuff (such that it resulted in the wrong portfolio for the client), but instead because of blatant situations like selling an 85-year-old retiree a portfolio full of dot-com tech stocks during the bubble. As a result, FinaMetrica gained a niche following among sophisticated advisers who appreciated FinaMetrica’s academic rigor, but it struggled to gain mainstream adoption and was leapfrogged by Riskalyze, both because “RTQs” alone were not a pain point for most advisory firms (Riskalyze’s success derived from its ability to turn risk tolerance into a sales/business development conversation with a prospect to get them to sign instead of a suitability/due diligence conversation with an already signed client), and also simply because FinaMetrica’s 25-question questionnaire — lengthier to obtain the necessary academic validity — was longer than what many advisers wanted to use with their clients … especially in an area that, again, wasn’t perceived by most to be a pain point. But perhaps the biggest challenge for FinaMetrica was simply that, in order to establish the most robust scoring mechanism for risk tolerance, it was deliberately not focused on investment-centric questions (which less financially sophisticated clients may misinterpret, leading to an incorrect assessment of risk tolerance), and instead used more abstract questions about risk preferences … which meant once the client completed the process, it wasn’t always clear to the adviser how to map an abstract score to a particular portfolio recommendation. In this context, it’s notable that this month, Morningstar (which acquired the Canadian PlanPlus financial planning software earlier this year, which itself had acquired FinaMetrica back in 2017) is integrating FinaMetrica’s new, shorter 10-question risk tolerance questionnaire directly into its Advisor Workstation Investment Planning Tool, with the risk tolerance score results mapped directly to Morningstar risk profiles and asset allocation models. For FinaMetrica, a deep embedding into Morningstar’s widely adopted Advisor Workstation (replacing Morningstar’s existing-now-legacy RTQ) may finally ramp up its adoption in the adviser community (given Morningstar’s tremendous reach and existing user base), and solve FinaMetrica’s long-standing challenge of clearly mapping a pure-but-abstract risk tolerance score to a concrete portfolio recommendation. For advisers using Morningstar, the FinaMetrica integration is a positive upgrade to a more robust RTQ. For Morningstar itself, though, the benefit may not simply be an uptick in the use of FinaMetrica itself, but the potential for FinaMetrica scores to be mapped to Morningstar asset allocation models, giving Morningstar yet another pathway to steer advisers to its own model marketplace (or even someday its own model portfolios and solutions), as once again adviser technology intersects with asset management distribution.

Pulse360 expands Client Meeting Notes Solution to automatically queue up adviser CRM follow-up tasks. Taking meeting notes has long been a staple of financial advice, in part for the compliance obligation of recording what was discussed and recommended to a client (as contemporaneous meeting notes are one of the adviser’s best defenses against future allegations of inappropriate recommendations), and in part simply to ensure that the adviser and their team capture all the important details for future reference, and all the relevant takeaways and tasks that may follow thereafter. Yet in practice, the actual mechanics of client note-taking are still surprisingly challenging; the proverbial (or literal) yellow pad of handwritten notes may be tossed into a physical client file but can’t be searched or referenced in the future, taking notes “live” in a meeting can distract the adviser from the focus on the client themselves, voice dictation of meeting notes still requires a process to transcribe them into the CRM system and may not necessarily capture key action items, and many financial advisers simply aren’t fast typists to enter their own meeting notes directly into their (sometimes cumbersome) CRM systems. To fill this void, earlier this year Pulse360 launched a “note-taking” solution for financial advisers, which goes beyond simply being a blank notepad into a tool where advisers can create their own micro-templates for capturing post-meeting notes or preparing upcoming-meeting agendas, assign tags to client notes for easier future lookup/reference, and then push all that information directly into the adviser’s CRM system to capture for compliance and the client’s (digital) file. And now, Pulse360 has the creation of a new automatic task creation feature, where tasks from the Client Meeting Notes can be created in Pulse and automatically queued up into the actual CRM system task engine (at least for currently integrated Wealthbox and Redtail), and advisers can create a standardized template for common follow-up tasks (so all of the follow-up tasks and assignments are implemented with a single click). On the one hand, Pulse360’s ever-expanding offering highlights the gap in practical solutions for advisers — like facilitating client note-taking more easily, in a world where Kitces Research shows that the average adviser spends more than 10 hours per week meeting prep and follow-up client servicing tasks (almost double the time advisers spend on actual investment management for their clients!). On the other hand, though, the fact that Pulse360 is increasingly pulling data from adviser CRMs to create meeting agendas and pushing client meeting notes into the CRM (now with the associated follow-up tasks), highlights that arguably what Pulse360 provides is simply what adviser CRM systems should be offering themselves (and are simply failing to do). Which means, in the end, the question for Pulse will be whether it is sustainable as an outside/stand-alone system, whether it needs to integrate deeper and even embed itself directly into adviser CRM, if a CRM system itself will replicate what Pulse is doing as it proves out to be valuable, or even if Pulse itself will be acquired by an adviser CRM system (that wants to be the fastest to market in solving for the problem Pulse has identified). Either way, though, it’s notable that while the industry has focused on “robo” tools that automate the investment onboarding and portfolio implementation process… Pulse is one of the few that’s tackling what is actually the most time-consuming (but solvable?) challenge for financial advisers.

Benjamin tries to become the glue to hold together the Holy Grail of building cross-platform business process automation for RIAs. The past 20 years have witnessed an explosion of independent adviser technology solutions as the rise of the internet led to the emergence of APIs to facilitate integrations from one piece of adviser software to another (without requiring a single parent firm to build it all internally to weave them together), and the growth of technology solutions for independent advisers attracted more to the independent channel, increasing the addressable market and feeding upon itself. The caveat, though, is that in practice, the potential for integrations across independent adviser software has rarely fulfilled its implied promise; the proliferation of APIs creates an impossible number of point-to-point integrations, companies all insist that “the other” platform should build to them, and independent advisers themselves are too small to compel their particular platforms to “talk better” to one another. The end result is a form of balkanization of AdviserTech solutions that cluster together, often driven by a key player that effectively chooses the winners and losers (who get deeply integrated, or not), or a large enterprise that forces its desired integrations (ironically steering what was originally independent-adviser-focused software back toward an enterprise-centric road map) … and a single unified solution — either an all-in-one or a series of best-of-breed tools that really talk to each other — becomes the long-sought-but-never-found Holy Grail. But now a solution called Benjamin — which started out as a form of digital assistant for advisers using natural language processing to fulfill basic assistant-style requests for basic client interactions, built originally as an internal solution for a pair of multi-billion RIAs and then spun off into an independent software solution for other firms — is expanding into a full-scale business process automation platform that aims to connect together the disparate adviser technology systems by building the specific cross-platform workflows that advisers actually need and use, from new client onboarding to meeting preparation, report preparation to meeting scheduling. Ultimately, the challenge is still that different advisers use different systems, and Benjamin will have to integrate with all of them to actually function as an effective middleware between them, and thus far is only boasting integrations with a handful of RIA tech solutions (albeit many of the largest, including Orion and eMoney, Schwab and Salesforce). And while more integrations will almost certainly come over time, the challenge of maintaining an ever-proliferating number of API integrations just reinforces the difficulty of maintaining so many different connections, raising the question of whether Benjamin will end out with a preferred set of solutions that it supports. Nonetheless, as advisers seek technology solutions that integrate more effectively into a unified platform, it’s entirely possible that if Benjamin is successful enough, advisers will be willing to conform to Benjamin’s preferred partnerships, especially when the level of automation can provide a multiple of its cost in ROI for the advisory firm in the form of outright staff savings (given the currently time-intensive processes that Benjamin is targeting). In the end, though, the proof is in the pudding, and whether Benjamin can succeed in unifying disparate adviser technology systems — even if just an initial preferred partnership set — that thus far have been remarkably difficult to (consistently and persistently) integrate.

DTCC launches Insurance Information Exchange (IIEX) to power AdviserTech insurance policy data reporting. From term life insurance and variable annuities to home and auto insurance, every client of a financial adviser is a consumer of insurance in some way, shape or form. And the marketplace is only bigger when you consider adviser-sold annuities as well, which saw over $241 billion sold in 2019 and are increasingly becoming a hot new opportunity with the rise of fee-based options for the RIA channel. Yet historically, insurance products were traditionally distributed in a very siloed fashion. While brokers at full-service firms have long had the ability to sell insurance, in the past it was treated more like an add-on (e.g., at wirehouses like Morgan Stanley or Merrill Lynch in the 90s and early 2000s). Most firms did not want the additional overhead of risk management and compliance for handling insurance in-house (which is why Merrill Lynch sold off its insurance business to Aegon in the early 2000s), while independent broker-dealers focused only on the brokerage-sold (i.e., Finra-regulated) version of insurance, aka variable annuities. With this being the reality, insurance products were siloed operationally as well. There was no reason for insurance products to be integrated, especially in the time before the holistic nature of financial planning became central to a client relationship. So insurance was sold on a stand-alone basis, or simply referred out, insurance commissions were collected (where applicable), and the data went off into the special digital filing cabinet for insurance-related matters. Fast forward to the 2010s. Advisers started doing holistic planning in a meaningful way and started talking about equities, fixed income, and insurance in an integrated way, all while using software to do it. This created demand on the software companies building performance reporting, CRM, and financial planning to integrate insurance (or at least annuity) data into their software products. So all of the software companies did the natural thing: They called DTCC, which for most advisers is the actual back-end “guts” of the financial system that handles the process of settling most investment trades for client accounts, and they asked DTCC to provide the insurance data alongside the investment data it already offers! But DTCC never had to provide data for this use case before; they only had the infrastructure to provide data at a firm-level for commission grid purposes. There were some adaptations made to the file formats, and DTCC started sending one huge file to the software companies every night, where the software companies were responsible for parsing it out for their clients… making some data flow but also leading to a lot of data spaghetti. The software companies did their best, but it has never provided a great experience, and to this day advisers have a lot of frustration in dealing with poor, or downright incorrect, data around their insurance products. But now, DTCC has announced the launch of the Insurance Information Exchange. IIEX, currently in a pilot period, is a modern API developed to make it easier for insurance data to be consumed and distributed. The pilot program is not surprisingly starting with the largest consumers of DTCC data — the insurance companies — to get access first, after which it will likely roll out to the brokerage firms (IBDs and wirehouses), and then AdviserTech software companies should be next in line to build around it. All of which should make it far easier for AdviserTech companies to pick and choose which data they need for advisers, down to the client/household level, all via (hopefully) easy-to-manage APIs, and be a huge boon for advisers that work with insurance products (both from the reporting perspective, and the potential to further automate everything from application to ongoing policy management for advisers’ clients’ insurance needs). The only question now is whether DTCC’s data really flows smoothly, how quickly AdviserTech companies will be able to build better integrations… and to see if DST and DAZL will follow suit…?

Will the SEC’s new RIA marketing rules spawn a new (more successful) wave of adviser review sites? In the past, when someone had a problem, they would pull out the Yellow Pages directory of local businesses and look up a local provider to solve their problem. But with the rise of the internet, it suddenly became possible to find not just the best local provider of services, but the best anywhere to solve the particular problem at hand. Of course, for a whole host of problems, the best local solution is fine or even preferred, from landscaping to plumbing, annual check-ups to simple 401(k) rollovers. But when our life is on the line — or our financial life is on the line — “local” preferences break down, and we want “the best,” making the internet an especially important source for finding specialized expertise to solve our most complex problems. Yet while the internet makes it possible to find the best experts, whoever they are and wherever they may be, in practice it’s still difficult to assess the quality and capabilities of an expert — who by definition, possess a level of expertise beyond the knowledge of the layperson who is ostensibly trying to evaluate that expertise — which makes it especially appealing to look for feedback from others about their experiences in working with that expert. In turn, the demand for reviews of experts has spawned a wide range of provider review sites, from Angie’s List to Lawyers.com, Yelp to Healthgrades. Except when it comes to financial advisers… where nary a dedicated adviser review site can be found, and most that have tried from Tippybob to WalletHub have had limited success at best or have outright failed. The driver, in large part, is a long-standing rule — known as Rule 206(4)-1 — that has barred financial advisers from using testimonials of their clients (such that they couldn’t cite reviews, and would even face scrutiny for soliciting clients to leave reviews on third-party sites), under the auspices that advisers would be overly tempted to cherry-pick the positive testimonials of their best clients in a manner that misleads consumers about the average experience (and in particular, the adviser’s average returns). But this month, the SEC issued a long-awaited update to its Investment Adviser Marketing rules, which will for the first time allow advisers to use testimonials, including site ratings and reviews on third-party review sites, and will permit advisers to encourage their clients to leave such reviews (with some reasonable requirements about not cherry-picking which clients are asked to leave reviews or which reviews are cited)… and opening the door for the rise of third-party adviser review sites, with newcomers like WealthTender already eyeing the opportunity. The caveat, though, is that arguably the real blocking point for adviser review sites was not the prohibition on their use by advisers, but the fact that the typical adviser can handle no more than 100 — 150 active client relationships, and often no more than 1% to 3% of consumers who use a provider ever even leave a review. Which means the average adviser may end out with an average of no more than two or three reviews on any adviser review site — barely enough to actually even be compelling to others who may be searching (and by then the adviser isn’t even looking for more new clients, anyway!). Of course, it’s also possible that the deeper nature of the adviser-client relationship will mean that advisers can convince a higher percentage of their clients to leave reviews than the typical business — which augurs a bit more favorably. And given the very high lifetime client value of an ongoing advisory client, and what is currently a $3,000-plus average client acquisition cost for an independent adviser (and higher for more affluent clients), there is a substantial economic opportunity on the table for a wide range of adviser lead generation services (which may include future adviser review sites). Still, though, the reality is that there will likely only 1 or perhaps 2 adviser review sites that may succeed and gain critical mass (as if reviews are split across multiple competitors in the space, no one site may ever reach a critical mass of reviews at all, and in the end, it’s still unclear if the mass of advisers at broker-dealers will even be permitted to also participate under Finra rules), and then rely on the network effects that ensue to sustain the volume. So stay tuned for what is likely to be a mad dash flurry in the coming year or so as new adviser review sites roll out, existing providers begin to tack on adviser reviews and ratings, and they all try to be the one that gets to critical mass first.

In the meantime, we’ve updated the latest version of our Financial AdviserTech Solutions Map with several new companies, including highlights of the “Category Newcomers” in each area to highlight new FinTech innovation!

So what do you think? Will Vise actually be able to gain traction as a custom-indexing TAMP? Will RIAs still be willing to use Flourish Cash when it is owned by an insurance company? Would it be helpful to have a platform to get matched to the next broker-dealer (and just be able to figure out which is which)? And do you think the SEC’s new RIA marketing rules really will permit the emergence of adviser review sites? Please share your thoughts in the comments below!

Special thanks to Kyle Van Pelt, who wrote the section “DTCC Launches Insurance Information Exchange (IIEX) To Power AdviserTech Insurance Policy Data Reporting” You can connect with Kyle via LinkedIn or follow him on Twitter at @KyleVanPelt.

Learn more about reprints and licensing for this article.