The latest in financial #AdviserTech — March 2022

This month’s #AdviserTech roundup includes FeeX’s rebranding and funding round, Datalign’s launch of a lead generation service and Fidelity’s new compliance solution, Saifr.

The March edition of the latest in financial #AdviserTech kicks off with the big news that FeeX is going all-in on helping financial advisers (get paid to) manage held-away 401(k) plans, providing the ability to facilitate trading and rebalancing without transferring or liquidating the employer retirement plan. In the process, it has raised a whopping $80 million of fresh capital and is rebranding away from its FeeX roots to a new name Pontera to signify how it is building a bridge to retirement plans (Pont is the Latin root for bridge.).

From the adviser perspective, the growing demand for Pontera highlights the ongoing expansion of wealth management services from just managing a client’s liquid investment account to providing more holistic advice on their entire household, for which advisers at the least are increasingly charging assets under advisement, or AUA, fees, but are increasingly interested in tools that allow them to manage the held-away accounts and provide their full scope of services and be able to charge their full scope of assets under management, or AUM, fees.

From there, the latest highlights also feature a number of other interesting adviser technology announcements, including:

- Datalign launches a new lead generation service that will allow the advisory firms with the best processes for converting prospects to clients to outbid their competitors for the best leads.

- Fidelity Labs launches a new compliance solution, dubbed Saifr, to facilitate more rapid compliance reviews of marketing and other advertising materials in large adviser enterprises.

- Morningstar launches a new Wealth Management Solutions offering in an attempt to TAMP-ify its existing Morningstar Office and related portfolio management tools.

Read the analysis about these announcements in this month’s column, and a discussion of more trends in adviser technology, including:

- AssetMark launches a new integration with RightCapital, less than a year after acquiring Voyant, highlighting the ongoing adviser demand for best-of-breed (over all-in-one) solutions.

- The Securities and Exchange Commission proposes new cybersecurity rules that would require RIAs to disclose to clients and, via Form ADV Part 2, to prospects any cyber incidents they’ve experienced, ostensibly in the hopes that the risk of being cybershamed will encourage more advisory firms to invest more into their cybersecurity practices.

- NaviPlan founder Mark Evans is preparing the launch of his new financial planning software — Conquest Planning — in the hopes that a “strategy-centric” approach will become the next big thing in financial planning software.

In the meantime, we’ve also launched a beta version of our new Kitces AdviserTech Directory, to make it even easier for advisers to look through the available adviser technology options to choose what’s right for them.

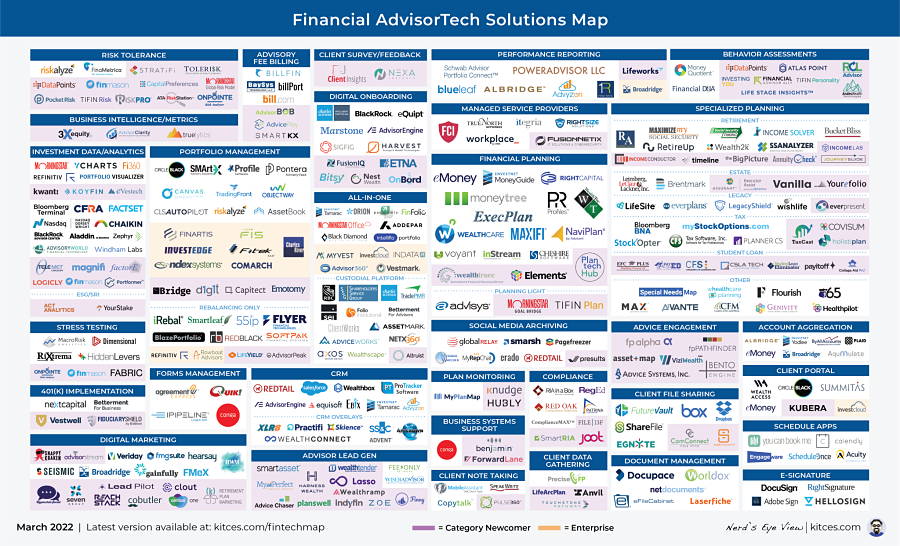

Be sure to read to the end, where we have provided an update to our popular Financial AdviserTech Solutions Map as well!

AdviserTech companies that want their tech announcements considered for future issues should submit to [email protected]!

FEEX GOES ALL-IN ON TRADING SOLUTION FOR HELD-AWAY 401(K)S WITH $80 MILLION CAPITAL RAISE AND REBRAND TO PONTERA

The rise of the robo-adviser nearly 10 years ago raised an industrywide question about whether the AUM model could and would survive technology competition. Yet in the years that followed, not only did stand-alone robo-advisers struggle to gain widespread adoption, but AUM fees have actually remained remarkably robust, as advisory firms have not buckled to fee compression but instead simply reinvested to value-add their way up to the ongoing AUM fees they were already charging.

However, the ongoing Great Convergence of the industry away from its commission-based roots and toward the AUM-based advisory model is creating a more fundamental challenge: there are only so many clients with assets available to manage, in accounts that are liquid and available to be transferred to a financial adviser in the first place. This is a challenge not only because of the simple fact that only about one-third of households even have more than $100,000 of investible assets outside of their primary residence (the so-called mass affluent and up to wealthier households), but a significant portion of those still hold the assets inside of a 401(k) plan that most advisers don’t have a way to manage. Unless the plan permits in-service distributions, the adviser must typically wait until the client retires and the assets become eligible for rollover.

The end result of this emerging squeeze — where there are more advisers pursuing the AUM model than there are clients with available assets to manage — is leading to a fork in the road, where advisory firms either pivot to alternative fee-for-service business models to serve non-AUM clients (e.g., working with higher-income households that may not have an existing portfolio but want to pay for advice by charging 1% to 2% of income instead of assets), or try to expand the scope of their advice by shifting from an AUM model to an AUA approach in which the adviser charges a fee based on the entire balance on which the client is being advised including both their managed accounts and held-away non-managed accounts.

The caveat to the AUA model, though, is that it’s difficult to charge the same advisory fee for held-away accounts as the ones that advisers do manage directly, as it puts into stark relief the difference between just giving advice about what the asset allocation of the portfolio should be and the service of actually being responsible for trading/implementing it upfront and on an ongoing basis. This both introduces new problematic conflicts of interest — the adviser has an incentive to persuade the client to roll over the assets from a held-away non-managed account to a managed account instead — and also undermines the pricing and service opportunity altogether (as if advisers can’t manage held-away accounts, they can’t provide the same level of service, and thus can’t charge the same level of fees, even if the client otherwise wanted to hire the adviser and pay them to do so).

That helps to explain the rise of FeeX, which last month announced that it has completed raising a massive $80 million of new funding as the company’s “held-away 401(k) managed account” services are seeing a rapid growth in demand. What’s unique about FeeX is that it has built the capability for advisers to actually manage held-away 401(k) plans without triggering problematic custody rule issues by having a client’s password to log into their account directly, and instead serves as an intermediary that the client grants access to, where FeeX then takes and implements discretionary trade orders from the adviser to implement their management strategies. The end result is that advisers are able to offer trading and rebalancing on clients’ held-away 401(k) plans (and 403(b)s and HSAs), and charge the same normal AUM fee they may charge for the rest of the client’s accounts rather than a reduced AUA fee.

Notably, enabling the management of held-away 401(k) plans is proving to be highly lucrative to FeeX itself, which reportedly charges a 25 bps fee on all the accounts it facilitates trading for, which may be very expensive by traditional AdviserTech software standards, but holds up quite well for financial advisers who can utilize the service to charge a full 1% AUM fee in the first place and simply net 0.75% for their advice and implementation support after FeeX’s servicing cut.

The irony of FeeX’s success is that originally it was a direct-to-consumer fee comparison tool, that captured investment costs from 401(k) plans to show consumers what they were really paying, and at one point somewhat controversially tried to pull advisers’ fee schedules directly from their Form ADVs and to highlight which advisers may be charging clients above-average fees and help them find other advisers who might charge less. In 2016, this pivoted to a model of using the FeeX to provide employer retirement plan data on fees and expenses to facilitate potential compliance with the proposed Department of Labor fiduciary rule on rollovers and then after the rule was vacated, extended into the current offering of providing the adviser with the ability to provide additional services and charge additional fees on top of 401(k) plans instead. Accordingly, with its new capital and new focus, FeeX is rebranding itself to Pontera, signifying its shift away from its fee-comparison roots and toward being a bridge for advisers to work with clients’ employer retirement plans (Pont is the Latin root for bridge).

More broadly, though, the FeeX-turned-Pontera growth story highlights the ongoing trend of financial advisers increasingly trying to expand their services beyond just managing a client portfolio that’s transferred to their broker-dealer or custodian to manage, and the ongoing rise of human financial advisers increasingly extending more directly into the realm of employer retirement plans while employees are still working for the company and need advice services, rather than just waiting to work with retirees after they separate from service and are ready to roll over their retirement accounts.

DATALIGN LAUNCHES LEAD GENERATION SERVICE TO AUCTION HNW PROSPECT INTRODUCTIONS TO ONE (HIGHEST-BIDDING) ADVISER

For as long as the business of financial advice has existed, the biggest challenge has simply been getting clients who will pay for the advice in the first place. The reality is that even when the adviser is knowledgeable and has a lot of value to add — and charges a very reasonable fee for that value — the financial services industry is still a low-trust business, and one in which competition for consumer attention is fierce. The end result is that according to Kitces Research, financial advisers face an average client acquisition cost of more than $3,100 per client. That cost is so high that most advisers don’t even have the wherewithal to spend that much on marketing and sales and instead invest their time engaging in various marketing activities, from seminars and webinars to networking to building relationships with centers of influence, to try to attract prospects.

Yet for a subset of larger advisory firms, the traditional time-based approach to growing the business through advisers trying to develop prospects one at a time creates scalability issues unto itself, as it’s difficult to train advisers to bring in clients, and the ones who do either quickly fill their book of business, and then don’t have the capacity to take on more clients, or must be compensated very highly with incentive compensation or equity, or risk that they leave and start their own competing advisory firm instead.

The pressure on scaling organic growth has, in recent years, led to a rising interest in growth strategies that are more directly scalable to the amount of dollars invested into them, in other words, centralized marketing and paid lead generation services that can bring prospects directly to the advisory firm where a centralized business development team can prequalify and even close the prospects, allowing the advisers to just do the work of serving clients for a reasonable base salary but without the costly business development incentives. Accordingly, the latest Kitces Research on Adviser Marketing found that when it comes to the marketing strategies that are generating the strongest return on investment, it’s increasingly the dollar-based (not time-based) strategies that are winning out. And lead generation solutions have become one of the hottest segments of the Kitces AdviserTech Map.

In this context, it is notable that this month witnessed the launch of yet another paid lead generation service — Datalign — which, similar to others in its category, aims to attract consumers to its website and then introduce them to prequalified financial advisers in exchange for a referral fee. That allows advisory firms to choose how much they wish to spend on lead generation, and dial up their marketing budget and the associated prospect leads as much as they want and need to in order to achieve their desired growth goals.

What’s unique about Datalign, though, is that unlike most lead generation platforms that simply determine a prospect’s geographic location and perhaps an anticipated level of assets to prequalify the prospect and then simply provide the lead to multiple financial advisers (kicking off a frenzy for advisers to be the first to follow up and respond to the lead before anyone else makes a connection), Datalign aims to provide each prospect to just one financial adviser, and will ask a series of up to 20 questions about everything from assets to income, their time until retirement and their required services to try to make a good match. In turn, according to Datalign’s Form ADV Part 2, any financial advisers who meet all of the prospect’s requirements will then have an opportunity to bid— auction-style — for the introduction, with Datalign making the introduction to the highest bidder.

From the consumer perspective, the appeal of the Datalign approach is that, unlike most other lead generation services, the consumers are not bombarded by multiple advisers all trying to reach out to them in the span of an hour or so after they submit their inquiry, providing a more comfortable experience with the subsequent introduction. And ostensibly, they have greater confidence in finding a good fit by being matched to a good-fit adviser on more details than just their ZIP code.

From the adviser perspective, the idea of being put in a competitive bidding situation with other advisory firms for prospect leads will likely be a turnoff for many. However, it may actually be especially appealing to advisory firms that have the most effective sales processes and are the best at actually turning prospects into clients. After all, the irony is that with standard paid lead generation or solicitor arrangements — where any/every adviser pays the same for each lead — the advisory firms that are the most confident in their sales process, and know they could be financially successful even if they paid more for leads, are effectively barred from doing so. Whereas with Datalign, the firms with the most effective sales processes will have an opportunity to put their money where their mouth is and actually out-pay the competition. This means in practice, Datalign won’t necessarily be an appealing solution to advisers who are just starting and trying to buy leads, but instead will be the best fit for larger, more scaled firms that have the financial capital to spend on organic growth and lead generation, and the most established sales processes to convert those leads into clients, thus giving them the most flexibility to pay the most forthose leads.

Ultimately, though, the real question for Datalign will simply be whether it can scale a sufficient volume of leads in order to generate the auctioned introductions in the first place. Thus far, the company has indicated an approach, similar to SmartAsset and Tifin, of targeting consumer media sites that have a higher concentration of potential prospects for advisers (that is, mass affluent or high-net-worth investors) and trying to facilitate introductions. But in the end, will Datalign actually be able to generate enough volume of prospects to meet the demand — those who are willing to go through an up-to-20-question questionnaire first — and with a sufficient lead quality that advisory firms are willing to bid up the price enough to make it economically viable for Datalign? Only time will tell but to the extent that Datalign can do so effectively, it’s uniquely positioned to find the true market-clearing price of what the most sales-effective growth-oriented advisory firms are really willing to pay for organic growth.

SEC REQUIRES RIAS TO RISK BEING CYBERSHAMED TO DRIVE COMPLIANCE WITH PROPOSED NEW CYBERSECURITY RULES

Over the past 20 years, the rise of the internet has increasingly digitized key aspects of the back offices of advisory firms, from the conversion of paper files to cloud-based document storage, to e-signature and electronic transfers of client accounts and the digital implementation of client trades. The good news from this shift is the rise in the back-office efficiency of firms, reflected in rising client/staff and revenue/staff productivity metrics. The bad news is that by storing more and more information online, protecting client data has shifted from what was historically a matter of protecting physical client files with intruder alarm systems and locked file cabinets to a digital realm of protecting against hackers and cyberthieves.

For the average advisory firm, the risk of a direct breach of private client data from its storage systems is relatively limited, as most advisers use various third-party systems with robust data protections (from using Microsoft or Google for client storage to CRM vendors with their own cybersecurity protections, to various broker-dealer and RIA custodian platforms that engage in their own cyber protections). However, in practice, advisory firms can still be at risk for cyber incidents, from phishing attacks against employees or malware that can gain passwords to access otherwise-protected systems, to more socially engineered attacks that persuade advisers to take actions on behalf of clients that turn out to be fraudulent (such as the fake urgent wire request from a client).

Unfortunately, though, the fact that advisory firms engage in such a range of different systems and approaches — from outsourcing to IT managed service providers that are expected to handle all the cybersecurity issues, to carefully selecting vendors with good cybersecurity protocols, to simply implementing their own tools and systems and buying the necessary third-party hardware and software to protect their systems — makes it difficult for regulators to determine a uniform approach and expectations for advisory firms when it comes to cybersecurity, even as a rising number of cyberbreaches (an estimated 70% increase in “data compromises” in just the past two years, according to SEC Commissioner Allison Lee) make it clear that something more needs to be done.

Accordingly, last month the SEC issued a newly proposed cybersecurity rule aimed at bolstering cybersecurity for registered investment advisers. Notably, though, the rule is purposefully vague about what, exactly, RIAs are expected to do even in a heightened cybersecurity context, stipulating only generally that under the new Rule 206(4)-9 that RIAs must “adopt and implement policies and procedures that are reasonably designed to address cybersecurity risks,” including a risk assessment (what systems and service providers hold or have access to client data that could be exposed), user security and access (who is able to access the key systems where client data is housed), information protection (monitoring information systems and whether they have been exposed), threat and vulnerability management (how the firm will respond if a cyberattack is occurring), and incident response and recovery (what the firm will do if it has been breached).

However, accompanying the new broad-based requirements for cybersecurity is a new Rule 204-2, which would require RIAs to maintain as a part of their books and records both a copy of their cybersecurity risk management rules and the occurrence of any cybersecurity incidents, which in turn would also include an obligation under new Rule 204-6 to disclose any “significant” cybersecurity incident (i.e., one that “disrupts or degrades the adviser’s ability … to maintain critical operations … or leads to the unauthorized access or use of adviser information … [that] results in (1) substantial harm to the adviser, or (2) substantial harm to the client … whose information was accessed”). Furthermore, the RIA would also be obligated to include a reporting of its cybersecurity incidents not only to current clients, but to prospective clients via a new section that would be added to Form ADV Part 2A.

In other words, rather than try to specify exactly what RIAs will be obligated to do to enhance their cybersecurity protocols, the SEC is providing more general guidelines that firms must implement “reasonable” policies and procedures but is also upping the ante even further by exposing the RIA to potential cybershaming with forced disclosures to the SEC itself, the firm’s clients and all of its future prospects that a cyber incident occurred. That’s ostensibly in the hopes that if advisory firms face even more public scrutiny over a cyberattack, the demands of the marketplace alone will drive firms to improve their own protections.

Ultimately, it remains to be seen whether or how much RIAs will really change their practices in response — given that most firms are already fearful of the impact to clients of a cyber incident, and simply struggle with limited resources in what they can actually do about it. But at a minimum, increased scrutiny from the SEC, if the proposed rule is passed, will likely both increase advisers’ focus on doing due diligence on their vendors to determine which have good protections in place (such as looking for SOC 2 certification), and the use of vendors that train advisory firm employees on good cybersecurity practices (such as KnowBe4).

FIDELITY LABS LAUNCHES SAIFR TO ACCELERATE COMPLIANCE REVIEWS OF MARKETING CONTENT WITH AI

Financial advisers have a fundamental obligation not to make misleading comments about the investment solutions they may be offering to clients, ranging from not overpromising returns or overstating guarantees to not understating or obscuring potential risks. Over the years, this has been codified into a compliance approach of both preapproving most adviser marketing materials to ensure that no misleading statements are made before any client or prospect sees the materials and post-reviewing ongoing adviser communication with clients to ensure that such statements aren’t being made to an existing client in an ongoing relationship.

While such an approach is important to protect consumers, in practice it creates substantial challenges that can limit or even undermine proactive communication with prospects and clients. If all advertisements and marketing materials, which are very broadly construed to a very wide range of content, must be approved by a compliance professional before they go out, there is at best a natural delay in timely communication and at worst a rising cost, by staffing up more compliance professionals to engage in a more rapid turnaround, that can render the advisory firm less competitive in the marketplace.

To combat this challenge, this month saw the launch of Saifr, a new compliance technology solution that’s specifically aiming to speed up the process of preapproval and post-review of advertising materials and marketing communication with clients by leveraging artificial intelligence to spot which adviser content has little or no risk (and can go straight through) and which may need to be paused at least briefly for a human compliance professional to review.

Specifically, Saifr announced the launch of both SaifrReview, and SaifrScan. The SaifrReview solution is intended to be a platform that facilitates content creation itself, where advisers can build their written, audio, video and other content assets, have Saifr review it for potential issues, escalate to compliance for speedy, or where appropriate, not-so-speedy, review, and support the back-and-forth editing process where changes and a re-review are required. In turn, SaifrScan is built to scan and monitor ongoing communications with existing clients to similarly spot potential compliance flags in post-review that may need to be escalated to compliance to review further.

From a development perspective, it’s notable that Saifr was developed from Fidelity Labs, the company’s internal fintech incubator platform that is building solutions that may be especially helpful for Fidelity itself, its end clients, or in this case the advisory firms that use its platform. For the firms, reinvestments into compliance technology, in particular, are especially appealing given the SEC’s new marketing rule, which is expected to increase how proactive advisers are in external marketing.

From the adviser perspective, smaller and even midsize independent advisory firms (e.g., one to five advisers) often just don’t have a very high volume of new marketing materials being developed and a more established base of reviews where communication review issues surface less often. Which means Saifr will most likely be of interest to larger advisory firms (10-plus advisers, even bigger mega-RIAs and broker-dealers that often have hundreds of advisers) where the sheer volume of advisers and content to review makes it especially difficult to balance cost with the timeliness of review, and AI solutions like Saifr that help the human compliance professionals focus their time on the reviews that matter most provide the biggest boost in productivity.

In the end, though, the key point is simply that when most advisers do what’s right for the client in the first place — because they came to the business to serve clients, and it’s good business anyway — the nature of compliance arguably should be one of issue-spotting and risk management, where not every piece of content and communication is scrutinized to the same extent, but instead is scanned quickly to triage which advisers and communication pose the greatest consumer risk and deserves the most attention — a task that AI-driven technology arguably should be especially good at delivering on. The only question is whether, in the end, AI tools like Saifr really can identify risky content and adviser communication effectively enough to avoid allowing bad actors to slip through.

MOMENTUM PERSISTS FOR BEST-OF-BREED AS ASSETMARK PARTNERS WITH RIGHTCAPITAL EVEN AFTER VOYANT ACQUISITION

In the early days of the financial advisory business — which were the early days of computer technology itself — software was expensive and time-consuming both to build and distribute, such that in practice the best software was developed by the largest advisory firms, which could build deep integrations across all of their tools and had the most advisers across which their costs could be amortized. The cottage industry of smaller independent advisers struggled with little technology that had no means to be connected together because the tools were developed independently.

However, the AdviserTech pendulum swung in the opposite direction with the rise of the internet and the emergence of application programming interfaces, or APIs, which made it both easier to distribute, and for advisers to purchase, software, and provided a mechanism for otherwise independent software providers to connect to one another, driving a shift from all-in-one solutions to the emergence of a robust “best of breed” approach where advisers would buy the best software in each category and leverage the available API integrations to weave them all together.

In recent years, though, the ongoing growth and scaling up of both mega-RIAs and hybrid broker-dealers is leading a push back in the opposite direction, as advisers increasingly complain of how arduous it is to actually link their best-of-breed solutions together, which large platforms are trying to capitalize upon by building or even acquiring their way to their own unique all-in-one, and thus already fully integrated, solutions in the hopes of tying advisers more deeply to their platform in particular.

That makes it all the more notable that this month, AssetMark announced a new deep integration with financial planning software provider RightCapital, less than a year after AssetMark closed on the $145 million acquisition of its own financial planning software solution, Voyant. In other words, even as AssetMark has acquired a financial planning software provider to integrate more deeply into its own platform and offering, the company is still finding it necessary (ostensibly based on its own adviser demand) to continue to deepen external integrations to third-party best-of-breed providers as well.

In part, the AssetMark integration with RightCapital simply helps to highlight how difficult it is for financial advisers to switch financial planning software providers — such that existing RightCapital users were more interested in seeing AssetMark integrate with RightCapital than in switching to Voyant. Especially since financial planning software providers have largely mimicked one another in core capabilities for years — such that it’s difficult for advisers to justify the time-consuming switching costs for what may only be small incremental new features or capabilities. It also emphasizes what has driven the all-in-one-versus-best-of-breed debate for more than a decade now — that category leaders whose sole focus is to execute well in their particular category make it difficult for all-in-one offerings to remain competitive as it means they have to try to be good at everything all at once). In practice, RightCapital has in the less than seven years since it was founded become the top-ranked financial planning software among independents, according to the latest Kitces AdviserTech study.

Ultimately, though, the key point is simply to recognize that even as the scaling up of large adviser platforms is leading a push toward more all-in-one proprietary solutions from those platforms, the platforms themselves seem to be facing an ongoing demand from their advisers to remain more open architecture — or that at the least, advisers are unwilling to give up their particular best-of-breed solution in the categories that matter most to them, which writ large across a large number of advisers will make it difficult for platforms to gain traction with more all-in-one consolidated solutions (or at best, force them to just build the unique middleware layers instead).

MORNINGSTAR LOOKS TO GET BPS FOR TECH BY BUNDLING RIA TECH COMPONENTS INTO A (DIRECT INDEXING) TAMP

One of the biggest differences between technology solutions for financial advisers and investment solutions for financial advisers is that technology charges software fees, but investments typically charge basis points on assets. To some extent, this is simply a recognition of where the solutions sit relative to the end-value proposition to the client — when the adviser manages a client’s portfolio, investment solutions tie directly to the revenue generation process, while technology typically supports the middle- and back-office functions of the firm. As a result, advisers are far more willing to pay for investment solutions that drive revenue (“you have to spend money to make money!”) than software that exists as overhead (“a cost to be managed”). That’s material, given that adviser tech budgets are often no more than about 5% of revenue, but investment solutions can add up to as much as 15% to 30% of revenue.

In fact, over the past decade, advisers have shown a remarkable unwillingness to pay for virtually any software solutions with bps pricing, despite increasingly commonly operating on an assets-under-management model that charges bps to their own clients, even as bps-based pricing for outsourced investment management solutions (turnkey asset management platforms) have become increasingly popular.

As a result, there has been an increasing shift toward the “TAMP-ification of tech,” where technology providers attempt to bundle themselves into investment management solutions, using their technology as the differentiator to win outsourced investment management business to the TAMP, thus enabling them to charge TAMP-style basis points to generate far more revenue for the tech-turned-TAMP solution. This convergence of tech-plus-TAMP has been the story of both the increasingly tech-ified Envestnet TAMP, along with the TAMP-ification of Orion with its acquisition of Brinker Capital in 2020.

In this context, it’s notable that Morningstar has announced the launch of a new “Wealth Management Solutions” offering that specifically aims to bring its Morningstar Investment Management TAMP offering with its Morningstar Office portfolio management tools and its ByAllAccounts account aggregation software into a single bundled platform, creating the potential to both bulk up its TAMP assets with a more tech-enabled offering, and upsell its software-user-fee-paying technology users into a bps-for-TAMP solution instead.

While financial advisers have heavily resisted the bundling of all-in-one solutions that include financial planning/advice tools, cohesive technology stacks for investment management are more popular, leading to both a rise in RIA custodians offering their own portfolio management tools for advisers who otherwise want to self-manage portfolios and leverage technology to do so, and growing competition between TAMP providers to show which has the best tech. Ironically, this is resulting in more and more TAMPs having more and more comprehensive feature sets, effectively commoditizing the tech and making it less able to be differentiated. In turn, that appears to be leading Morningstar toward differentiating on its investment offering itself, by working on the development of its own direct indexing solution allowing it to leverage its own core capabilities as an index and investment research provider.

In fact, the biggest challenge for Morningstar may simply be the process of actually weaving together its disparate technology tools for RIAs into a single coherent solution, in what has historically been a series of very siloed technology offerings. Fortunately for Morningstar, the company’s brand itself is still very strong among advisers, and it remains especially connected to independent advisers who moved from broker-dealers to RIAs, who are accustomed to relying on home office solutions and may be more willing to outsource to a Morningstar TAMP offering especially with a differentiated direct indexing offering.

Ultimately, though, the key point is simply that investment management technology tools appear to be increasingly bifurcating into two distinct directions — advisers who prefer to self-manage their portfolios and obtain their investment technology tools for free directly from their RIA custodians, and those who are willing to outsource, where investment technology tools can be bundled directly into TAMP offerings that command a higher price for the technology from those advisers willing to pay for it bundled into an outsourced investment management offering in the first place.

CAN NAVIPLAN FOUNDER MARK EVANS CREATE THE NEXT BIG THING IN PLANNING SOFTWARE WITH CONQUEST PLANNING?

Financial planning software has gone through several major evolutions over its multidecade history.

The very first generation of tools — back in the 1980s, as computers started to appear in the offices of financial advisers — were product-centric and existed primarily to illustrate the benefits of buying and implementing a particular insurance or investment solution. As technology tools became more robust in the 1990s, an alternative, more cash-flow-based approach emerged that aimed to create more value in the planning process by modeling out the full range of a household’s savings and spending, not just those pertaining to a particular product, to make better planning decisions.

But modeling out every household cash flow for multidecade time periods became overly time consuming, given that, in the end, advisers were typically trying to plan around particular concrete goals for which they could provide solutions such as retirement, college and family protection, leading to the rise of goals-based planning software in the 2000s.

However, one of the limitations of goals-based planning is that once the plan is formulated and a course of action is set, there’s little to be done on an ongoing basis. In the 2010s, that led to the rise of financial planning portals, powered by account aggregation, that allowed clients to engage more holistically and on a more ongoing basis around all of their household finances and not just whether they were on track for their primary goals.

The significance of these shifts in the focal point of financial planning software is that each time the dominant value proposition shifted, so too did the leading financial planning software, from more product-based tools like Financial Profiles in the 1980s, to NaviPlan’s cash-flow-based software in the 1990s, MoneyGuide’s goals-based planning of the 2000s, and eMoney’s portal-based planning experience of the 2010s. All of which raises the question: What new differentiated approach to financial planning will emerge in the 2020s and lead to the next breakout provider of financial planning software?

According to Mark Evans, the original founder of NaviPlan, the next big thing in financial planning software will be a more “strategy-centric approach,” which he’s building into a new financial planning software competitor called Conquest Planning. At its core, the distinction of Evans’ strategy-centric approach is that Conquest can evaluate the impact of a wide range of strategies — such as various action items and recommendations that clients might implement — and surface which may be most impactful for clients, making it easier to narrow down to a concrete set of recommendations more readily than just dragging sliders in real time and trying to figure out which combination of recommendations is best. In other words, Conquest is aiming to expedite the process of actually coming up with the best recommendations for clients — which has the potential to reduce one of the most time-consuming phases of the financial planning process.

Because Evans (and NaviPlan originator EISI) is based in Canada, Conquest itself has initially launched in Canada, but is expected to come to the U.S. in the second half of 2022. That means that while Conquest may be new to the U.S. when it launches, it won’t be starting entirely from scratch, as it will already have been vetted in practice by Canadian advisers.

Nonetheless, the challenge remains that with financial planning software, no two systems use the same assumptions nor have standardized ways of viewing data, which means, unlike CRM or portfolio management software conversions, advisers can’t download a massive file of data, map it, upload it to the new tool and then just clean it up. Instead, advisory firms effectively have to recreate every financial plan in their system manually when they move to a new planning tool. As a result, there is tremendous reluctance from financial advisers to switch financial planning software providers for anything short of a true paradigm shift — as occurred with the rise of NaviPlan’s cash-flow-based planning, MoneyGuide’s goals-based planning, and eMoney’s portal-based ongoing planning — and it remains to be seen whether Conquest’s offering will be seen as incremental or as a more substantive leap to something new that merits the trouble of switching to new software.

Still, though, given that financial planning software epochs have lasted about a decade each with remarkable consistency, arguably the landscape is overdue for the next big thing in financial planning software. Will Conquest be different enough? Time will tell when it launches in the U.S. later this year.

In the meantime, we’ve rolled out a beta version of our new AdviserTech Directory, along with making updates to the latest version of our Financial AdvisorTech Solutions Map with several new companies including highlights of the “Category Newcomers” in each area to highlight new FinTech innovation.

So, what do you think? Will advisers continue to expand their AUM scope to held-away accounts by leveraging FeeX-turned-Pontera to manage outside 401(k) plans? Will the potential for a required public disclosure of cyber incidents drive independent advisers to reinvest more into their own cybersecurity? Will advisers buy the TAMP-ification of Morningstar Office? And is there really room for a new provider like Conquest Planning to break into the current world of financial planning software?

Michael Kitces is the head of planning strategy at Buckingham Strategic Partners, co-founder of the XY Planning Network, AdvicePay and fpPathfinder, and publisher of the continuing education blog for financial planners, Nerd’sEye View. You can follow him on Twitter at @MichaelKitces.

Debate over custodians’ fees

Learn more about reprints and licensing for this article.