Gross withdraws shares from Janus Henderson fund

Bill Gross, co-founder of Pacific Investment Management Co. (PIMCO), speaks during a Bloomberg Television interview at the Bloomberg FI16 event in Beverly Hills, California, U.S. Photographer: Patrick T. Fallon/Bloomberg

Bill Gross, co-founder of Pacific Investment Management Co. (PIMCO), speaks during a Bloomberg Television interview at the Bloomberg FI16 event in Beverly Hills, California, U.S. Photographer: Patrick T. Fallon/Bloomberg

His personal stake fell to about $566 million at end of September, from $775 million a year earlier.

Outside investors may not be the only ones who have pulled money from Bill Gross’ bond fund.

The manager and his family’s personal stake in the Janus Henderson Global Unconstrained Bond Fund fell to about $566 million at the end of last month from $775 million a year earlier, a regulatory filing last Monday shows. When accounting for the fund’s 6.3% loss, that suggests Gross may have withdrawn or transferred about $150 million of shares.

(More: Bill Gross chooses to load up on futures, generates big losses)

Mr. Gross didn’t reply to an email requesting comment. A spokeswoman for fund company Janus Henderson Group didn’t immediately respond to a request for comment.

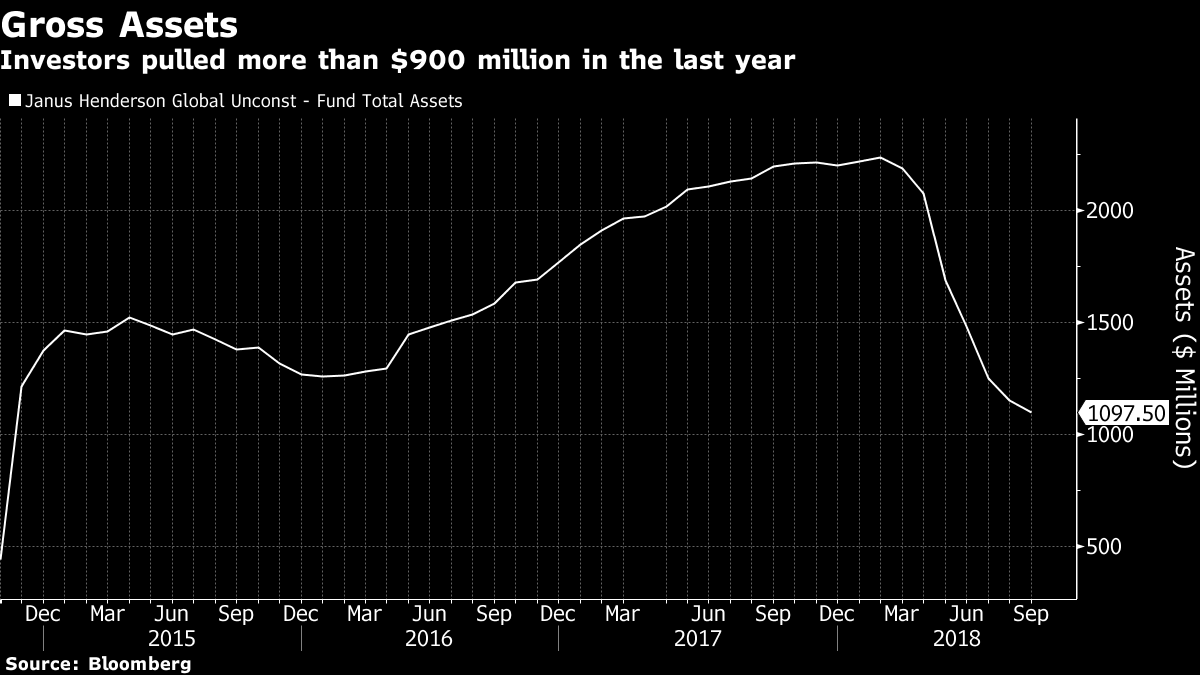

The filing, meanwhile, shows Mr. Gross has a bigger piece of a smaller pie. His share of Global Unconstrained rose to 51.6% as of Sept. 30 from 35.2% a year earlier, while the fund’s assets fell to $1.1 billion from $2.2 billion in September 2017.

Investors pulled more than $900 million from the unconstrained fund over the 12 months, according to Bloomberg estimates, as the fund posted losses from misplaced bets such as one that the yield spread between U.S. and German government debt would converge.

(More: Stamps from collection of Bill Gross sell for $10 million)

Bloomberg’s estimates for the Janus Henderson fund’s flows are based on the change in assets over time that aren’t accounted for by performance, reinvested dividends or fees. The numbers may vary from actual figures and from estimates compiled by other data providers.

Learn more about reprints and licensing for this article.