Jeremy Grantham: A hierarchy of problems

With hindsight, there are a few additions and qualifications I would like to make regarding my letter on resources of last quarter. I will start with an overview of the prospects for our collective well-being: there is nothing about the resource limitation problem that we cannot resolve. We have the brain power and, especially, the inventiveness.

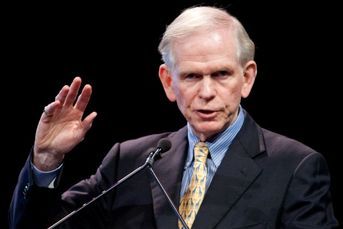

The following is an excerpt from the July letter of Jeremy Grantham, chief investment officer of GMO. The full letter can be viewed here.

With hindsight, there are a few additions and qualifications I would like to make regarding my letter on resources of last quarter. I will start with an overview of the prospects for our collective well-being: there is nothing about the resource limitation problem that we cannot resolve. We have the brain power and, especially, the inventiveness.

We have some nearly infinite resources: the sun’s energy and the water in the oceans. We have some critically finite resources, but they can be rationed and stretched by sensible, far-sighted behavior to fill the gap between today, when we live far beyond a sustainable level, and, say, 200 years from now, when we may have achieved true long-term sustainability. Such sustainability would require improved energy and agricultural technologies and, probably, a substantially reduced population. With intelligent planning, all of this could be reasonably expected. A population reduction could be arrived at by a slow and voluntary decline (perhaps with some encouragement of smaller family size achieved, for example, through greater education). Such a reduction might leave us with a world population of anywhere from 1.5 billion to 5 billion, depending on the subtleties and interactions of many complicated variables.

We would then be in long-term balance with our resources, including what will remain by then of our current biodiversity, which will hopefully be as much as one-half to three-quarters of what we have today.

The problem is not what we are capable of, but how we will actually behave. The wasteful status quo has powerful allies in the present corporate and political system. We do not easily accept bad news, nor do we easily deal with long horizon problems. As mentioned last quarter, we are not particularly good with numbers, especially when it comes to probabilities, compound growth, and discount rates. We have a capitalist system that reflects our weaknesses; one that is fine-tuned only for the present and immediate future. Because of these factors, we will probably wait to deal with the obvious problems of living well beyond our means until the signs are powerful and clear that we must change: until, that is, it is basically too late. Too late in the sense of failing to protect much of what we enjoy and value today.

Too late to have avoided plundering our grandchildren’s resources. It’s a shame, but it’s the bet a well-informed gambler, observing from another planet, would probably make. It’s why, in the environmental business, which shares many of the same problems with resource management, it can be honestly said that there are old environmentalists and optimistic environmentalists, but no old, optimistic environmentalists. I’m probably as close as you’re going to get. The following argument looks at the resource problems we face in order of declining optimism. I think what follows is reasonable rather than apocalyptic. And, there is one remarkable piece of good news – the steady rise of no-till farming. In this, the developed world at least seems to have truly lucked out! However, with the pressures of short-term profi t maximizing, there is some chance that we will not capitalize on our good luck.

A possible hierarchy of problems

1. Energy

The transition from oil will give us serious and sustained problems. We passed peak oil per capita long ago and we are within 30 years, possibly within 10, of peak oil itself. The price will be volatile beyond our wildest dreams (or nightmares), and the price trend will rise, although at times this will be diffi cult to discern through the volatility.

Transportation will be difficult in general and air transportation in particular. But behind oil, there is a relative plenty of natural gas and coal, which can, although with cost and diffi culty, be substituted for oil. Even with coal and gas,however, we are dealing with only many decades of supply, not centuries. But beyond hydrocarbons there really is good news. Within 50 years or so, I believe we will have made spectacular progress in the science and engineering of solar, wind, tidal, and other energy sources, together with storage. One simple storage management idea for the nearer term, for example, is that every electric car would have two easily-exchangeable battery packs, with one in the garage, storing solar from your roof while you drive to work. Whenever possible, all such batteries would be attached to an intelligent grid that would be able to raid batteries or deposit into them, giving massive flexibility by today’s standards. It is also possible (although, unfortunately, I believe improbable) that we will have a new, large-scale burst of activity in nuclear fi ssion, perhaps stimulated by some technological improvements. Further out, completely new forms of commercial energy are likely, perhaps from nuclear fusion of some kind, or perhaps from something completely off of our current radar screen. This is where my optimism comes in, for I believe that in 50 or so years – after many and severe economic and, possibly, social problems – we will emerge with sufficient, reasonably-priced energy for everyone to live a decent life (if we assume other non-energy problems away for a moment) even if we don’t radically improve our behavior and make true sustainability our number one goal. In other words, current capitalist responses to higher prices should get the job done. We should realize, though, that reasonably-priced does not mean the nearly give-away prices of oil in the post war period, which serves as a real testimonial to the failure of standard free-market practices to recognize that a vital resource being finite changes everything in the long run.

“Reasonably-priced” fuel would be where prices rise steadily faster than the CPI rather than ruinously so.

2. Metals

Metals are, of course, a bigger long-term problem than energy. They are entropy at work … from wonderful metal ores to scattered waste. Even the best recycling will have slippage. Entropy is impressive; everything really does run downhill, iron really does rust. So our future will undoubtedly be increasingly constrained, particularly if our population and its wealth both grow steadily. Eventually, the growth of both population and wealth will be limited and possibly even stopped by a lack of metals, but that should, with luck, be a long time away. If we respond to increasing price pressures, as I’m sure we will, with a greater emphasis on quality and small scale along with an increasingly sensible and non-wasteful lifestyle, then we can push these serious constraints out for well over a hundred years. This is assuming, once again, no radical shift in attitudes and behavior other than those elicited by higher prices.

3. Agriculture

The trouble really begins with agriculture. This is the factor that I believe almost guarantees that we end up with a world population between 1.5 and 5 billion. The only question for me is whether we get there in a genteel, planned manner with mild, phased-in restraints, or whether we run head down and at considerable speed into a brick wall.

There are three particular aspects of agriculture where the shoe pinches the most: water, fertilizer, and soil. All three must be seen in the context of a rapidly growing population. To set the scene, Exhibit 1 shows arable land per person.

Unlike us, suitable land for agriculture has not increased since farming started some 10,000 years ago. In fact, with our help it has declined considerably, perhaps by as much as half or more!

Learn more about reprints and licensing for this article.