Lawyer sees pickup in breakaway business

A lawyer who works with breakaway brokers says that his workload so far this year is double what…

A lawyer who works with breakaway brokers says that his workload so far this year is double what it was in the early months of 2011.

And he expects that pace to continue.

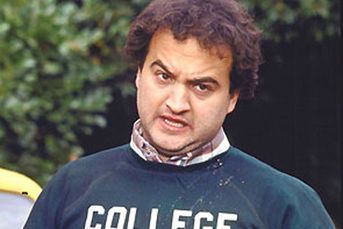

“They have had enough,” Brian Hamburger, founder and managing director of compliance consulting firm MarketCounsel, said about the mood of many wirehouse brokers he has advised. “They pay a lot for a logo that doesn’t open doors the same way it did years ago.”

LOST GOOD WILL

In an interview on the sidelines of the Financial Planning Association’s Business Solutions Conference in San Francisco last Tuesday, Mr. Hamburger noted that retention contracts are winding down, and more and more representatives are confident that they can make a successful transition to independence.

The biggest driver, he said, is a growing perception that wirehouse reps are paying for brands that have lost much of the good will that once made them an asset.

The financial crisis has tarnished the financial heavyweights so much so that being associated with a big player, such as Bank of America Merrill Lynch, sometimes works against them, many brokers have told him.

“Many believe that they no longer are getting enough in return for the 60% to 70% they give to the house,” Mr. Hamburger said.

A call to a Bank of America representative seeking comment wasn’t returned by press time.

Mr. Hamburger did acknowledge that wirehouses are “showing more love” to their most successful teams by making better offers as the time comes for them to renew contracts — particularly if management gets a sense that a particular team is becoming less loyal.

“But advisers are skeptical,” he said.

Learn more about reprints and licensing for this article.