Legislation to impose financial transactions tax introduced

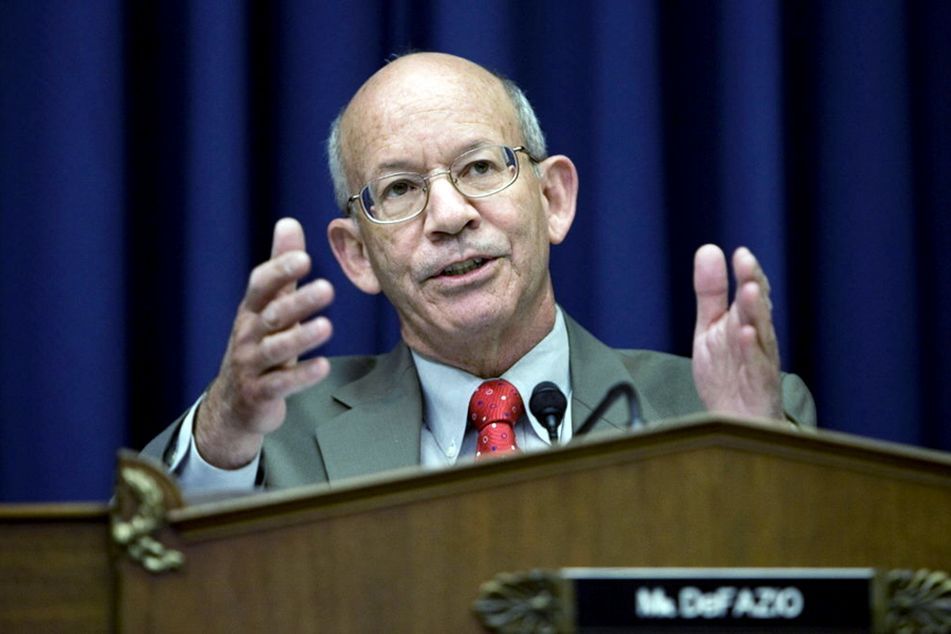

Rep. Peter DeFazio

Rep. Peter DeFazio

The legislation, which would place a tax on stocks, bonds and derivatives trading, was rolled out now to elevate the issue in this fall's election.

Rep. Peter DeFazio, D-Ore., introduced legislation Wednesday that would impose a tax on stocks, bonds and derivatives trading in an effort to elevate the issue in this fall’s election.

The measure would place a levy of three basis points on financial transactions, a move that could generate $417 billion over 10 years, according to congressional estimates.

Mr. DeFazio asserts that the tax would rein in speculative trading, make the financial markets more efficient and help fund infrastructure improvements and college tuition assistance.

He acknowledged that the bill has no chance of advancing in the Republican-controlled Congress, but he is trying to take advantage of the momentum a financial transactions tax has received by being included in the Democratic Party platform.

“I don’t expect the knuckleheads running this Congress to take it up,” Mr. DeFazio said at a press conference on the east lawn of the Capitol. “It’s a meritorious proposal whose time is not quite here yet but will be soon, and I want it to be amply discussed during the election.”

He said another recent event also boosted the profile of the issue: Britain’s departure from the European Union. The EU approved a financial transactions tax, but it had been held up by British opposition, Mr. DeFazio said.

“We have been helped by Brexit,” Mr. DeFazio said.

The political attention is good for the issue, according to Dean Baker, co-director of the Center for Economic and Policy Research.

“It no longer sounds like a crazy idea,” he said at the Capitol Hill event. “That’s very big progress.”

The Securities Industry and Financial Markets Association opposes Mr. DeFazio’s bill.

“A new federal sales tax on Americans saving for retirement is a bad idea,” Payson Peabody, SIFMA managing director and tax counsel, said in a statement. “If the experience of other countries is any guide, an FTT would raise less revenue than promised; it would also reduce liquidity sharply in the affected markets, reducing asset values and increasing borrowing costs for US businesses, consumers, and the federal government itself.”

Mr. Baker disputed that assertion.

“Your typical person with their 401(k) is not hurt by this [tax],” he said.

Damon Silvers, director of policy at the AFL-CIO, said “a small tax on financial transactions is good for the capital markets” because it would curb high-speed computer trading that doesn’t add value to the holdings of ordinary investors.

Learn more about reprints and licensing for this article.