Janus’ Bill Gross slams central bankers again, arguing negative rates turn assets into liabilities

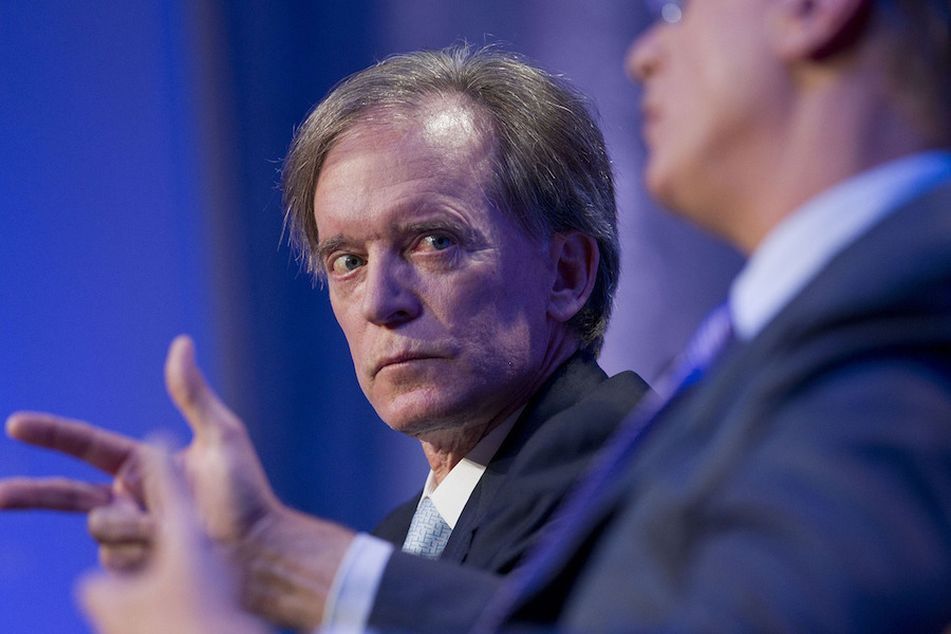

Bill Gross

Bill Gross

Billionaire money manager Bill Gross said negative interest rates are turning assets into a liability stifling the capitalist…

Billionaire money manager Bill Gross said negative interest rates are turning assets into a liability stifling the capitalist system.

In his monthly investment outlook posted Wednesday, Mr. Gross, 72, reiterated his long-running criticism of central bankers, including Federal Reserve Chair Janet Yellen, for slashing interest rates to zero or below to help raise asset prices in the hope they will trickle down into the economy. It’s a plan, Mr. Gross argued, that will fail to produce sustainable economic growth.

“Capitalism, almost commonsensically, cannot function well at the zero bound or with a minus sign as a yield,” wrote Mr. Gross, who manages the Janus Global Unconstrained Bond Fund. “$11 trillion of negative yielding bonds are not assets — they are liabilities. Factor that, Ms. Yellen, into your asset price objective.”

(More: Don’t count small-cap funds out because of looming interest rate hikes)

Central banks in Europe and Japan are relying on stimulus packages that include negative deposit rates to fuel inflation and revive the economy. Germany, Switzerland, France, Spain and Japan are among countries that have negative yields, according to data compiled by Bloomberg. While the U.S. hasn’t used that tool, Ms. Yellen said last week that further asset purchases must remain part of the Fed’s toolkit.

Mr. Gross has been sounding the same alarm for so long he might be “compared to a broken watch that is right twice a day but wrong for the other 1,438 minutes,” he wrote. “But believe me: This watch is ticking because of global debt and out-of-date monetary/fiscal policies that hurt rather than heal real economies.”

Mr. Gross’s $1.5 billion Janus unconstrained fund gained 4.3% this year through Aug. 30, outperforming 61% of its Bloomberg peers.

Learn more about reprints and licensing for this article.