7 biggest ways top-performing firms sustain their growth

The fastest-growing and most profitable firms often take unconventional approaches to their business models. To see how your firm stands up, take part in this year's study.

Advisers spend a lot of time thinking about their growth strategies. Two years ago, when InvestmentNews fielded the 2012 InvestmentNews/Moss Adams Financial Performance Study of Advisory Firms, we identified a subset of firms that were deemed “top performers.” These firms were defined as the top quartile of participants across a range of metrics including revenue growth, cost control and profitability. The study found that the fastest-growing and most profitable firms sometimes take an unconventional approach to their business models.

Fast forward to 2014. We’ve internalized the study’s findings and are now fielding an updated survey that we hope will help firms not only benchmark their practices and attain greater productivity and profitability, but will also help them rethink their strategic processes and confirm that their firm is on the right growth track.

To see how your firm stands up, take part in this year’s study by visiting www.investmentnews.com/2014fp.

Below, we’ve presented seven of the biggest trends that separated the best-performing organizations from their peers:

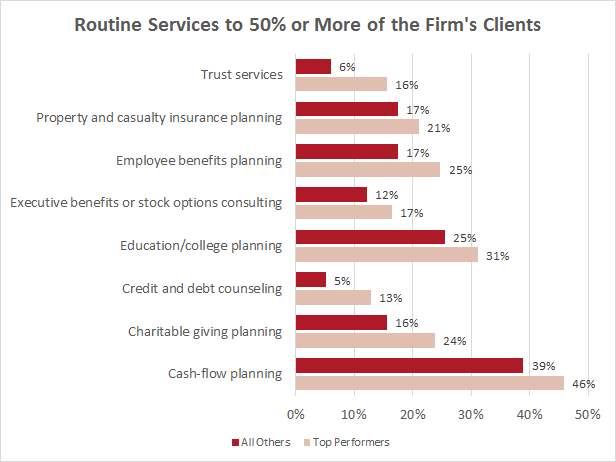

1. Take a holistic approach to services

When participants were asked to identify services they routinely provided to a majority of their clients, top performers offered an average of 10% more services than their counterparts.

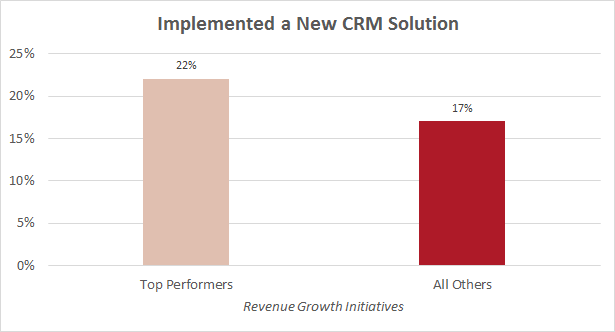

2. Upgrade your CRM

Top performers distinguished themselves from the field in two major revenue-expanding initiatives. Implementing a new customer relationship management system created the second-biggest gap between top firms and the rest of the industry among the list of revenue growth initiatives. Easier access to intelligence about your clients translates to higher productivity.

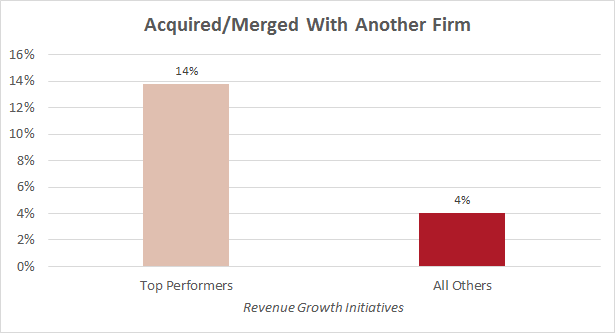

3. Merger talks

The biggest gap among revenue-growth initiatives between top performers and all others? M&A. Partnering with another firm can be a quick avenue to strategic growth.

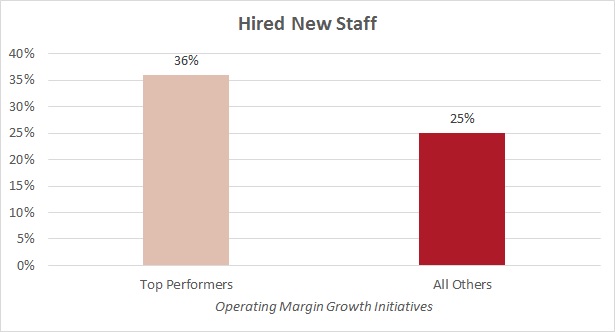

4. Leverage staff to increase profits

Hiring new staff was the No. 1 profit growth initiative among top performers, as well as the biggest differentiating factor from their non-top performing counterparts — and by a wide margin. Staffing costs are by far the biggest expense at today’s advisory firms. Leveraged properly, they are the surest path to sustained growth.

5. Update your website

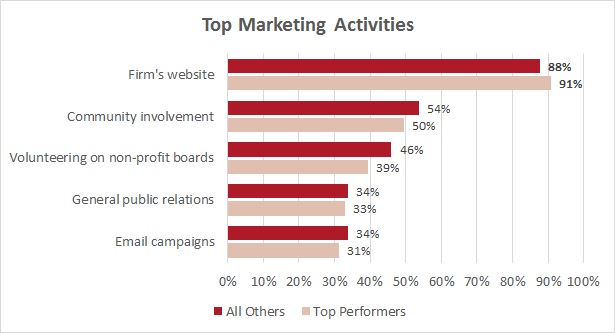

The only marketing activity top performers engage in more frequently than all other firms? Updating their own websites. Web technology moves fast — a modern design can set your firm apart.

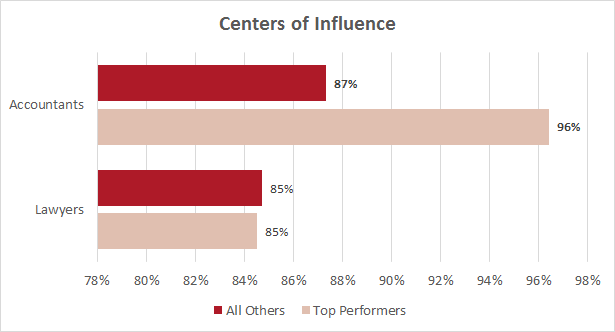

6. Form relationships with centers of influence

Particularly accountants. 96% of performers use accountants as centers of influence, vs. 87% of all others.

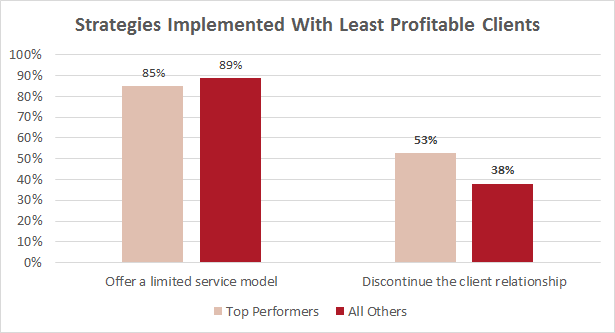

7. Be selective with your clients

The most popular strategy advisers use when dealing with clients that are not profitable is to limit service, but top performers take things a step further — 53% of top performers say they will discontinue an unprofitable relationship, versus just 38% of all others.

Learn more about reprints and licensing for this article.