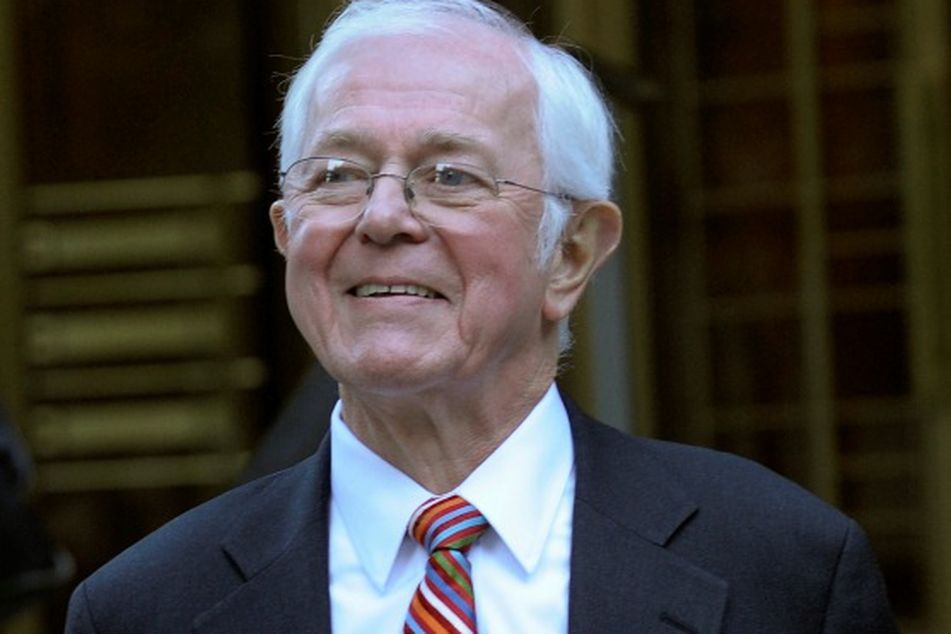

Bruce Bent, son cleared in SEC fraud case

Bruce Bent: Got caught in 'a perfect storm'

Bruce Bent: Got caught in 'a perfect storm'

Bruce Bent and his son were cleared Monday of fraud charges stemming from the Primary Reserve Money Market Fund's breaking the buck in 2008.

The portfolio managers of the Reserve Primary money market fund, which famously “broke-the-buck” in 2008, were cleared of fraud in a federal civil trial on Monday.

Bruce Bent and his son Bruce Bent II were charged by the Securities and Exchange Commission in 2009 with allegedly misleading investors, regulators and the fund’s board of directors about their ability to prevent the $62 billion fund from going under in the midst of the financial crisis.

“In a lot of ways, my clients were caught up in a perfect storm,” said John Dellaportas, the Bents’ lawyer, in the closing arguments for the case on Friday.

The fund had invested $785 million in Lehman Brothers Holdings Inc. debt that plunged in value when the investment bank went under. It caused the fund to “break the buck” which means its net asset value fell below $1 a share.

The loss sparked a run on money market funds as investors feared the same could happen to their money funds. It led to the SEC stepping in to guarantee money market investments and set the stage for the fight over further money market fund regulation — a battle that is still ongoing today.

In April, The Reserve Primary fund sold it’s Lehman debt for 22 cents on the dollar.

Learn more about reprints and licensing for this article.