Custody, compliance and tech lay the foundation for going independent

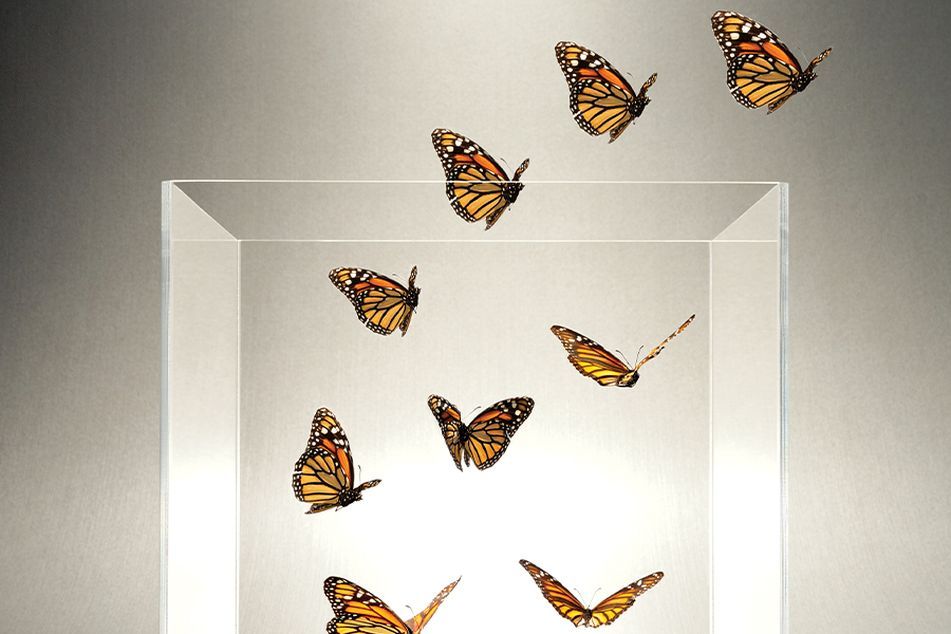

An expansive network of platforms and services has evolved that's designed to support breakaway brokers.

As a river of breakaway brokers keeps flowing toward independence, the network of products and services designed to help them with the transition has never been more expansive, and that network continues to evolve.

But while more access to support services, including technology, compliance and custody, can be a good thing for a broker planning to go RIA, it can also make things look even more complicated and daunting.

“Being independent is all about putting clients’ interest first and building a business around the client,” said Eric Clarke, founder and chief executive of Orion Advisor Solutions.

Clarke was part of a panel discussion hosted by goRIA from InvestmentNews that took a deep dive into some of the planning and early moves related to leaving a brokerage firm and joining or establishing a registered investment advisory firm.

“It boils down to getting the technology you need to deliver your specific value proposition and connect advisor-client relationships,” Clarke said, but added that that doesn’t need to be a single turnkey tech stack solution.

The three primary components of a tech stack are client relationship management, account management and some type of risk analyzer, he said.

“Back in the mid-1990s when we were getting started, the only option was to build your own tech stack, but for today’s advisors there are myriad choices,” Clarke said. “While I like to think of technology as being the great equalizer, I don’t think advisors should have to feel like they have to build it today. There are technologies that can be bought off the shelf.”

He said RIAs should plan to spend between $20,000 and $30,000 to get the basic components of a tech stack.

There are also decisions to be made when it comes to compliance, said Alisha Dowell, chief compliance officer at Key Bridge Compliance.

Like technology, compliance isn’t something that can be taken lightly, but Dowell said there are different ways to cover your bases.

An outsourced compliance solution like Key Bridge can cost between $5,000 and $8,000 a month, Dowell said, depending on the size of the firm and whether it’s registered at the state or federal level.

A comprehensive compliance package, she said, “is going to be higher cost, but how much would you be paying an internal chief compliance officer and how much resources would they have?”

In terms of choosing a custodian, Bob Evans, head of RIA sales at Fidelity Institutional Wealth Management Services, said RIAs should partner with platforms that have a focus on both current and future needs.

“There’s a lot of options in terms of insourcing versus outsourcing, and it’s not just where you are today, but where you’re heading,” Evans said. “Do they plan to grow organically or inorganically? We have an economics indicator to help with that.”

One theme that ran through the panel discussion was the matter of firm size, especially since many breakaways are launching independent firms with smaller books of business.

For regulatory purposes, it was generally agreed that meeting the $100 million threshold to qualify for registration with the Securities and Exchange Commission was preferable to state-level registration.

“From a compliance perspective, it is infinitely easier to go it alone if you’re over that $100 million threshold, because dealing with state regulators is a pain,” Dowell said.

Moderator Chuck Failla, a breakaway broker and founder of Sovereign Financial Group, pointed out that assets under management shouldn’t be viewed as a criteria for going independent.

“You can have a laptop and a dream and $5 million in AUM and you can go it alone, because there’s so many resources out there,” he said.

However, Failla acknowledged, sometimes it can make sense to join an existing RIA or partner up with someone to get to the $100 million mark.

Dowell, a former Florida state regulator, said the layers of complexity are virtually endless at the state level and can include having to register in multiple states if an RIA has more than a handful of clients based in a different state.

“The SEC, by and large, has one rule book, compared to 50 different sets of rules at the state level,” she said.

Another area of universal agreement among the panelists was the importance of owning your client data, regardless of which service providers and platforms you partner with or how you partner with them.

“Make sure you can integrate the other pieces and components you need to help you grow not only today with your needs, but what you will need in the future,” said Clarke. “Data ownership will give you key insights about how that firm integrates with other firms, and that’s fundamental to independence. You need to make sure that data flows seamlessly.”

Learn more about reprints and licensing for this article.