Federal Reserve raises interest rates by a quarter percentage point

It’s the second straight rise of 25 basis points following a string of aggressive moves starting in March 2022, when rates were near zero.

The Federal Reserve raised interest rates by a quarter percentage point and signaled it’s not finished hiking, despite the risk of exacerbating a bank crisis that’s roiled global markets.

The Federal Open Market Committee voted unanimously to increase its target for the federal funds rate to a range of 4.75% to 5%, the highest since September 2007, when rates were at their peak on the eve of the financial crisis. It’s the second straight rise of 25 basis points following a string of aggressive moves starting in March 2022, when rates were near zero.

“The U.S. banking system is sound and resilient,” the Fed said in a statement in Washington after a two-day meeting.

At the same time, officials warned that “recent developments are likely to result in tighter credit conditions for households and businesses and to weigh on economic activity, hiring, and inflation. The extent of these effects is uncertain.”

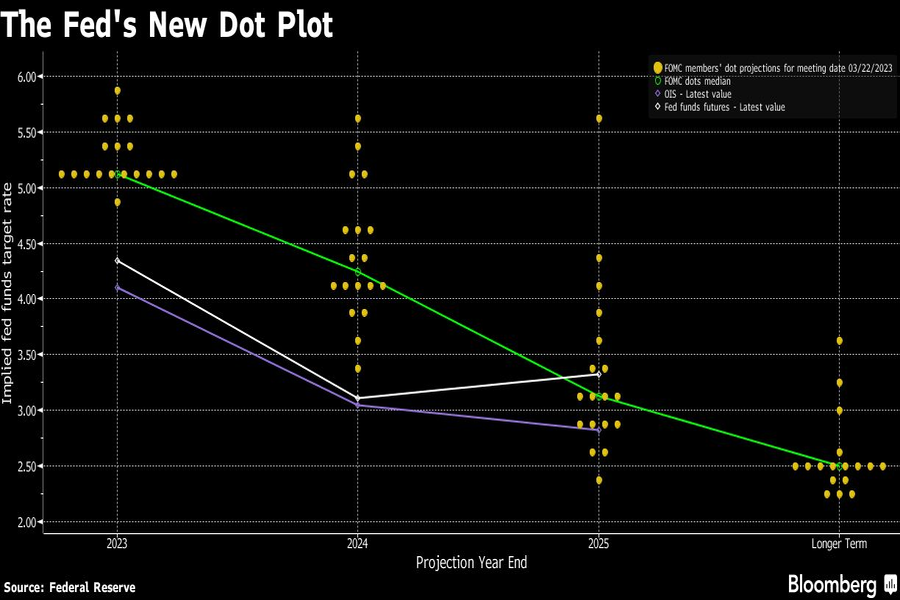

Fed policymakers projected rates would end 2023 at about 5.1%, unchanged from their median estimate from the last round of forecasts in December. The median 2024 projection rose to 4.3% from 4.1%.\

Treasury yields slid along with the U.S. dollar, and stocks rose after the announcement.

The hike and forecasts suggest policymakers remain firmly focused on bringing down inflation to their 2% goal, indicating they see rising prices — especially based on recent data — as a bigger growth threat than the bank turmoil. It also projects confidence that the economy and financial system remain healthy enough to withstand the string of bank collapses.

At the same time, rising borrowing costs risk worsening the bank crisis, especially since it was higher interest rates on holdings of Treasuries that precipitated Silicon Valley Bank’s collapse and threatened other lenders. If the Fed is underestimating the extent of financial fissures, the latest move risks adding to pressures that could tip the economy into recession.

TOUGH CALL

While Wednesday’s hike was in line with most economists’ and traders’ expectations, it was one of the central bank’s toughest calls in recent years, with some Fed watchers and investors calling for a pause to mitigate the risk of financial contagion following multiple bank collapses.

The Fed “anticipates that some additional policy firming may be appropriate in order to attain a stance of monetary policy that is sufficiently restrictive to return inflation to 2% over time,” officials said in their post-meeting statement.

The change in the statement language — policymakers had previously said that “ongoing increases” in the benchmark rate would be appropriate — signals they want to add flexibility to pause if necessary.

Officials also removed a reference in the statement to inflation having eased, saying price pressures remain elevated. It noted that job gains have picked up in recent months, and are “running at a robust pace.”

The Fed said it would continue the same pace of shrinking its balance sheet, a process known as quantitative tightening, though recent emergency measures have swelled assets once again. The central bank will keep the monthly caps of $60 billion for Treasuries that are allowed to mature without being reinvested and $35 billion for MBS.

Earlier this month, before the SVB failure, Powell indicated that the Fed might ramp back up to a 50 basis-point hike at this meeting to combat persistent inflation and a too-tight labor market. This week’s gathering was the first for policymakers since the January and February data came in surprisingly hot.

The collapse of SVB and two other banks in the U.S. were followed in Europe by the sale of Swiss banking giant Credit Suisse Group AG.

CONTAGION FEARS

The turmoil ignited fears of contagion to other banks. The Fed and other regulatory agencies introduced backstops, including an emergency lending facility to banks and an increase in the frequency of U.S. dollar swap-line operations with foreign central banks, the latter of which the Fed and five other institutions announced Sunday.

The past two weeks’ events had increased ambiguity about what the Fed would do at this meeting.

The European Central Bank last week raised interest rates by a half percentage point, arguing that it saw its inflation mandate as separate from its price stability one. Some Fed watchers said that action gave the U.S. central bank cover to still raise rates, while others argued that any rate increase would add fuel to fire already raging in markets.

Concerns over sufficient liquidity have also increased. Data released last week showed banks in the US borrowed a record amount from Fed backstop facilities in the week ended March 15, topping a previous high reached during the 2008 financial crisis and signaling widespread funding strains.

That’s adding to bets that the Fed will cut rates at some point this year, something that most investors didn’t expect just before the bank failures, and that Fed officials repeatedly said wouldn’t happen.

Advisors need to review cash options in wake of SVB’s collapse

Learn more about reprints and licensing for this article.