T. Rowe Price has a $1 trillion answer to claims stock-picking is dead

Total mutual fund assets: $582.9 billion

Total mutual fund assets: $582.9 billionLong-term assets: $566.2 billion

Founded by growth-stock pioneer T. Rowe Price, the Baltimore fund complex has become a stalwart no-load fund company, offering brokerage and advice to its lineup of funds. Still largely a growth shop — its largest fund remains the $51.2 billion T. Rowe Price Growth Stock (PRGFX) fund — T. Rowe has expanded aggressively into international and fixed-income investments.

The asset manager’s focus on stock funds in retirement accounts has helped it flourish as peers have struggled

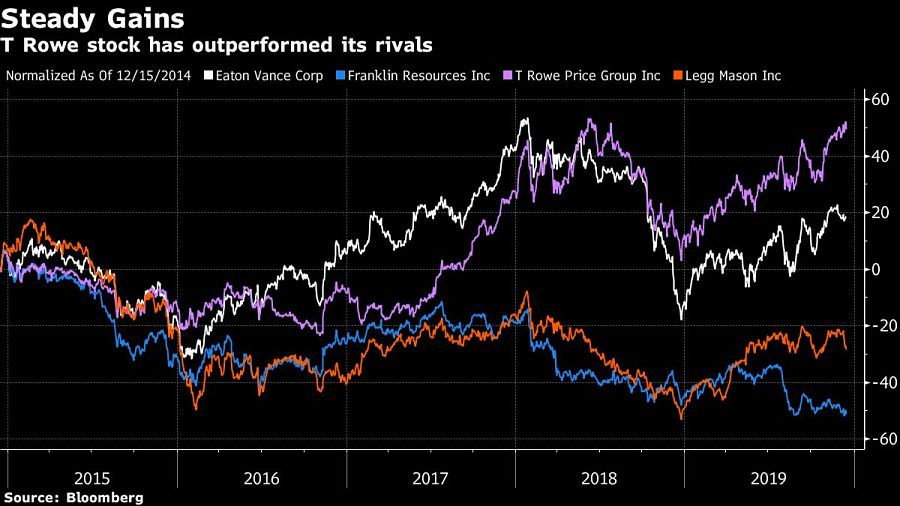

Stock pickers may be under siege after decades of ruling Wall Street, but not every old-school champion of active mutual funds is losing ground to cheaper rivals tracking indexes.

T. Rowe Price Group Inc. is one of the rare winners.

The 82-year-old company, which built its reputation sifting the standouts and laggards in U.S. equities, has seen assets under management swell to just over $1 trillion from around $400 billion at the start of the decade. That means it stayed abreast of the long bull market even as peers including Franklin Resources Inc. and Legg Mason Inc. suffered outflows and revenue declines.

With its focus on plain old stock funds in retirement accounts, Baltimore-based T. Rowe is an unlikely success in an era when the likes of BlackRock Inc. and Vanguard Group are luring investors looking to make low-cost bets on broadly rising markets. But the fund firm, whose informal motto is “get rich slow,” has thrived by establishing itself in an area that’s yet to embrace exchange-traded funds.

“They decided early on that they’d focus on one niche part of the market, and that’s really helped them,” said Greggory Warren, an analyst at Morningstar Inc. “Combined with their dedication to investment performance, they’ve done a lot of the right things historically.”

About two-thirds of T. Rowe’s assets under management are held in retirement-related products. The firm started offering funds in company-sponsored defined-contribution plans in 1974 and today sits among the top 10 providers of recordkeeping services for 401(k)s — a role tracking employee investments in a company’s retirement plan. Its funds are also available on platforms managed by other providers.

“Defined contribution is an important marketplace for us,” CEO Bill Stromberg said in an interview.

About 4,600 retirement plan sponsors were using T. Rowe’s platform at the end of 2018, according to the company.

“Those are sticky, high-quality assets,” said Robert Lee, an analyst at Keefe Bruyette & Woods who rates T. Rowe’s own shares “market perform.”

Index-tracking products such as exchange-traded funds aren’t as popular in retirement accounts like 401(k) plans, where their tax advantages aren’t relevant.

T. Rowe’s strategy has helped the company secure net inflows in all but one of the five years through 2018; revenue rose 35% over the period. By contrast, Legg Mason saw outflows of more than $80 billion in its past four fiscal years. Franklin’s outflows were even deeper, with clients withdrawing more than $100 billion in its past four fiscal years.

A Franklin spokesman declined to comment. A spokeswoman for Legg Mason said it “has sought to diversify its investment offerings in fixed income and equity categories, while adding alternative investment capabilities.”

T. Rowe keeps a narrow focus on U.S. mutual funds — a strategy that comes with trade-offs. The fund manager obsesses over its cautious, meticulous investment process and long history, to the extent that it called its company mascot — a bighorn sheep — “Trusty” for fear the

original name, “Lucky,” would reflect badly on how it chooses stocks.

One ex-staffer recalled toting a photo of founder Thomas Rowe Price Jr. on sales calls, displaying the image to institutional investors to illustrate the firm’s principles and history.

The steady-as-she-goes ethos is part of the investment process and has helped about 75% of the firm’s U.S. mutual funds do better than the median offering in their class over the past five years, according to Morningstar. The company also competes on price, with about half of T. Rowe’s funds charging below the industry average, Morningstar data show.

Mr. Stromberg has spent more than 30 years at the 7,000-person company, which he joined after a brief stint playing for the Philadelphia Eagles. It’s not uncommon to see portfolio managers for T. Rowe funds stay put for decades. Some financial advisers favor that consistency.

The CEO is aware that the years ahead could be challenging, despite the firm’s successes.

Passive investing continues to gather momentum. In August, assets in U.S. index-based equity mutual funds and exchange-traded funds topped those in active stock funds for the first time: $4.3 trillion compared with $4.2 trillion, respectively, according to Morningstar.

While it may help with stock-picking T. Rowe’s conservative culture means it can miss out on major industry shifts, such as the growth of index funds. The firm chose not to make a heavy push into such products, Mr. Stromberg said, deciding it was too crowded to stand out.

“There wasn’t much room for another player,” he said.

That stance seems to be changing. Regulators recently approved partially concealed, actively managed ETFs from T. Rowe that would reveal their holdings once a quarter, rather than every day as conventional ETFs do. Active strategies account for around 2% of U.S. ETF assets.

Alternative investment strategies could also make sense at some point, Mr. Stromberg, though he didn’t give more details. Those investments tend to come with longer time horizons and higher fees.

“We’re on our toes,” Mr. Stromberg said. “We’re trying to keep abreast of the changes and keep an open mind about how we innovate and evolve our business.”

[More: T. Rowe Price steps up its game to serve financial advisers]

Learn more about reprints and licensing for this article.