6 big takeaways from Larry Fink’s letter to shareholders

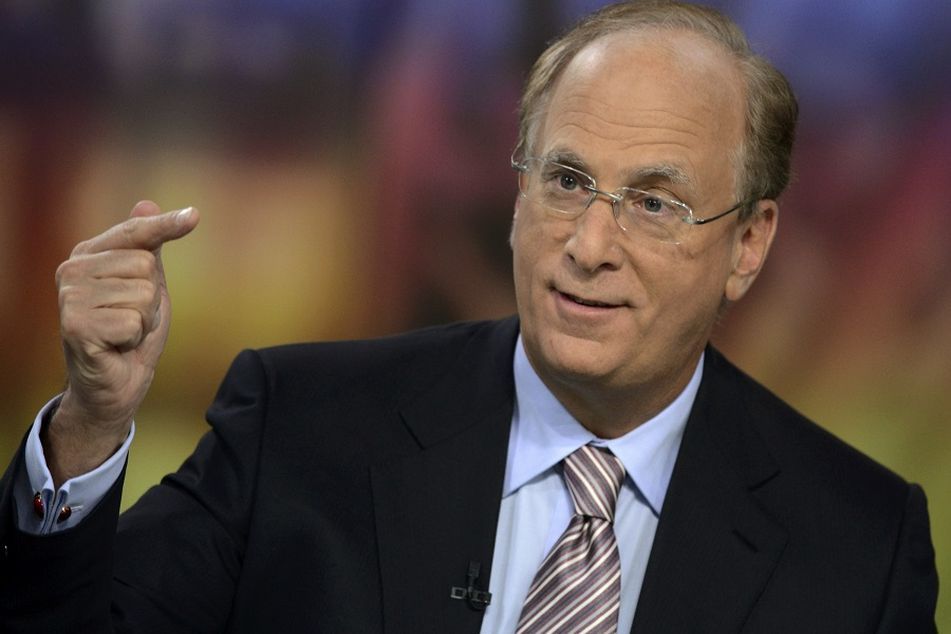

Larry Fink, chief executive officer of Blackrock speaks at an interview at Bloomberg headquarters in New York, U.S., on Tuesday, Dec 11. 2012 Photographer: Peter Foley/Bloomberg *** Local Caption ***

Larry Fink, chief executive officer of Blackrock speaks at an interview at Bloomberg headquarters in New York, U.S., on Tuesday, Dec 11. 2012 Photographer: Peter Foley/Bloomberg *** Local Caption ***

BlackRock's chairman and CEO thinks returns are tougher to find, the retirement crisis looms large and asset managers are far too focused on the short term.

Larry Fink, chairman and CEO of BlackRock, published his annual letter to shareholders this week, and InvestmentNews scoured its contents to find the most important nuggets for financial advisers.

Here’s what the head of the world’s largest asset manager had to say.

INVESTORS DON’T KNOW WHERE TO TURN

Mr. Fink alluded to a “heightened sense of uncertainty” in the markets last year. Although equity markets began 2018 at record highs, they slid persistently throughout the year, intensifying investors’ fears of a recession.

(More: Is volatility coming?)

“Markets have experienced bouts of volatility several times over the last decade. But last year — for only the second time in the past three decades — global stock and bond markets both delivered negative returns. While U.S. short-term rates surpassed 2%, making cash a more profitable placeholder investment, that return is not enough to sustain the long-term objectives of most savers.”

INDUSTRY TOO SHORTSIGHTED

Society is increasingly frustrated with the short-termism of investing culture, said Mr. Fink, who described “a focus on speed and a lack of substance.”

Asset managers sell products without placing them in a broader context, by focusing on delivering returns that are in line with or beat certain benchmarks over 1, 3 and 5 years.

“While these metrics are an important component of portfolio return, alpha doesn’t pay pensions. Sustainable return on investments in actual dollars is what is ultimately required. Our purpose as a firm — and as an industry — has to be broader than tracking error or alpha generation.”

The industry, Mr. Fink said, should instead be “the standard-bearers for long-termism” — more focused on explaining how investments today will help investors achieve the financial outcomes they need in the future.

60-40 NO LONGER CUTS IT

Investors used to follow general rules of thumb with investing: for example, allocating 60% of a portfolio to equities and 40% to investment-grade bonds. That approach worked for many years and for many people.

(More: How mid-cap growth funds owned the first quarter)

“That same portfolio allocation is no longer expected to deliver nearly the same return as it did in the past. Today, the traditional investing frameworks are insufficient to meet the needs of most investors, whether individuals saving for retirement or pension funds seeking to close their asset-liability gaps.”

RETIREMENT CRISIS LOOMS LARGE

Helping workers navigate retirement is “one of the greatest societal challenges of our generation,” Mr. Fink said.

“Globally, people are living longer, and in some countries, there is an additional demographic challenge of an aging population with fewer workers to support them. The need for solutions addressing the entire journey — from saving for retirement to spending during it — is more pressing than ever.”

ASSET MANAGEMENT BUSINESS GETTING TOUGHER

Last year was rough for asset managers and a harbinger of things to come: a greater focus on value, tougher competition, more operational complexity and the disruption of legacy business models, Mr. Fink said. The success they’ve had post-financial-crisis will be challenged going forward — something for which many asset managers haven’t adequately prepared.

“Operational complexities are increasing as a result of an evolving regulatory environment and more global business models. Investors are realizing that they have been paying high fees for underperforming traditional active investment strategies, where many managers haven’t invested in innovation. And there is a major movement in the wealth management landscape from a historical commission-based business model to a fee-based advisory business model,” Mr. Fink said.

BULLISH ON FINANCIAL-ADVISER TECH

The most “impactful” results, Mr. Fink said, come from the combination of technology and human insight. He sees that potential especially with Aladdin, BlackRock’s risk analytics software.

“I firmly believe one of the biggest opportunities for Aladdin is to make it the language of portfolio construction for wealth managers, financial advisers and individual investors. Bringing institutional risk transparency and portfolio construction capabilities into the wealth market will enable financial advisers to have richer conversations with their own clients and will ultimately allow them to achieve better results.”

Learn more about reprints and licensing for this article.