The real risk of bonds

Stretching for yield in this interest-rate environment is a recipe for disaster

The lifeblood of financial services today is families nearing or already in retirement. This massive cohort of investors will be, or already is, dependent on their investment portfolios for current and future income. Our team has had the privilege of receiving and reviewing portfolios from all over the U.S. and we’ve noticed a common theme.

The risk of forced lifestyle sacrifices to avoid running out of money (longevity risk) is increasing … fast. It is the biggest issue facing our clients, and we believe the culprit is bonds.

We’re not concerned about drawdown or volatility risk with bonds, but with the impact on a portfolio’s total expected return. Insufficient returns increase longevity risk, and owning bonds, especially too many of them, is a significant threat.

ZERO RETURNS (MAYBE NEGATIVE)

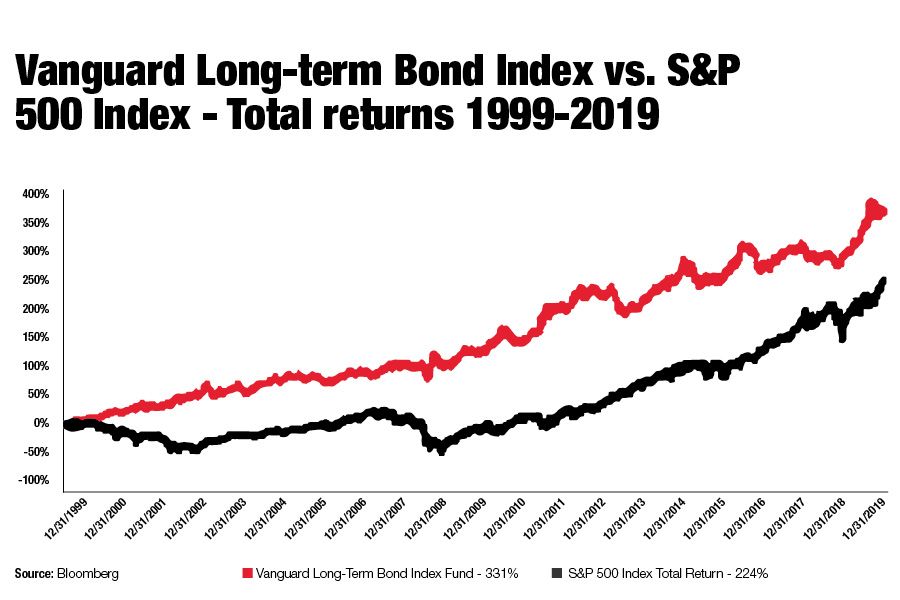

Investors’ retirement nest eggs have enjoyed multiple decades of decent yields, correlation benefits and upside price appreciation from bonds. However, bonds could fail to deliver any of these benefits for the foreseeable future. The positive impact of bonds to portfolios in recent history is often overlooked.

Bonds can generate returns from:

- Their current yield

- Dropping interest rates

- Tightening credit spreads (if applicable)

Can bonds deliver any positive contributions when the 10-year Treasury yields 56 basis points? Or when Amazon issued 40-year paper with a 2.70% interest rate in June?

Using the 10-year Treasury as an example, think about bonds through a price-to-earnings lens where price is the par value and earnings is the yield. If you lend the government $100 (price), it will pay you $0.56 per year (earnings) for 10 years. That is a P/E multiple of 178.5! And the kicker is those earnings are guaranteed to have a growth rate of 0%!

If today’s valuations impact tomorrow’s returns, what are you expecting from bonds moving forward?

We believe the best rationale for owning bonds is dampened volatility. However, swapping near-term volatility for a long-term shortfall is a bad trade-off.

INCOME NEEDS

Investors need income from their portfolios and part of that should come from yield. Now, more than ever, consistent and repeatable yield matters most. Can you find bonds that yield 4%, 5% or more? Sure, but we don’t think the credit risk entailed is worth it. We believe stretching for yield in this interest-rate environment is a recipe for disaster. The juice is not worth the squeeze. Income requirements should be planned for and met through a total return framework in today’s market.

REDUCING THE RISK OF BONDS

Are fewer bonds and more stocks the answer? Yes, that is the simple answer.

Uneasiness about that decision can be alleviated if advisers consider blending long volatility with quality stock exposure. Long volatility can address drawdown concerns, while high-quality stocks can provide access to repeatable, growing income streams.

Viewing volatility as a separate asset class and considering ways to benefit from a rise in volatility helps address longevity risk with a powerful lever — asset allocation.

Get asset allocation right, and the margin for error in other areas can be forgiving. Get asset allocation wrong, and longevity risk becomes a reality.

Owning bonds, despite how good they have been, increases the chance of poor prospects moving forward. Asset allocations should be built looking through the windshield, not the rearview mirror.

[More: Making a 60/40 portfolio work when bond yields are low]

JD Gardner is founder and managing member of Aptus Capital Advisors.

Learn more about reprints and licensing for this article.