Medicare premiums, surcharges to rise slightly in 2021

Income brackets to be adjusted for inflation for high-income retirees next year

Medicare Part B premiums will increase by about $4 per month next year and high-income surcharges will also rise modestly in 2021, the Centers for Medicare and Medicaid Services announced late Friday.

The standard Medicare Part B premium, which covers doctor’s visits and other outpatient services, will increase to $148.50 per month in 2021, up $3.90 from this year’s monthly premium of $144.60.

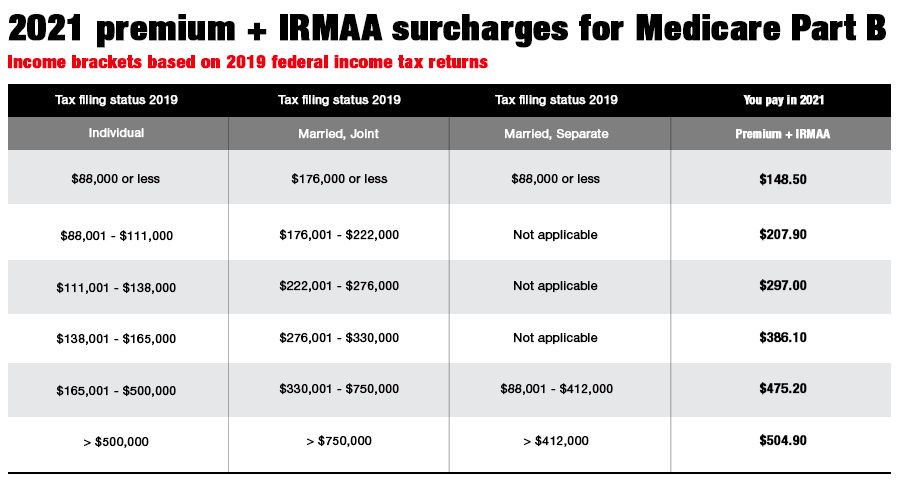

Higher-income Medicare beneficiaries will pay more. In 2021, individuals with modified adjusted gross income of $88,000 or more and married couples with MAGIs of $176,000 or more will pay additional surcharges ranging from $59.40 per month to $356.40 per month on top of the standard Part B premium. Married couples where both spouses are enrolled in Medicare will pay twice as much.

High-income surcharges for 2021, officially known as income-related monthly adjustment amounts or IRMAA, are based on income reported on 2019 federal tax returns. Income brackets that trigger IRMAA surcharges will increase slightly in 2021 as a result of inflation adjustments.

The $3.90 increase in the monthly Part B premium for 2021 is much less than had been expected earlier this year when Medicare spending soared due to the COVID-19 pandemic. But Congress stepped in with emergency spending legislation to offset a rise in the premium that CMS actuaries projected could have been as much as $50 per month for some beneficiaries in 2021.

High-income retirees are also subject to monthly surcharges on their Medicare prescription drug plans, ranging from an extra $12.30 per month per person to an extra $77.10 per month per person on top of their monthly premium. Medicare drug plans are run by private insurers and costs vary widely.

Normally, Medicare Part B premiums and IRMAA surcharges are deducted directly from monthly Social Security benefits, resulting in a smaller net Social Security benefit. People who have not yet claimed Social Security or are not eligible for Social Security are billed directly by Medicare.

The Medicare premium and surcharge announcement from CMS follows last month’s announcement by the Social Security Administration’s announcement of a 1.3% cost-of-living adjustment for 2021, one of the smallest COLAs on record. SSA said the average Social Security benefit for a retired worker will rise by $20 a month to $1,543 in 2021, while the average benefit for a retired couple will grow $33 a month to $2,596. The higher Medicare Part B premium will reduce retirees’ net monthly Social Security payments.

CMS says 7% of Medicare recipients will have to pay income-related surcharges.

For example, an individual earning more than $88,000, but less than or equal to $111,000, will pay $207.90 in total a month for Part B premiums in 2021, including a $59.40 surcharge. That’s up 2.7% from a total monthly payment of $202.40 per person 2020, including a $57.80 surcharge.

At the top end of the sliding income scale, the wealthiest retirees — singles with $500,000 of income or more and couples with $750,000 of income or more — will face total premiums of $504.90 a month per person, including a $356.40 surcharge, in 2021. That comes to $12,117.60 a year for a married couple.

The following table shows the combined impact of monthly Medicare Part B premiums and surcharges for 2021 based on tax-filing status and modified adjusted gross income ( in 2019. MAGI includes adjusted gross income plus any tax-free interest from municipal bonds.

[More: Medicare premium increase due to sale of property]

HOW TO APPEAL AN IRMAA SURCHARGE

In some cases, clients can appeal a Medicare premium surcharge if they have experienced a life-changing event that caused their income to decrease or if they can prove that the income information that Social Security used to determine the IRMAA premium is incorrect or outdated.

Social Security considers any of the following situations to be life-changing events: the death of a spouse; marriage, divorce or annulment; retirement or reduced work hours for one or both spouses; loss of income-producing property due to natural disaster; or loss of a pension.

However, a one-time boost in income due to the sale of a vacation home, large portfolio distribution or Roth IRA conversion would not qualify as a life-changing event and would boost the client’s Medicare premium for at least a year. If the clients’ income subsequently declined, so would their Medicare premiums two years later.

Learn more about reprints and licensing for this article.