3 tips on building recession-ready retirement income plans

Advisers need to help clients understand that the question isn’t whether the markets will drop, it’s when and how far

One of the biggest mistakes pre-retirees make is not preparing their investment portfolios for landing in retirement. We’ve all heard pilots announce, “Flight attendants, prepare the cabin for landing,” causing passengers to buckle their seat belts and stow their electronics as the pilot prepares to land. Now imagine, instead, a plane trying to land at roughly 500 mph, with no landing gear down and passengers still walking freely around the cabin — not a pleasant picture, is it?

That’s comparable to what pre-retirees experienced in 2000, 2008 and now in 2020. Too many pre-retirees today haven’t prepared their finances for a possibly bumpy landing in retirement.

Pre-retirees may also find it hard to maintain their current standard of living in their early years of retirement. To top it off, in June the National Bureau of Economic Research said the economy is in recession, just over three months after the downturn began, in what’s been called “the fastest recession ever.”

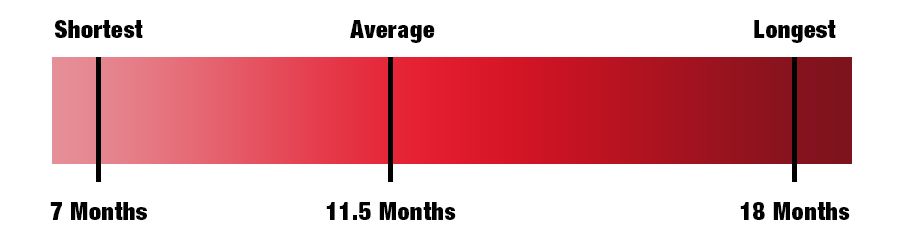

But here’s the thing: In the past 70 years, there have been 10 recessions in the United States, which lasted on average 11.5 months.

This means that even without the extraordinary trigger of a global pandemic, clients are likely to experience up to four recessions during their retirement — a staggering statistic. Advisers need to help retirees understand that the question isn’t whether the markets will drop, it’s when and how far.

Advisers should incorporate solutions that will help their clients weather these difficult conditions and, equally important, protect their retirement savings over the long term.

As you look to create recession-ready plans for your clients, here are a few tips:

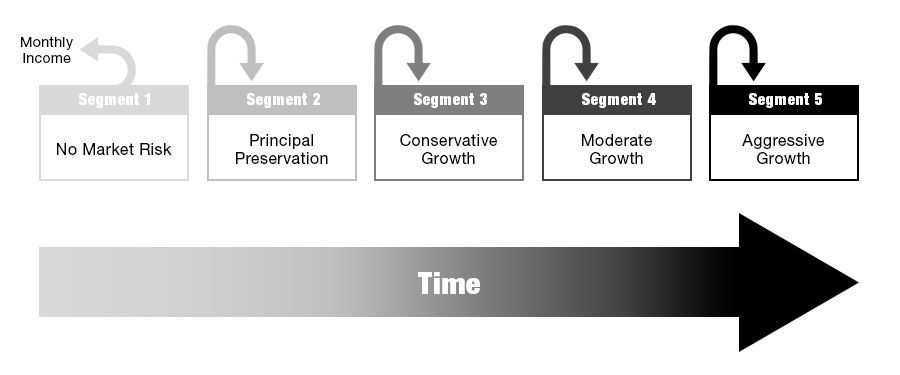

Prepare and protect. Aim to create a plan at least five years prior to retirement and put aside the assets needed to fund your client’s first five years of retirement. That gives individuals a 10-year safety zone. Even if there is a large market downturn prior to their retirement date, they will have their first years of retirement income guaranteed, while the rest of their assets will have time to recover from the downturn.

Segment your clients’ income plans. In addition to a five-year safety zone, clients need retirement income plans that cover them over a lifetime. Funds allocated to the short term should be protected from any financial instability, such as a recession or even a pandemic, so clients can maintain the standard of living they’ve come to expect. Money pegged for later in retirement has more time to grow and recover from recessions, so it can be invested more aggressively.

Look to create “COVID-proof” virtual interactions. Advisers may feel stymied by their inability to offer their counsel face-to-face with clients as a result of the pandemic. But don’t discount the use of technology with baby boomers. Thanks to the pandemic’s stay-at-home orders, many boomers are now entirely comfortable with virtual interactions.

Implementing a flexible segmented strategy creates an asset allocation ladder during retirement, which may alleviate clients’ biggest fear: outliving their assets. And many clients will welcome the opportunity to discuss these retirement options with you virtually, from the safety of their own couch.

[More: Creating time-tested retirement income plans]

Phil Lubinski is co-founder and retirement income specialist at IncomeConductor.

Learn more about reprints and licensing for this article.