The one thing that matters most to clients during a crisis

It’s not whether you’re an adviser or a broker. It’s not whether you’re fee-only or fee-based. It’s not the designations after your name, or even whether you’ve taken a fiduciary pledge. What clients care most about during a crisis is whether you can be trusted.

The first casualty of any crisis is trust. Indeed, what often turns a series of events into a crisis is the erosion of trust.

If there’s a silver lining to the crises of the past year, it’s that we’ve been reminded of what matters most to clients during a period of turmoil —trust — the type of trust that also needs to be integrated with a fiduciary standard.

An understanding of the critical link between trust and a fiduciary standard can be found in the behavioral sciences, particularly the groundbreaking research in neuro-leadership. The academic team that conducted the research discovered that exemplary leaders have greater neurological capacity to build trust.

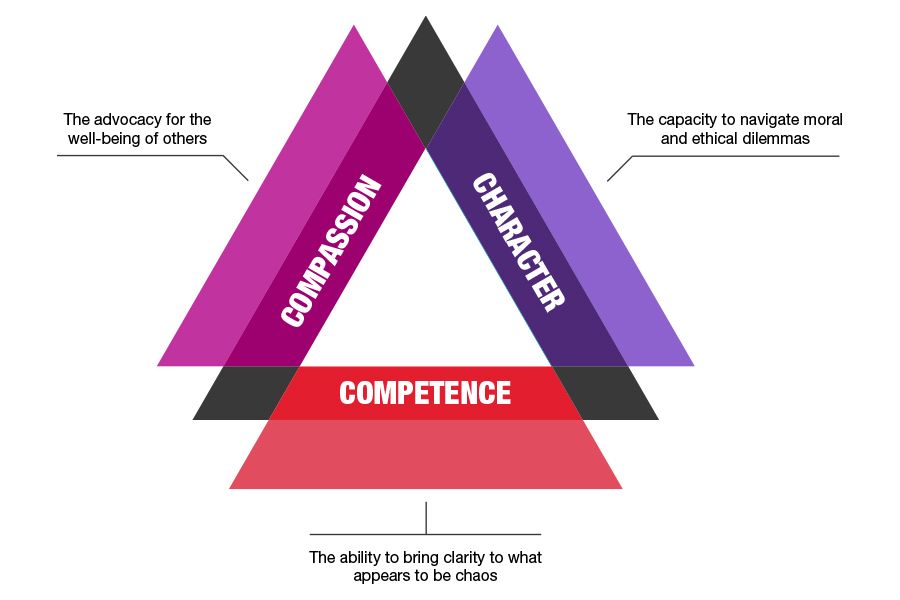

Studies show that in order to build trust, fiduciaries must demonstrate their capacity for compassion, character and competence.

During a crisis, even the order of these behaviors is critical. A fiduciary must first demonstrate their capacity for compassion and character before a client will take the fiduciary’s competence is taken into consideration.

Or, stated differently, during a crisis a client may forgive an occasional error in account management. But a client may not be willing to overlook a lack of compassion or a breach of character.

To paraphrase the late American poet Maya Angelou: “[During a crisis] I’ve learned that people will forget what you said, people will forget what you did, but people will never forget how you made them feel.”

Over the past nine months, a group of fiduciary advocates have begun to translate the seminal work in neuro-leadership into a new field of research called neuro-fiduciary — the study of the cognitive behaviors that amplify and improve the quality of a fiduciary’s decision-making process.

To date, there are two important takeaways associated with the research in neuro-fiduciary:

- Compassion and character are getting buried by regulations. Complex disclosures are making it harder for clients to trust you.

- Competence is getting buried by “stuff.” Fintech has made it easier to produce more “stuff,” but the additional “stuff” is making it harder for clients to evaluate your competence.

During a crisis, what matters most to clients is trust and your capacity for compassion, character and competence. During a crisis, what matters most to clients is your passion and discipline to protect their long-term interests.

Don Trone is CEO of the new Center for Board Certified Fiduciaries.

Learn more about reprints and licensing for this article.