3 hires that help RIA firms enter the elite

The 2020 Elite RIA Study sheds light on the staff structures that allow top firms to be more productive

Many advisory practices start off with a single professional, who by necessity juggles everything from clients and portfolios to marketing and IT management. But as a solo firm grows past the capacity of that single professional, the time comes to hire specialized staff for some of these roles.

Where should that effort start?

The latest InvestmentNews Elite RIA Study, produced this year in partnership with ETrade Advisor Services, provides some insight. Among other things, the study examines the staffing strategies in place at the industry’s most productive registered investment advisory firms.

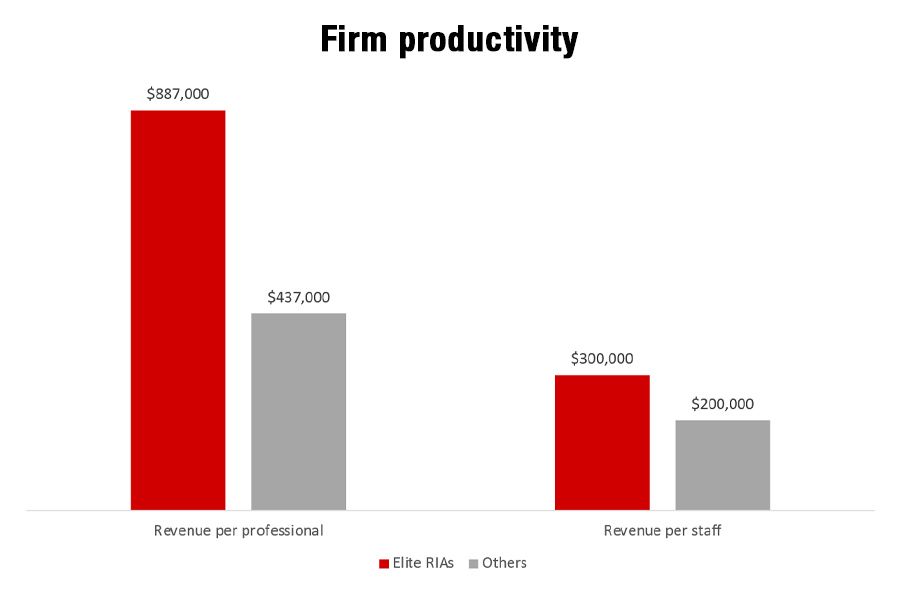

The median elite advisory firm in the study had about twice the number of professionals, but three times the total staff of other practices. By hiring more support and specialist staff, elite firms achieve double the professional productivity, as measured by revenue per adviser and partner, of other firms.

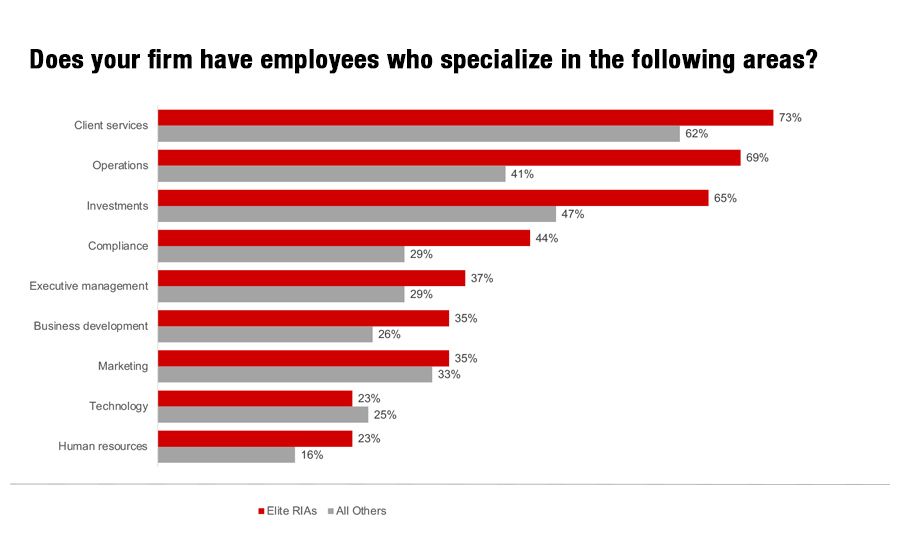

At all firms, client service was the most common area for the employment of specialists, who are employees that spend at least three-quarters of their time in a role. Elite RIAs in the study were more likely to employ specialists in every area except technology, which most of them outsourced.

As a result, elite firms can take a team-based approach that helps land bigger clients and allows professionals to focus on the things they do best.

Although elite firms were more likely than others to employ specialists almost across the board, three areas stood out for the particularly large gaps in hiring between them and other firms.

OPERATIONS

The hiring of operations specialists was the biggest differentiator between elites and other advisory firms. Sixty-nine percent of elite RIAs employed operations specialists, compared with only 41% of other firms. Most commonly, this is an operations or office manager who may have some client responsibilities, but who focuses primarily on day-to-day tasks so advisers can work with high-value clients. According to the latest InvestmentNews Compensation & Staffing Study, about a third of even the smallest single-adviser shops employ an operations manager.

[More: Chief operating officers lift advisory firms to the next level]

INVESTMENTS

Elite RIAs were also much more likely to employ investment specialists than other firms, 65% versus 47%. Investment specialists lend themselves well to team-based structures, in which multiple advisers work on client needs, each bringing their own area of expertise. These structures create deeper relationships that help retain clients even when staff transition. In line with their team structures, elite firms were also more likely to brand themselves as holistic providers of wealth management services, offering a full range of client services.

COMPLIANCE

Compliance specialists may not be top of mind when it comes to growing a firm’s business, but the time they free up for more valuable tasks helps them set their firms apart. Forty-four percent of elite RIAs employ compliance specialists, compared with 29% of other firms. Often this role takes the form of a highly paid chief compliance officer, so is added later in a firm’s evolution. Still, many firms start by bringing on a more junior employee to help coordinate approvals and filings.

There are, of course, many other strategies that set elite RIAs apart. But having the right people, and knowing where to put them, is where a firm’s path to the elite begins.

Want to learn more? Download a free copy of the 2020 Elite RIA Study here.

Learn more about reprints and licensing for this article.