Retirement risks in the RIA world and how to manage them

Experts discuss life expectancy and other retirement risks faced by advisors and their clients at a recent RIA LABs webinar.

When it comes to the different risks that surround retirement planning, advisors tend to focus on market risk. However, there are two more that shouldn’t be ignored: longevity risk and sequence of return risks.

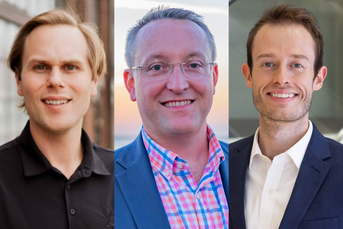

These were among the takeaways for attendees at the recent RIA LABS webinar, Fee-based Insurance & Annuities. Hosted by InvestmentNews, it featured views from various experts, advisors and executives from Jackson, Boston College, Apollon Wealth Management, DPL Financial Partners, RISA and Allianz.

Longevity risk has to do with people living longer.

“With regard to the severity of longevity risk, looking at it quite simply, is your money going to last as long as you do?” asked Glen Franklin, assistant vice president of RIA and lead gen strategy and research at Jackson. “Fear of running out of money in retirement is the No. 1 thing that [clients] worry about retirement. Fifty percent of Americans are not in a place to save for retirement in the first place so that makes complete sense.”

Gal Wettstein, senior research economist at Boston College, said one of his former colleagues ranked various risks to retirement security.

“He found that longevity risk was the most severe of these risks in terms of how much rational people should be willing to pay to eliminate the risk … In particular, he found that single men should be willing to give up about a quarter of their retirement savings to eliminate longevity risk,” Wettstein said.

Meanwhile, according to recent studies, the average age at which people retire has risen three years over the past 30 years.

“It’s a combination of improved health and the fact that Social Security retirement ages have increased, as well as the increased longevity,” Wettstein said.

When advisors ask people to project their own longevity, Franklin said there’s a lot of error in the mix. As it turns out, there’s a significant minority that underestimate how long they’re going to live.

“It’s a very emotional issue contemplating your own mortality,” he said. “We found that only 10% or so accurately predict based on life expectancy tables … the majority overestimate how long they’re going to live.”

While longevity risk is a more well-known risk to advisors, sequence of returns risk can hurt just as much if clients aren’t properly prepared. And the two risks, interestingly enough, relate to one another.

“Sequence of returns risk is a problem in the crucial decade that spans from five years before you retire to about five years afterwards,” Franklin explained. “It’s about a down market. If you’re withdrawing money in a portfolio that’s shrinking, you significantly increase your risk that you’re going to run out of money, which triggers, in effect, longevity risk before you pass away.”

Seth Radow, managing director and senior portfolio manager at Apollon Wealth Management, had some advice for advisors looking to help their clients with sequence of return risk.

“The only way that one can really address that is to generate enough income from the assets in the portfolio to sustain the client’s objective, that is their retirement,” Radow said. “The minute one starts to infiltrate the principal of their portfolio, that’s when the entire investment plan falls apart … You have to be proactive in what you do. That’s where the annuities come in and really mitigate that risk significantly.”

Follow these ‘tectonic’ trends to cash in on venture capital investments

Learn more about reprints and licensing for this article.