Former AssetMark CEO Ahluwalia joins Hightower as president

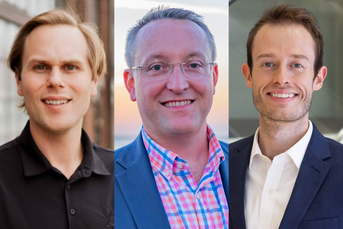

Gurinder Ahluwalia of Hightower

Gurinder Ahluwalia of Hightower

RIAs should have ‘quality leadership teams,’ says Hightower CEO Bob Oros.

There’s a new face and title at Hightower Advisors.

According to Hightower’s recent Form ADV filing with the SEC, the $131 billion registered investment advisory firm appointed Gurinder Ahluwalia as its president, a new position, effective this month.

Bob Oros, chairman and CEO of Hightower, believes that by adding Ahluwalia as president, and Michael DiBiasio as chief operating officer, Hightower is supporting the structure of growth “by adding talented leaders who can support our business and client objectives.”

“At the same time, [we’re] ensuring that we can continue to drive momentum for our advisors in a way that is proactive and scalable,” Oros added, in a statement provided to InvestmentNews.

Ahluwalia currently serves as an executive partner at Thomas H. Lee Partners, Hightower’s private equity owner, in its financial technology and services vertical, and as lead director on Hightower’s board. He has been registered with Hightower Securities, the firm’s broker-dealer, since November.

Ahluwalia is no stranger to the RIA space. He has a long history of working in the wealth management space, having led AssetMark as its president and CEO and worked at Genworth and Terra Financial. Other positions include serving as an advisor and chief operating officer at Ovo Cosmico and as co-founder and CEO of 280 CapMarkets, according to his BrokerCheck report.

Jodie Papike, CEO of Cross-Search, a third-party recruiter, says Ahluwalia’s strong leadership background, along with his position as lead director of Hightower’s board, is perfectly in tune with Hightower’s focus on growth and scaling businesses.

“It always makes sense to me when someone promotes from within,” Papike said. “It’s someone that’s had a big impact, most likely, and someone who knows the culture and knows the direction of the firm.”

In a recent interview with InvestmentNews, Oros said one of the qualities that would make a firm “a good fit” for Hightower comes down to the “quality of the leadership team.”

“We’re not doing a deal to come in and take you over so it’s really important we fall in love with the leaders and that they invest in the next generation of their talent,” Oros said. “We want people that are hyper-focused on the client relationship and the client experience.”

The other factor, Oros said, is that Hightower wants leaders who are “proven to grow organically.

“By proven that means not one year of growth, that means they’re growing every year,” he said. “And that’s really important in our thesis.”

In addition, the key for any RIA is to have a well-thought-out succession plan in place, Oros added, ensuring that firms have someone who can foster the next generation of leaders.

With an increase in advisors going independent, he said that while wirehouses likely won’t lose relevance anytime soon, that doesn’t mean RIAs haven’t been able to hold their own, either.

“It’s no longer this little thing off to the side, it is a big, mature growing industry, which I think is good for, at the end of the day, the client,” Oros said.

Small-cap growth stocks setting up for big year, says Alger strategist

Learn more about reprints and licensing for this article.