401(k) plan savings challenge has been solved

It's clear auto enrollment and auto escalation help employees save. Why aren't more smaller plan sponsors using them?

Helping people save for retirement isn’t a mystery. Automatic enrollment and auto escalation clearly lead to better outcomes for employees, and those features are used by most institutional 401(k) and 403(b) plan sponsors — but not smaller plans.

What’s the resistance, and why aren’t retirement plan advisers and record keepers pushing harder?

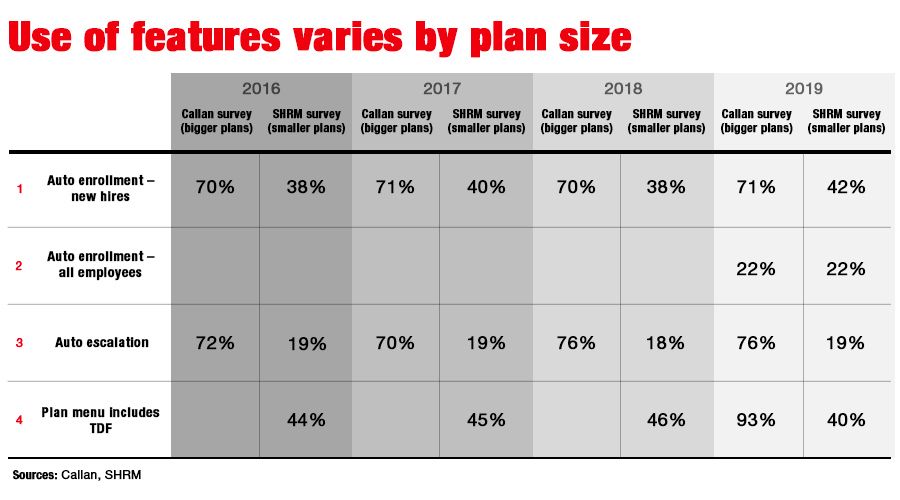

There is a stark contrast between the retail and institutional defined-contribution markets. Ninety percent of the plans surveyed for Callan Institute’s Defined Contribution Trends Survey had more than $100 million in plan assets, and 72% had more than $500 million. By contrast, plans in the 2019 SHRM benefits report were much smaller, with the majority of respondents representing fewer than 250 participants per plan.

What’s most striking is the low use of target-date funds in the SHRM study, at 40% last year, down from 46% in 2018, compared to 93% for larger plans surveyed by Callan. Though auto enrollment in smaller plans increased to 42% in 2019, up from 38% in 2018, 71% of larger plans used the option last year. And auto escalation was almost nonexistent for the so-called “retail” market at 19% in 2019, compared to 76% of institutional plans.

The retail DC market understands the importance of offering retirement savings at work — 93% offered a plan last year and rated that as their most attractive benefit, next to health care. Three-quarters of smaller employers offered a match, though the COVID-19 crisis will likely affect those numbers.

But clearly the retail market is misguided on how to improve outcomes. Financial literacy education, for example, has generally failed to change behavior, yet 56% of retail plans offer it, a third more than those that use auto enrollment.

The evidence shows that auto enrollment and re-enrollment are the best way to get participation rates to 90% or more. It’s also clear that default deferral rates should start at 6% of pay, as few more employees opt out of participating at that rate compared to those who do at a 3% default rate. Auto escalation, along with stretching the match, dramatically increases deferral rates, the most important factor in producing good outcomes.

So what’s the problem?

Some plan sponsors are worried that matching contributions will lead to higher costs for the company when auto enrollment is used. Other are concerned that when the match rate is stretched, participants will feel pressured to increase their contribution rates. Many employers don’t want to be paternalistic and force workers to save for retirement.

Smaller employers rely on their providers for plan design and advice. That makes RPAs and record keepers the real culprits in the lack of use of auto features.

Both RPAs and record keepers need to be more proactive. They can help human resources professionals make the case to senior management. Why many are not is interesting, warranting its own discussion.

At the 2019 InvestmentNews RPA Record Keeper Roundtable and Thinktank, one small plan provider admitted that its more than 100 onsite educators had limited impact compared to results they’ve seen through the use of auto features.

The good news is there is a lot of opportunity for the retail market to follow their institutional peers, which clearly understand how to improve outcomes. And while the institutional market has lessons to learn from the adviser-sold DC market, like providing in-person advice, the convergence of these markets can only help improve outcomes for smaller organizations.

[More: Secure Act’s pooled employer plans a dramatic change for 401(k)s]

Fred Barstein is founder and CEO of The Retirement Advisor University and The Plan Sponsor University. He is also a contributing editor for InvestmentNews’ Retirement Plan Adviser newsletter.

Learn more about reprints and licensing for this article.