Love it or hate it, ESG has been around for decades — and it isn’t going away

Interest both for and against sustainable investing will almost certainly be rising — and that means that financial advisors can’t afford to ignore it.

Last year, investors pulled money out of U.S. mutual funds and ETFs, to the tune of $370 billion — the first occasion of net redemptions since Morningstar began tracking sales in 1993.

But that wasn’t the case for a category that has gotten more than its share of attention recently. Sustainable funds saw lower inflows than usual but still raked in $3.1 billion, figures from the data and ratings provider show.

Such funds, which seriously consider various environmental, social and governance, or ESG, factors, have grown in popularity. Though sustainable investing has existed in some form for nearly 50 years, it has just recently become vilified by some conservative groups and politicians, who have cast it as a major threat to democracy.

Two politicians who will likely be vying for the Republican Party’s presidential nomination for the 2024 election — Florida Gov. Ron DeSantis and Strive Asset Management co-founder Vivek Ramaswamy — have even made the war against ESG a pillar of their platforms. That comes as numerous states have considered or enacted laws forbidding ESG considerations for public assets.

With all of that, interest both for and against sustainable investing will almost certainly be rising — and that means that financial advisors can’t afford to ignore it.

“If you’re not at least integrating some sustainability-focused companies in your portfolio, then your growth over the long term is probably going to lag,” said Peter Krull, partner and director of sustainable investing at Earth Equity Advisors, which was recently acquired by Prime Capital Investment Advisors.

“Every advisor needs to at least have a basic understanding of what ‘ESG’ is, what ‘sustainable investing’ is, and what the difference is,” Krull said. “And they have to have a solution that clients are going to be comfortable with in their bag of tricks.”

GROWING MARKET

The growth in the market for sustainability-themed funds is one indication of how important it could be for advisors to be aware of clients’ needs and preferences on the subject.

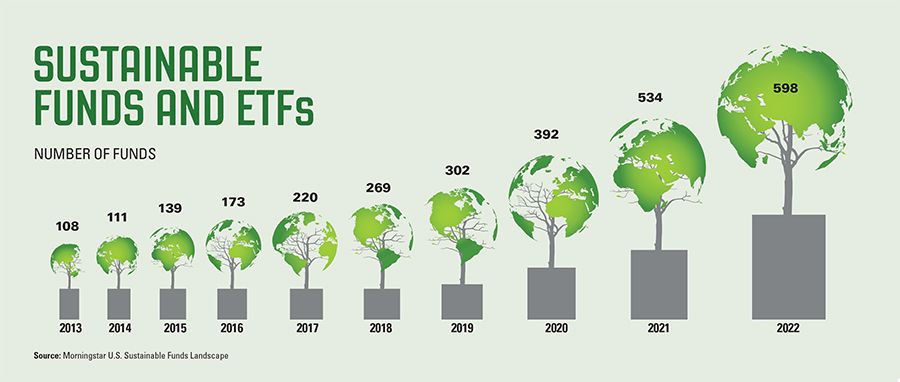

As of the end of last year, the number of sustainable U.S. mutual funds and exchange-traded funds was nearly 600 — a 12% increase from the end of 2021, according to data from Morningstar. By comparison, there were just over 300 such funds as of 2019.

That leaves little doubt that there is interest among retail investors. Last year, when many sustainable funds underperformed the broader market indexes due to exclusions of energy holdings, the category nonetheless saw money flow in.

In 2022, 46% of large-blend sustainable mutual funds and ETFs had returns that were in the bottom quartile among peers, largely as a result of lower holdings in the energy sector, according to Morningstar. However, that category nonetheless saw stronger long-term performance than most conventional funds, with 60% of sustainable funds having returns in the top half of peers for returns over three- and five-year periods.

“When it comes to [investors] who are pro-ESG, they’re really into it … Clients like that are feeling a little bit empowered in the face of policy that goes against it,” said Jennifer Coombs, director of client success at Ethos ESG, which is part of ACA Global.

“The younger generations, the more they learn about this, the more they are driven to make that shift to sustainable investing or at least consider it,” Coombs said. “Some RIAs are just completely shutting down when the lead advisor retires. But if you have a legacy business that you want to keep going — these are who your clients are.”

“If you are taking anything away from your business to add ESG, you are doing it wrong.”

Jennifer Coombs, director of client success, Ethos ESG

Not all advisors see it that way. For those who don’t shy away from politics, taking a stance against ESG could be a way to attract like-minded clients.

“When they’re anti-ESG, they’re all the way,” Coombs said. “It’s really unfortunate that it turns into politicization, because it’s getting the message wrong.”

ESG represents data sources, and it doesn’t necessarily mean excluding anything from a portfolio, she noted.

“Sustainable investing is investing. It’s just adding one dimension,” Coombs said. “If you are taking anything away from your business to add ESG, you are doing it wrong.”

HISTORY LESSON

The first fund to heavily weigh ESG factors — a practice historically called socially responsible investing — was the Pax World Balanced Fund , which launched in 1971.

Until about 10 years ago, sustainable investing grew modestly and was considered a niche that most asset managers paid little attention to. It was more common among foundations and endowments, often because the organizations they were part of had values that were reflected in their investments.

Over the past decade, the number of sustainable mutual funds and ETFs has quintupled, data from Morningstar show. When considering institutional assets as well, a total of $8.4 trillion is in sustainable investments, representing 13% of all professionally managed money in the U.S., according to figures from US SIF.

That rising popularity has attracted criticism, and the recent growth in the push against ESG by numerous states has implications for advisors. Operating on the premise that many mainstream asset managers boycott the fossil fuel industry — a notion that’s largely untrue — politicians in at least 16 states have proposed or enacted legislation seeking to ban ESG data from being used to guide investment decision-making for public assets. That, according to data in January from the law firm Morgan Lewis, contrasts with pro-ESG legislation floated in eight states.

BACKLASH AND CONSEQUENCES

The push against ESG has been fast and impactful. In Texas, for example, a law forced the biggest banks out of the market for municipal bond deals, and competition plummeted. That led to issuers in the state paying an estimated $300 million to $500 million more in interest on $31.8 billion borrowed in the first eight months after the law became effective, according to research from the Wharton School.

Since then, the state has also blacklisted 10 asset managers and 350 funds, including fund providers that are its biggest investors in oil.

And recently, Congress passed legislation that would overturn the Department of Labor’s new rule governing ESG in retirement plans — a regulation that allows plan fiduciaries to consider such factors when choosing investments but does not require them to. President Joe Biden killed the joint resolution on March 20, in his first veto.

Media coverage of the issues has been ample. Even though few people might currently know what ESG stands for, it’s a subject that has been hard to avoid when reading news coverage.

“We can’t help that now we’re in the cross hairs of some political rhetoric. Most of the attacks are not really in good faith. The people with the loudest voices are pretty clearly funded by fossil fuel interests,” said Michael Young, director of education and outreach at US SIF: The Forum for Sustainable and Responsible Investment. “Regardless, it’s definitely going to be in the news more.”

Forthcoming rules from the Securities and Exchange Commission will also factor into that. One regulation expected to be published later this year would require most major public companies to disclose data around their greenhouse gas emissions. That would provide more consistent, reliable data around climate risks and opportunities for investors to consider.

In response to the rapidly increasing world of sustainable investing, the SEC is also working on rules that address fund naming and marketing. If a company calls a product “sustainable” it would have to prove such a claim.

“We need to standardize. We can’t have so many different metrics [for ESG],” Krull said.

“If there was any criticism of ESG … it’s that lack of standardization,” he said. “If they can figure out a way to overcome that, it will make it much more difficult to criticize.”

NEXT GENERATION

Companies with businesses within the European Union and Japan already must report ESG-related data — so many U.S.-based firms are used to gathering and disclosing such information, Young noted.

“It’s a global financial services world,” he said. “The biggest and best firms in the U.S. do business all over the world.”

Between 2015 and 2021, the percentage of people in the U.S. who said they were at least somewhat interested in sustainable investing went from 71% to 79%, survey data from Morgan Stanley show. But among millennials, that proportion grew from 84% to 99% during that time frame.

“The demographics of those who are going to be inheriting trillions of dollars, for the most part, are people interested in sustainable investing and values-based investing,” said Krull, whose firm has more than $150 million in assets under management for at least 250 households.

But while it appears more people are interested than ever in sustainable investing, many of those clients have no idea what ESG is, Young said. At a recent US SIF roundtable-style training session with advisors, participants explained that they increasingly have conversations with clients about what ESG is before determining whether and how to apply it to their portfolios, he said. Asking about their values and involvement in the community for example, can help determine whether impact investing is appropriate and where to focus, such as affordable housing.

“ESG doesn’t do anything. It is literally just data,” Young said. “[That] data is used by investment professionals to hopefully uncover risks … or find opportunities that give them some long-term investment performance that they may not have had from traditional financial analysis.”

[More: ESG in advisors’ own words]

Learn more about reprints and licensing for this article.