The latest in financial #AdviserTech — June 2022

This month’s #AdviserTech roundup looks at Tifin’s latest founding round, Snappy Kraken’s acquisition of Advisor Websites and Lumiant’s new solution for engaging the less-engaged spouse.

The June edition of the latest in financial #AdviserTech kicks off with the big news that Tifin has raised a new $109 million Series D round at an eye-popping $842 million valuation, with a vision that embedding investment recommendations and solutions directly into adviser technology can lead advisers to make purchases through Tifin’s various applications, allowing Tifin to get paid by asset managers for those asset flows.

Yet as was seen by the rise — and subsequent fall — of various robo-adviser-for-advisers solutions that attempted to offer similar kinds of model marketplaces for advisers, technology is not an “if you build it, they will come” solution in a world where the typical adviser changes a core system less than once per decade. Even if Tifin is right about the long-term vision of “embedded finance,” it’s unclear whether its barely 3,000 current adviser users will even be able to gain material traction against Envestnet’s own embedded finance vision … and its 100,000-adviser head start.

From there, the latest highlights also feature a number of other interesting adviser technology announcements, including:

• Snappy Kraken acquires Advisor Websites to offer an even more unified adviser marketing solution that packages together the adviser’s website and the marketing funnels attached to it.

• Lumiant launches a new financial planning software solution that aims to supplement existing tools by providing a more engaging client portal specifically to better engage the nonfinancial spouse.

Read the analysis about these announcements in this month’s column, and a discussion of more trends in adviser technology, including:

• Vanilla raises a $30 million Series B round to power not just estate planning software for advisers but what appears to be a tech-enabled estate planning service that will help advisers implement advanced estate planning strategies with their ultra-high-net-worth clients.

• FP Alpha launches a new Estate Snapshot that, similar to Holistiplan’s Tax Summary, will scan a client’s estate planning documents uploaded by the adviser and provide an instant summary of the key details and potential planning opportunities.

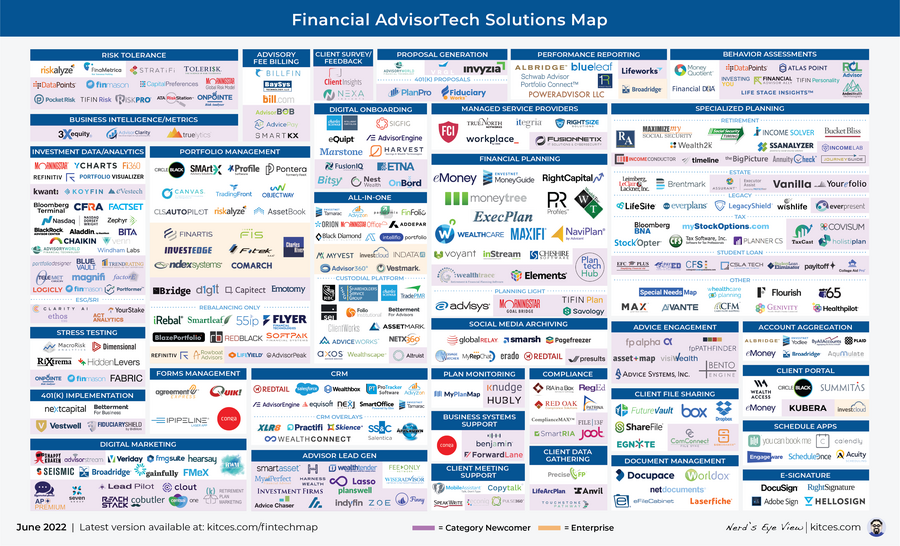

In the meantime, we’ve also made several updates to the beta version of our new Kitces AdviserTech Directory, to make it even easier for financial advisers to look through the available adviser technology options to choose what’s right for them.

Be sure to read to the end, where we have provided an update to our popular Financial AdviserTech Solutions Map!

AdviserTech companies that want their tech announcements considered for future issues should submit to [email protected]!

While robo-advisers didn’t exactly replace the world of traditional human advisers, one of their lasting legacies was spurring the realization that good technology experiences can impact investors’ investment choices — from nudges within a technology platform that steer investors toward one investment selection over another — to the fact that good technology can become a distribution channel unto itself (gathering assets into whatever asset managers are embedded into the technology solution).

In the years that followed the emergence of robo-advisers, this realization of “technology as a distribution channel” led to a slew of traditional asset managers acquiring various robo-adviser tools (e.g., BlackRock acquiring FutureAdvisor, Invesco acquiring Jemstep) to embed their funds into the robos’ portfolio solution. This also led to the rise of model marketplaces, where asset managers embedded their models, comprised of their own funds, into various rebalancing software platforms which in turn led to the acquisition of various rebalancing tools by asset managers. This included Invesco acquiring RedBlack and Portfolio Pathways and Oranj acquiring TradeWarrior, which was subsequently rolled up into SEI.

At the same time, the OG of using technology as a distribution channel — Envestnet itself — has also been increasingly making its own big bet on embedded finance. This featured very prominently in its recent Envestnet Advisor Summit, most notably by acquiring MoneyGuide and attaching it to the various exchanges for insurance/annuity products, and credit/loan products, in addition to its existing platform-TAMP investment offerings. This allows advisers to purchase solutions for their clients from workflows that are embedded directly into the planning software.

And Tifin Group announced a stunning $109 million Series D round, at an eye-popping $842 million valuation, making its own bet that the combination of various tools it has acquired in recent years — from MyFinancialAnswers for financial planning software to Totum Risk for risk tolerance assessments — can be woven together into a similar adviser interface that will allow Tifin to capitalize on the embedded finance trend by steering advisers to select investment offerings and getting paid by those investment providers for the flows.

In fact, as a part of the recent announcement, Tifin highlighted that it has already signed on 30 investment managers that will compensate Tifin with virtual shelf space payments for over 60 funds that will be embedded into Tifin’s apps. In addition, Tifin itself recently acquired Qualis Capital. an alternative investments platform that would similarly allow Tifin to monetize adviser flows into featured alts.

Yet while Envestnet and its $3.5 billion-plus market capitalization have arguably validated the market opportunity for embedded finance — especially since Envestnet is still mostly just getting paid for investment flows, and hasn’t even fully integrated and ramped up its other insurance/annuity and credit exchanges into material transaction flows — the reality is that AdviserTech-as-distribution strategies only work when advisers use the software in the first place. As in the end, the majority of robos-turned-model-marketplaces ultimately failed because, in the adviser world, technology is not an “if you build it, they will come” opportunity.

In fact, the recent 2021 Kitces AdviserTech Research study showed that independent advisers only change any particular piece of their core technology roughly every 12 to 20-plus years, with an intent-to-change rate of only 4% to 8% for most tools. This means in the aggregate, there may only be a few thousand adviser seats in play in any particular year. Even Envestnet “only” serves just over 100,000 financial advisers across all of its tools, and it took over 20 years, and the acquisition of major platforms like MoneyGuide for half a billion dollars, to get there.

This raises the concern that even if Tifin is right on the long-term bet that embedding insurance and investment solutions into adviser technology will be able to impact and steer advisers toward certain solutions, for which Tifin gets paid, it’s unclear whether Tifin can possibly attract enough advisers from an existing base that reportedly is just approaching 3,000 advisers to justify its stunning valuation in any foreseeable time frame. Tifin has largely acquired AdviserTech tools that didn’t yet have any significant traction in the adviser marketplace in the first place. This means Tifin hasn’t bought existing market share, and at best will still have to figure out how to adapt each of the tools it has acquired in order to find a segment of advisers they can gain traction with, in a hyper-competitive adviser technology marketplace where most major tools already have near-total adoption from the entire addressable market.

In the near term, Tifin’s significant round likely means even more business-to-business acquisitions of smaller (and maybe more sizable?) adviser technology platforms. It also means more dollars into marketing. So expect to see a lot more marketing of Tifin’s solutions as it makes the push for adviser adoption while it continues to iterate behind-the-scenes on its various tools to try to find product-market fit. But in the long run, similar to the bubble of robo-advisers and their ultimately unfulfilled valuations at the peak, I suspect we’ll look back on this moment and see that while Tifin was right that embedded finance really is a part of the future, PE investors still grossly overestimated the pace at which advisers and their clients are willing to change platforms. They also overestimated how hard it is to break into an existing adviser software category and win away market share as a new entrant, much less trying to break into nearly all of them at once.

ADVISER DATA – AND PLATFORMS THAT MAKE IT USEFUL – TAKE CENTER STAGE AT T3

The Technology Tools for Today Conference is the longest-standing conference in adviser technology, with a slow and steady growth path that has mirrored the broader growth in adviser technology. From a tiny cottage industry of homegrown solutions (adviser sees problem, can’t find solution, builds solution for themselves, sells solution to other advisers, now owns a software company on the side), it’s expanded to a robust landscape ranging from niche offerings to large enterprise players, with venture capital investors fueling new innovation and private equity firms powering mergers and strategic acquisitions. And so, given the boom in new investor dollars flowing into adviser technology over the past few years, it is no great surprise that the recent T3 conference — in its first return since the pandemic — boasted its largest turnout ever, with nearly 1,000 attendees.

In addition to the strong turnout, though, the flow of dollars into adviser technology was even more evident in the T3 exhibit hall itself. Not only was the hall sold out to capacity at very-not-inexpensive booth rates but it featured not the typical adviser technology booth (a table draped with a logo-embroidered cloth and a basic pop-up poster behind). Instead, the hall was decked out with multiple double-wide booths with lounge furniture, wood-paneled booths and high-end LED lighting. In other words, many exhibitors were buying not only $8,000-plus booth spaces, but now have the conference budgets to spend that much again in decking out their booths with whatever they could to attract advisers to stop by. This is something that, prior to the recent rise of outside venture capital, private equity and strategic investors putting dollars into adviser technology, most companies simply couldn’t afford.

On the main stage podium, though, the clear and dominant theme of the T3 conference was not necessarily new startups and innovation. In fact, there were remarkably few AdviserTech companies that made a debut at this year’s T3 conference. Instead, the theme was how to weave together the proliferation of the providers in the increasingly crowded AdviserTech landscape, as advisers increasingly struggle with the breadth of solutions that result in a splintering of workflows and the underlying client and adviser data. The largest adviser platforms are making the case that they — and their all-in-one offering that builds on a single unified data source — are the solution.

For instance, Orion highlighted how its centralized all-in-one solutions can unify an adviser’s data across Orion’s increasingly comprehensive solutions that cover most or all the areas an adviser needs as Orion highlighted its just-announced Redtail CRM acquisition. Envestnet doubled down on the theme with the announcement of its new Envestnet Wealth Data Platform at its own Advisor Summit. AdvisorEngine debuted new branding and a new look, and sponsored a keynote slot to highlight its new platform, which emphasized how data lives at the center of its new unified CRM + portfolio management platform. Invent.us highlighted how it’s solving the data architecture challenges of larger adviser enterprises. Also, Reed Colley, previously of Black Diamond, debuted his new Summit Wealth Systems, which aims to unify adviser data, while multiple Salesforce overlays highlight how it are unifying data within its CRM system.

Notably, though, the latest 2022 T3 Advisor Technology Survey Report — which also was featured at the conference — still shows that all-in-one solutions are garnering a small minority market share, up from just roughly 18% market share in 2021 to 21% in 2022. This implies that interest in such solutions is growing but that the overwhelming majority of advisers are not yet sold on the value or at least, not convinced that the value is worth the hassle of switching costs to consolidate into a new system.

Nonetheless, in a world where the pendulum had swung very far toward all-in-one platforms in the 1990s (where the largest enterprises had the biggest technology budgets to build the best unified platforms), and then back toward the best-of-breed solutions in the 2000s and 2010s, the pendulum appears to be swinging back toward unified solutions once again, where the unifying theme is “if the advisor only uses one core system for everything, all their data is in one place and is naturally unified across all of their application.” The question, though, is whether the all-in-one solutions can build — or buy — their way to good enough capabilities in each of the core categories to make advisers willing to let go of their existing best-of-breed solutions.

SNAPPY KRAKEN ACQUIRES ADVISOR WEBSITES BECAUSE ADVISER MARKETING SUCCESS RELIES ON A GOOD WEBSITE

The financial adviser business has traditionally been an “eat what you kill” kind of business — where new advisers are trained in how to hunt for their new business opportunities through cold-calling, cold-knocking, attending business networking events or, if they’re lucky, reaching out to their existing natural market of friends and family, or former colleagues, for career changers. Those who are successful eventually find that some of their satisfied clients begin to refer others to them as well, slowly shifting the traditional outbound approach to more of an inbound client referral flow.

Notably, in this adviser marketing context, most advisers spend very little at all on marketing in the first place, as we are trained into a more outbound sales-based approach to finding prospects. In practice, most advisers start their firms with very little in the bank and don’t have much to spend on marketing, opting instead to spend what they do have a lot of, which is time since they don’t have many/any clients yet, such that the average adviser’s client acquisition cost of $3,119 is 80% based on their time and only 20% based on their hard-dollar spend.

However, in the digital era, the reality is that even consumers who meet an adviser in-person or are referred often still “check them out” online as well — if only to verify that the adviser wasn’t Madoff’s lesser-known partner and doesn’t have some salacious regulatory history that might be unearthed in a quick Google search. In practice, an adviser’s website and digital presence often serve to affirm for the prospect that the adviser is a bona fide professional, which means showing up professionally with their website and perhaps some related social media channels. At the same time, for advisers who leverage more proactive marketing strategies, their website becomes even more important. Functionally, it serves as a digital storefront to which prospects are sent when they’re marketed to, in order to check out the adviser’s services and decide whether to reach out.

In that context, it’s not surprising that adviser marketing software Snappy Kraken announced the acquisition of Advisor Websites, one of the few remaining independent providers of adviser-specific websites.

The deal has a number of clear synergies out of the gate, such as ensuring that advisers using Snappy Kraken for marketing have a strong digital brand and website foundation with Advisor Websites. Advisers can apply Snappy Kraken’s SEO consulting services to their own Advisor Websites-built websites. They can also leverage Snappy Kraken’s marketing tool to convert visitors to the adviser’s Advisor Websites website. In addition, advisers can leverage Advisors Websites’ calendaring tool to convert Snappy Kraken prospects into actual prospect meetings.

Notably, Snappy Kraken also gains Advisor Websites’ compliance review tools, an essential capability to push into enterprises that have more rigorous compliance review processes for adviser marketing. This better positions Snappy Kraken to move upmarket into adviser enterprises, in particular, independent broker-dealers, where they will compete more directly with the likes of FMG Suite.

Strategically, the decision by Snappy Kraken to acquire and more vertically integrate the marketing funnel makes sense, and mirrors a broader trend of marketing technology tools (not even specific to the advisory industry) that have pursued similar strategies, from MailChimp launching a Website Builder to Infusion Soft/Keap building out its own Landing Page capabilities. Ultimately, it’s hard to grow a mailing list without a good website to attract them, and it’s hard to turn mailing list readers into clients without a good website to send them back to in order to convert. The affinity is natural.

In the end, the only questions will be around Snappy Kraken’s ability to execute and effectively integrate Advisor Websites’ team and capabilities into a more tightly wound marketing process from website to mailing list to conversion. Then, turn it into real results to demonstrate that advisers who spend on marketing really can build more sustainable marketing systems.

Helping clients with their estate planning has long been part of the core offering of a comprehensive financial plan for the simple reason that for more than half of financial planning’s history, the federal estate tax exemption was so low (e.g., no more than $600,000 for much of that time) that the typical financial planning client had an estate planning problem. For which the adviser could sell a life insurance policy, typically to be held inside of an irrevocable life insurance trust, as a solution. In other words, estate planning conversations with clients generated good sales opportunities. However, in the early 2000s, the federal estate tax exemption began to rise and the majority of states eliminated their own state estate tax, such that the number of households exposed to federal estate tax today has plummeted by more than 95%.

The end result of this shift is that estate planning today is more about the income tax planning opportunities of passing assets at death (e.g., to maximize step-up in basis), and about ensuring an orderly distribution of estate assets in the first place. This means making sure that clients have their wills and trusts in place as necessary, and that the documents reflect the clients’ current wishes.

When it comes to ultra-high-net-worth clients, though, planning for estate taxes is as relevant as ever. In fact, when clients have 8-figure, 9-figure or 10-figure net worths, advisers can arguably add even more financial value to their clients. This can be done with effective estate planning that can literally save millions or tens of millions rather than just trying to add basis points of return to their affluent clients’ portfolios. It becomes all the more important as advisers seek to expand their value proposition beyond just the portfolio to defend and better substantiate their fees.

From the adviser technology perspective, this dynamic is leading to a bifurcation in estate planning software itself. At the low end and in the middle market of the mass affluent and mere millionaires, the primary focus is on modeling the flow of assets (e.g., Yourefolio), and the outright preparation of estate planning documents (with players like Helios-now-EncorEstate and Trust & Will). For higher net worth clients, Vanilla is competing to support more complex estate planning strategies.

Now, Vanilla has announced a massive $30 million Series B round, on the heels of an $11.6 million Series A round just last summer, which the company says it was not actively seeking out but accepted in response to inbound interest from venture capital firms.

At its core, Vanilla supports advisers in the estate planning process, from serving as a repository for gathering existing estate planning documents to providing estate illustration tools and deliverables to report the client’s current estate plan back to them. Vanilla aims to facilitate collaboration between advisers and the estate planning specialists working with their clients. Vanilla is now looking to expand even further into an “Ultra” version of its platform for truly ultra-HNW clients that provides a more detailed analysis of complex estate planning strategies and visualizes their impact (e.g., the tax savings of implementing SLATs or GRATs).

Notably, though, the market for estate planning software is significantly smaller than the market for broader-based financial planning software, where even the largest players (e.g., eMoney, MoneyGuide) measure their revenue in the tens of millions but not hundreds of millions. According to a Spectrem study, there are barely 2 million ultra-HNW households in the U.S. compared with over 40 million mass affluent and millionaire households. This raises the question of how exactly Vanilla will be able to justify the valuation implied by a $30 million Series B round.

The answer is services. After all, an individual adviser will only pay so much for estate planning software to use with all their clients where financial planning software typically sells for about $2,000 to $3,000 per year, and separate estate planning software would be an additional cost. But each client the adviser serves may need new or updated estate planning documents themselves. The average fee for estate planning documents — especially for ultra-HNW clients — can be $5,000 to $15,000 or more, especially when considering the layers of wills, revocable living trusts and additional trust strategies from SLATs to GRATs to IDGTs and more.

In other words, the market for providing estate planning services to clients’ advisers — where the estate planning software is both a distribution channel to reach those clients, and a tool to enable the unique B2B2C dynamics of working with advisers and their clients — is much bigger than the opportunity for just the software itself. Or viewed more broadly, Vanilla in the long run may be less of an adviser technology company, and more of a tech-enabled estate planning service provider, which is arguably a much bigger opportunity.

FP ALPHA LAUNCHES ESTATE SNAPSHOT THAT SCANS CLIENT ESTATE PLANNING DOCUMENTS FOR OPPORTUNITIES

Financial advisers are not typically lawyers, but estate planning is a staple of the financial planning process. In practice, this doesn’t mean the adviser will draft or make changes to a client’s actual estate planning documents, but often clients don’t even know or realize what’s in their own documents in the first place. As a result, advisers can and do create value by simply reading through a client’s estate planning documents. They can identify the key players (executors, trustees, beneficiaries) and the flow of assets either outright to those various beneficiaries, or held in further trusts for their benefit, and then summarize and report it back to clients, to discuss whether their documents still align with their actual goals and wishes.

The caveat is that estate planning documents themselves are long and dense, which means it takes a significant amount of time for the financial adviser to read through the documents and glean those insights — presuming the adviser even has the training and experience to read through the documents and know what to look for, and where to find it, in the first place.

To fill this gap, FP Alpha announced a new “Estate Snapshot” solution in May, which will take uploads of the client’s wills, trusts, powers of attorney and other key estate planning documents, scan them and provide a summary report back to the adviser of the key people (e.g., executors and trustees) and how the estate assets will transfer, and identify potential planning opportunities. This can potentially turn what, for some advisers, is a one- or many-hour process of evaluating client documents into just a few minutes to read and review the Estate Snapshot output before beginning the discussion with a client.

FP Alpha’s Estate Snapshot mirrors a similar kind of tax summary that Holistiplan produces by scanning and reporting back the details of a client’s tax return. This has quickly turned Holistiplan into one of the fastest-growing AdviserTech solutions in the latest Kitces AdvisorTech Research. It also positions FP Alpha well to grow in a parallel manner by easing the analysis of estate planning documents.

Notably, though, estate planning documents are arguably much more complex to analyze than tax returns, which at least have standardized forms from which the key numbers can be read. Estate planning documents are drafted differently from one attorney, or at least, one attorney’s drafting software, to the next. This means FP Alpha will still have to prove itself in the quality of “readings” it does from potentially complex estate documents, especially since the software is only valuable if advisers can fully rely on its output. After all, if the adviser has to review the documents after the software to make sure nothing important was missed, virtually all of the time savings are lost.

The FP Alpha solution may also face greater challenges in adoption because unlike Holistiplan — which just offers its tax return analysis as a core solution — the Estate Snapshot is part of a broader AI-driven comprehensive financial planning solution. This potentially creates friction for advisers who only wanted the access Estate Snapshot and don’t want to buy the rest of the FP Alpha solution. That raises the question of whether, if it gains traction similar to Holistiplan, FP Alpha will spin off the Estate Snapshot solution as a stand-alone offering.

Nonetheless, as advisers look to go deeper into their advice relationships with clients, with a particular focus on tax and estate planning, there can be substantial dollars at stake. This, in turn, means substantial opportunity to demonstrate value. There is an inexorable trend toward financial planning and advice engagement tools that don’t necessarily help advisers get through the planning process faster, but instead expedite the initial steps of the planning process so advisers have the time and capacity to go deeper. FP Alpha’s Estate Snapshot appears very well positioned to help advisers get through dense estate planning documents more quickly to have better and deeper estate planning conversations with clients.

AUSTRALIAN PLANNING SOFTWARE LUMIANT LAUNCHES IN U.S. WITH GOAL OF ENGAGING THE NONFINANCIAL SPOUSE

One of the most often cited industry statistics over the past few years draws from a study by marketing consultancy Iris, which found that a whopping 80% of women leave their financial advisers after losing a spouse. This casts into stark relief the tendency of typically-male financial advisers to interact primarily with the historically more financially focused male member of a client couple, and either under-nurture the relationship with, or in some cases, outright ignore, the nonfinancial spouse.

On the one hand, this gap in the relationship between the financial adviser and the nonfinancial spouse has led some to call for better gender diversity among advisers in the hopes that women advisers will better relate to the typically female nonfinancial spouse. It has also led some to call for better communication and relationship training for all advisers to more holistically engage both members of the client couple.

On the other hand, some have suggested that if the nonfinancial spouse is not financially oriented in the first place, then the better approach is to find other nonfinancial ways to bring them into the relationship, in part through leveraging technology that may engage them more meaningfully.

In this context, in May, Australian financial planning software provider Lumiant announced that it is bringing its technology from Australia to advisers in the U.S., particularly in the hopes that it can become the tool that engages more meaningfully with, and hopefully, prevents the long-term attrition of the nonfinancial spouse.

In fact, Lumiant might arguably be called an “Advice Engagement” tool more than traditional financial planning software, given its particular focus on the nonfinancial aspects of the advisory relationship. While Lumiant does engage clients in a process to better understand their goals, its intake process also engages in a broader discovery with clients around their values. The process features an account-aggregation-based portal that highlights the family’s entire wealth and not just its investment accounts. In addition, Lumiant helps to track the clients’ own tasks and to-dos to help nudge them toward actually following through and completing their planning recommendations.

At the same time, though, Lumiant help clients project out whether they’re on track for their “Best Life” by performing a more traditional financial planning projection that allows clients to see multiple planning scenarios and how they fare through various Monte-Carlo-based return simulations.

In the interests of being more engaging for the entire family, Lumiant is also structured to allow multiple members of the client household to log in, and is priced accordingly, with a base fee of $3,000 per year for up to 80 client logins. Additional logins are priced at $10 per household, down to $1.50 per household for bulk purchases of 500-plus client logins, to access the advice engagement clients. This is increased to a base fee of $6,000 to access the financial planning projection engine and other add-on features, including client vault storage and some estate planning tools to show clients their legacy asset flows after death.

From the broader industry perspective, Lumiant is most interesting for how it is living at the intersection of traditional financial planning (projections for whether the client is on track for their financial goals), and the rise of “Advice Engagement” tools that are meant to keep the client engaged in an ongoing manner after the initial plan, with a combination of a client portal with a holistic financial dashboard, Knudge-style task tracking of financial planning action items, and a more values-based lens for understanding clients beyond their financial goals alone.

From the individual adviser perspective, though, it is striking that Lumiant prices at $3,000 per adviser or more, as an advisor with 100-plus clients will probably average 150 to 200-plus logins given spouses and/or other family members who are also engaged. This may bring the pricing to $3,500 to $4,000 for the additional logins, akin to the cost for the entire financial planning software package from MoneyGuide or eMoney or RightCapital. Since planning software is still built to go deeper than Lumiant on the core financial planning analysis (which will likely make it hard for planning-centric advisers to give up their core planning software), it raises the question of whether advisers will really want to pay that much more for a second financial planning portal on top of the ones they already receive from their core financial planning software.

In the long run, it seems that Lumiant is building in the right direction for where the broader nature of financial planning is going, with a stronger focus on ongoing advice engagement beyond the initial financial planning process. But at this point, it’s not clear if Lumiant will really be able to win any material market share from advisers who want to buy it on top of the planning software they already own, or if Lumiant’s more appealing or popular features will simply be mimicked by existing financial planning software providers that undercut Lumiant by rolling out similar capabilities with little or no added cost to the advisers already using their existing platforms.

In the meantime, we’ve rolled out a beta version of our new AdviserTech Directory, along with making updates to the latest version of our Financial AdviserTech Solutions Map with several new companies (including highlights of the Category Newcomers in each area to highlight new FinTech innovation).

So what do you think? Can all-in-one platforms build good enough solutions in all the key areas for advisers to be willing to let go of their individual systems for one data-unified solution? Will advisers increasingly turn to their adviser technology tools to find the ideal insurance and investment products to recommend and implement for their clients? Would FP Alpha’s Estate Snapshot make you more interested in having estate planning conversations if the document review process was faster and easier? Does Lumiant’s portal sound appealing enough to pay for, in addition to existing financial planning software, in the hopes of better engaging a less-engaged spouse?

Michael Kitces is the head of planning strategy at Buckingham Strategic Partners, co-founder of the XY Planning Network, AdvicePay and fpPathfinder, and publisher of the continuing education blog for financial planners, Nerd’sEye View. You can follow him on Twitter at @MichaelKitces.

Learn more about reprints and licensing for this article.