The alternative strategies that outperform with mutual funds

In some cases, hedge funds are no investment panacea.

Hedge funds, like fine wines, are trappings of the ultra-wealthy. So any upstanding member of this caste should no more expect their wealth manager to offer them a lowly alternative mutual fund than their favorite restaurant’s sommelier would present them with wine from a box.

But what if wine makers discovered that a particular grape fermented better in a paper box? Would it gain acceptance as a fine wine, or would the well-heeled continue paying exorbitant markups for an inferior product? Thankfully, wine isn’t our trade, so we won’t need to disabuse connoisseurs of their aversions to wine in cardboard cartons. Yet a reasonably similar dynamic is playing out in wealth management as a few alternative strategies are performing better within mutual funds than they are in hedge funds. It’ll be interesting to see how quickly finance’s connoisseurs — ultra-high net worth managers — come to grips with the fact that hedge funds are not an investment panacea.

The clearest case of mutual fund’s superiority over hedge funds in the alternative space is the event risk merger arbitrage sector. Merger arbitrage (M&A arb) has produced superior returns with lower risk than its hedge fund comparables. In fact, M&A arb liquid alts have outperformed to such a degree that one wonders why large institutional investors continue to pay exorbitant fees for the “opportunity” to invest in this sector’s hedge funds.

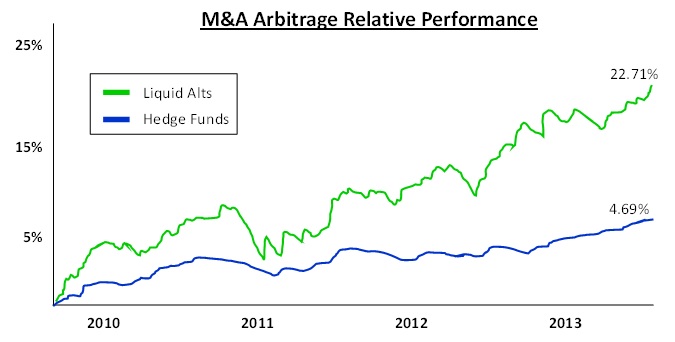

Liquid alternatives in this sector have outperformed hedge funds by a large margin on a trailing three year basis, 22.71% to 4.69%.

This outperformance becomes even more noteworthy in light of liquid alts funds’ implied liquidity premium. The theory behind this premium is straightforward enough: investors prefer the daily liquidity of liquid alts to hedge funds’ highly illiquid structure. This preference for liquidity results in a premium placed on liquid alt funds vis-a-via hedge funds. This premium is a direct cost to investors and thereby drives down prospective returns. The premium is difficult to pinpoint as it varies over time and by asset class, but valuation firm FMV Opinions Inc. computed an average of 10 and 20%. This is a one-time cost upon purchase and thus should be amortized over an assumed fund holding period. We used an 8-year holding period — a conservative assumption considering mutual funds today are only held for an average of 3.29 years — 10-year historical returns for merger arb hedge funds come out to only 0.54% annually. The five-year post-crisis timeframe meanwhile produces an actual loss with investors losing 0.56% per annum.

And what about alternatives’ highly-coveted potential for non-correlated returns? Here liquid alternatives again outperform their hedge fund brethren and by an even larger margin. The HFR Merger Arb Index has a 0.77 correlation with the S&P 500 Index. Thus, statistically speaking, 77% of merger arb hedge funds’ returns can be explained by the S&P 500. A correlation of this degree provides very little diversification benefit for an investor’s portfolio.

In contrast, this same sector within liquid alts has a correlation factor of only 0.41 and thus more than half of its performance can be attributed to non-systemic factors. The impact of this difference in correlation coefficients cannot be overstated. To illustrate, adding the lower-correlated liquid alt to a portfolio of 60% equities and 40% bonds results in twice the diversification risk benefit (as measured by increase in Sharpe Ratio).

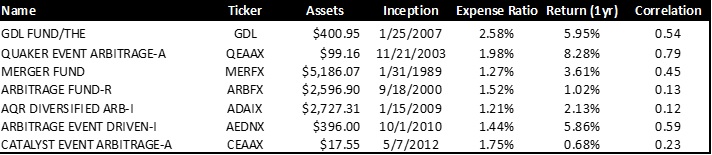

Merger Arbitrage Liquid Alternative Funds

In addition to the numerical outperformance, a strong qualitative case can be made for merger arb liquid alternatives. With merger arb and other event driven strategies, above market returns, or alpha, tend to cluster in specific time periods. For the most part, this simply ties to periods of heightened activity for the given strategy’s events. Merger Arb in particular exhibits this tendency due to the high cyclicality of M&A deal activity. Compounding this cyclicality, merger deal premiums vary concurrent with activity; reaching average highs of 38% when the deal market is hot and just 7% when it’s not. Consequently, when a strategy is as simple at betting for or against a transaction, as it is with M&A arb, it’s easy to understand why one would stand to make more when more bets (deals) are available and betting correctly earns 38% instead of 7%.

In and of itself, this pronounced cyclicality doesn’t impact investors’ returns. Yet what’s seldom recognized is the considerable impact it can have on returns depending on the fund fee structure. The primary difference is hedge fund’s carried interest, which unduly punishes investors when returns vary considerably from year to year. To illustrate, take a simple three year investment holding period in which returns are 6%, 20% and 3%. The variance is representative of M&A arbs’ cyclicality while the average gross return of 9.67% should be satisfactory by all investors’ standards. Net returns, however, are far from conclusive. Liquid alts, with an average fee of 1.62%, register a respectable net return of 8.05%. Hedge funds’ 2 & 20 standard fee structure, on the other hand, produces a net return of just 6.13%. M&A deals are public market transactions and finite enough that managers mostly bet on the same transactions. So it’s not unreasonable to assume two distinct funds make use of the same assets. The difference here is that liquid alt investors pay 20% of their net returns in fees while hedge fund investors sacrifice an incredible 58%. The difference accounts for much of liquid alts’ outperformance, leading us to conclude the trend is likely to continue.

If you’re still not ready to take our word for it, you may want to listen to hedge fund managers themselves. Recent hedge fund 13F Securities and Exchange Commission filings report more than a few of them as investors in the liquid alt funds we have mentioned in this article. The sommeliers are privately imbibing wine in a box. It would be foolish for us not to join them.

Dan Thibeault is the chief investment officer of GL Capital Partners, which publishes the Annual Report on Liquid Alternative Investments. He can be reached at [email protected].

Learn more about reprints and licensing for this article.