The annuity industry eyes another record year after 2022’s grand slam performance

Like baseball star Aaron Judge, annuity sales set a record in ‘22. Here’s why the retirement income instrument could pop out of the dugout for a curtain call in ‘23.

Annuities and Aaron Judge, the chase is on.

New York Yankees slugger Aaron Judge homered off Texas Rangers pitcher Jesus Tinoco last October for his 62nd round-tripper of the season. The blast made him the all-time American League single-season home run king, eclipsing the mark set by fellow Yankees legend Roger Maris 61 years earlier.

Unfortunately for Judge, as soon as the season ended, sportswriters and fans alike immediately began wondering if he could repeat his Ruthian (or perhaps “Judge-ian”) feat in 2023. There was almost no rest for the weary or resting on his laurels or any kind of rest for Judge at all. In the blink of an eye (or crack of a bat), expectations were raised as the public moved from celebrating his record-setting heroics into “What have you done for me lately?” mode.

Fans, alas, are fickle, and records, as they say, are made to be broken.

Luckily, Judge will have some company this year in his quest to raise his own bar. The right fielder might not know (or care), but the entire annuity industry will be joining him in a similar pursuit, even if it won’t be doing it in pinstripes and cleats.

You see, 2022 was a record-setting grand slam of a year for annuity sellers. The more than 18% drop in a wildly volatile S&P 500 index, coupled with a Fed-induced sell-off in supposedly safe bonds, sent investors streaming into the steady-paying products, no matter the cost.

While the wealth advisors who sold these annuities hand over fist likely didn’t receive the $360 million contract awarded to Judge for his monumental achievement, there’s no doubt they cashed in last year.

How could they not? Freaked-out investors seeking safe harbors for their money propelled a record-high $312.8 billion in total U.S. annuity sales in 2022, a colossal 23% jump over the 2021 total and 18% higher than the previous record of $265 billion set in 2008, according to Limra’s 2022 Individual Annuity Sales Survey.

In the fourth quarter alone, bank sales of annuities more than doubled (117%) to $21.8 billion. For the full year, annuity bank sales were a record $73.7 billion, 69% higher than in 2021.

Limra noted that this was the first time banks had led total annuity sales since 2004 and that they accounted for 24% of the U.S. annuity market in 2022. Banks typically attract more conservative investors, thereby driving the growth that resulted in record-high fixed-rate deferred annuity sales. Short-term FRD crediting rates outpaced comparable CD rates for most of 2022, enticing investors desperate for guaranteed growth and protection.

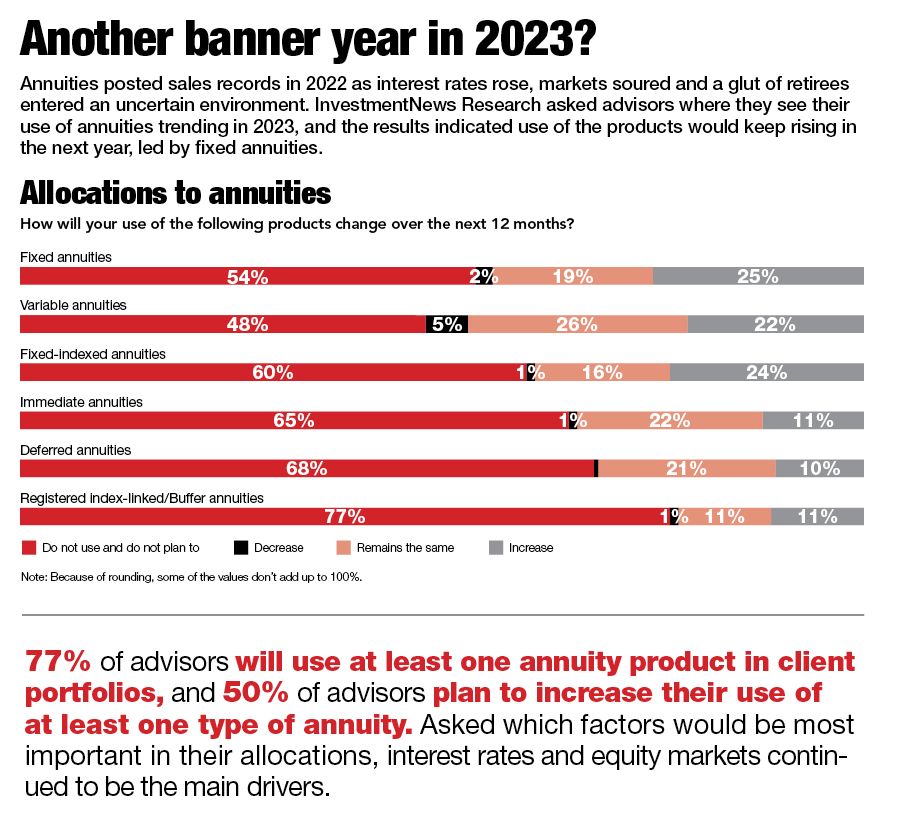

“Limra anticipates annuity sales to maintain momentum in 2023 as we continue to experience economic conditions like low interest rates and a volatile market that are beneficial for the annuity product value proposition. Yet it will be a challenge to replicate the strong year the industry experienced in 2022,” said Todd Giesing, assistant vice president at Limra Annuity Research. “Limra is forecasting sales to be ‘near’ last year’s levels.”

FAVORABLE FIELD CONDITIONS

Giesing’s prediction of annuity sales “near” last year’s record levels does not exactly resemble Babe Ruth pointing to the fence for his famous called shot. However, it’s certainly not a bad forecast if you’re in the business of selling annuities. And judging from conversations with industry professionals, the favorable economic winds that helped drive sales last year have not substantially died down.

“There are three reasons that 2023 can be another record year. The first is that between Covid and the 2022 market downturn, we do have some clients who are actively reducing their risk level, and annuities provide the guarantees they are looking for in retirement,” said Debra Brennan Tagg, president of BFS Advisory Group, which is affiliated with Advisor Group.

“The second trend is that annuities can ‘age’ over time, and due to various life and market changes, clients may benefit from a new type of annuity,” Tagg said. “And last, the tax deferral provided by annuities is a very compelling financial planning tool.”

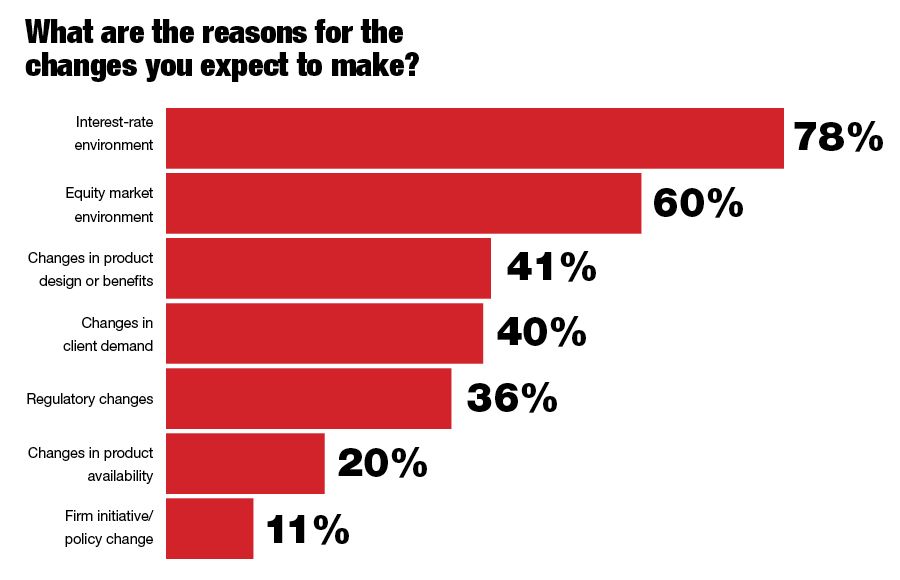

Steve Parrish, co-director of The American College Center for Retirement Income, agrees that the conditions are certainly favorable for another record-setting year. Parrish highlights two reasons why annuities will retain their popularity among investors this year: rates and momentum.

“By ‘rates,’ I’m saying that many fixed asset categories are suddenly more popular. CDs, bonds and yes, annuities benefit from the combination of higher interest rates and a sour equity market,” Parrish said. “By ‘momentum,’ I mean that between the endorsement Congress offers of lifetime income concepts in SECURE and SECURE 2.0 and the ability to price annuities with or without compensation, there is a momentum for financial advisors to give annuities a serious look when designing retirement income solutions.”

David Lau, CEO of DPL Financial Partners, said the bank channel will once again need to be robust if annuity sales are to break through last year’s high-water mark. But he believes that insurance carriers will take on the mantle in 2023 as rates rise and banks focus on getting their balance sheets in order in the wake of the Silicon Valley Bank failure.

“In this rapidly rising rate environment, insurance carriers are in a better position to offer competitive rates than banks. Insurance carriers’ assets are better matched on duration to their liabilities than banks’ are. This is why you see the banking industry struggling while carriers are thriving,” Lau said.

Todd Anderson, managing partner at Anderson Financial Group of Kingswood U.S., is on the record saying that annuities will have a “robust” year, but that sales won’t set any records, primarily because he expects a return to normalcy in the market after last year’s frantic performance.

“With all of the turbulence that occurred in the equities market in 2022, many investors jumped ship and moved to annuities,” Anderson said. “I think as some stability returns to the stock market, we will see less knee-jerk reactions going to annuities.”

LEAGUE LEADERS

Of course, not all annuities are alike. A wealth manager, like a baseball manager, has a number of options at his or her disposal to meet the moment.

Last year, for instance, fixed-rate deferred annuities led the proverbial league. FRD sales were $38.4 billion in the fourth quarter, 249% higher than fourth-quarter 2021 sales, according to Limra. For the year, FRD annuities totaled $113 billion, more than double (113%) the sales in 2021.

“Fixed-deferred or multiyear guaranteed annuities remain attractive as bond alternatives in a rising-rate environment, but we’re also seeing the broader protected accumulation category of annuities appeal to investors — especially those in the ‘red zone’ of retirement which is five years before and five years into retirement,” said Todd Taylor, head of retail annuities at New York Life.

Meanwhile, fixed-indexed annuity sales also posted a record fourth quarter and year. FIA sales were $22.3 billion in the final quarter of 2022, a 34% increase from the prior record set in the fourth quarter of 2021. For the year, FIA sales were $79.8 billion, up 25% from 2021, and 9% higher than the record set in 2019, according to Limra.

Elsewhere, single-premium immediate annuity sales were $9.2 billion in 2022, 44% higher than 2021 results, as fluctuating interest rates spurred investors to lock in favorable payout rates. Deferred income annuity sales were $2.1 billion, up 13% year over year.

Finally, registered index-linked annuity sales reached $41.1 billion in 2022, 6% higher than the prior year and a new all-time high for the product line’s sales.

Pete Golden, chief sales and distribution officer for individual retirement at Equitable, said RILAs are perfectly positioned for today’s market as investors will be seeking to return to the equity market after last year’s bloodbath, but with greater caution this time.

“Today’s RILAs have extremely competitive caps and downside combinations,” Golden said. “Also, innovation in the RILA marketplace has created the most flexible and dynamic features for protection and income options, making them very attractive for the current environment.”

As for the big winners last year, New York Life topped the standings with $23.24 billion in total U.S. individual annuity sales in 2022, followed by Athene Annuity & Life at $20.67 billion and Corebridge Financial at $20.16 billion.

On the fixed side specifically, Athene Annuity & Life was the leader with $19.78 billion in sales, trailed by New York Life with $18.18 billion and Massachusetts Mutual Life with $17.63 billion. FRD sales specifically came in at $14.85 billion at New York Life, $11.9 billion at Massachusetts Mutual Life, and $9.7 billion at Athene Annuity & Life.

“Right now, clients seem to be clamoring for two things, guaranteed income — in most cases, lifetime income — and some level of safety of principal with a portion of their portfolio,” Anderson said. “So, with that in mind, we are seeing a rise in use of contracts with guaranteed lifetime income riders, for instance, Nationwide’s High Point 365 income rider.”

MIRED IN A SLUMP

On the flip side, traditional variable annuity sales tumbled last year as investors were determined to reduce the volatility in their portfolios. In 2022, traditional VA sales totaled $61.8 billion, down 29% from 2021 results.

As for the VA sales leaders in 2022, Equitable Financial led the way with $15.09 billion, followed by Jackson National Life with $14.53 billion and Lincoln Financial Group with $8.77 billion.

Limra’s Giesing, for one, doesn’t see it getting much better for VA sales “over the next several years” given the current economic forecast and competitive pressures.

That said, Brian Sward, head of Jackson National Life’s product solutions group, believes VA products on the whole are improving even if the market is not, and noted that prices are coming down, which will also help lift sales.

“While much of the industry has been focused on increasing the headline withdrawal rate well above 5% at the key age 65 age band, Jackson has focused more recently on reducing the cost of VA living benefits with two back-to-back charge reductions in October 2022 and March 2023. We did increase our withdrawal rate in March of 2022 back to 5% at age 65, which is the same level we had been offering since the financial crisis in 2008 up until the pandemic,” Sward said.

A BRAND NEW BALLGAME

Speaking of lower prices, the cost of annuities has always been a sticking point for investors who don’t like seeing too much taken off the top.

That sentiment has grown considerably over the past decade during the brokerage industry’s move to low-fee, or even no-fee, investing. Some might even say Wall Street’s great asset grab has spoiled Main Street into thinking they don’t need to pay anything for their investments.

Last year’s market turmoil, however, became a reminder for many investors that you not only get what you pay for, but that peace of mind comes at a price.

“Annuities have gotten a bad name due to some types of annuities having higher expenses and paying high commissions to brokers,” Tagg said. “Advisors who spend the time to understand the details of different annuities and also to understand their client needs are well-versed in how an annuity can be an important tool for certain clients, who tend to be either nervous about investing or concerned about longevity risk.”

“The benefits of annuities are not too good to be true, but they are too good to be free,” said Kevin Kennedy, head of distribution for annuities and mutual funds at Pacific Life.

You can put that one in the books, too.

Here’s why lending products belong in client portfolios

Learn more about reprints and licensing for this article.