Managing your clients’ expectations around Social Security

Don’t let clients sabotage their retirement plans because of fears about the program’s finances. Advisers can help clients put trust fund solvency woes into perspective.

At a time when more Americans rely on Social Security than at any other time in the program’s 86-year history, political brinkmanship and alarmist headlines are undermining public faith in the nation’s bedrock retirement system. Those concerns are tempting some people to grab their benefits as soon as they can.

But claiming Social Security benefits early out of fear has a similar result to selling stocks in a down market: It turns perceived losses into real ones.

For financial advisers who have crafted retirement plans based on assumptions that clients will claim their Social Security benefits at full retirement age or later, a client’s decision to claim reduced benefits early may require some income adjustments or budget trade-offs.

Waiting until full retirement age or later to claim produces a larger monthly benefit for life. Benefits increase by 8% per year for every year an individual postpones claiming them beyond full retirement age up to age 70. Someone whose full retirement age is 66 who waits until 70 to file for benefits can increase their annual checks by 32% compared to what they would receive at full retirement age. And each year when there is a cost-of-living adjustment, that COLA will be applied to a larger benefit base.

For married couples, maximizing retirement benefits for the higher-earning spouse can translate into a larger survivor benefit for the remaining spouse. Planning for a survivor benefit is critical since 80% of women survive their husbands by an average of 14 years.

The significance of the COLA’s impact on benefits will be clearly felt next year, when Social Security recipients will get a 5.9% increase in benefits, the largest annual boost in 40 years. Anyone who is 62 or older and eligible to claim Social Security in 2022 will benefit from next year’s COLA — even if they haven’t yet claimed benefits. The COLA will be factored into their monthly benefit amount when they file for Social Security in the future.

Advisers should remind clients that Social Security represents only a portion of their retirement income. Even in the unlikely event that benefits are cut in the future, illustrating the impact of a potential cut in Social Security benefits can demonstrate that their retirement will still be secure — if somewhat less comfortable than previously imagined.

LONG-TERM OUTLOOK

More than 175 million covered workers are paying taxes on up to $142,800 of their wages in 2021. Those payroll taxes fund more than $1 trillion in payments for 65 million current beneficiaries, including retired and disabled workers, their family members and survivors of deceased workers.

Today’s workers expect to collect their own retirement benefits in the future based on their average lifetime earnings and payroll tax contributions throughout their careers. But Social Security is not sustainable over the long term at current benefits and tax rates.

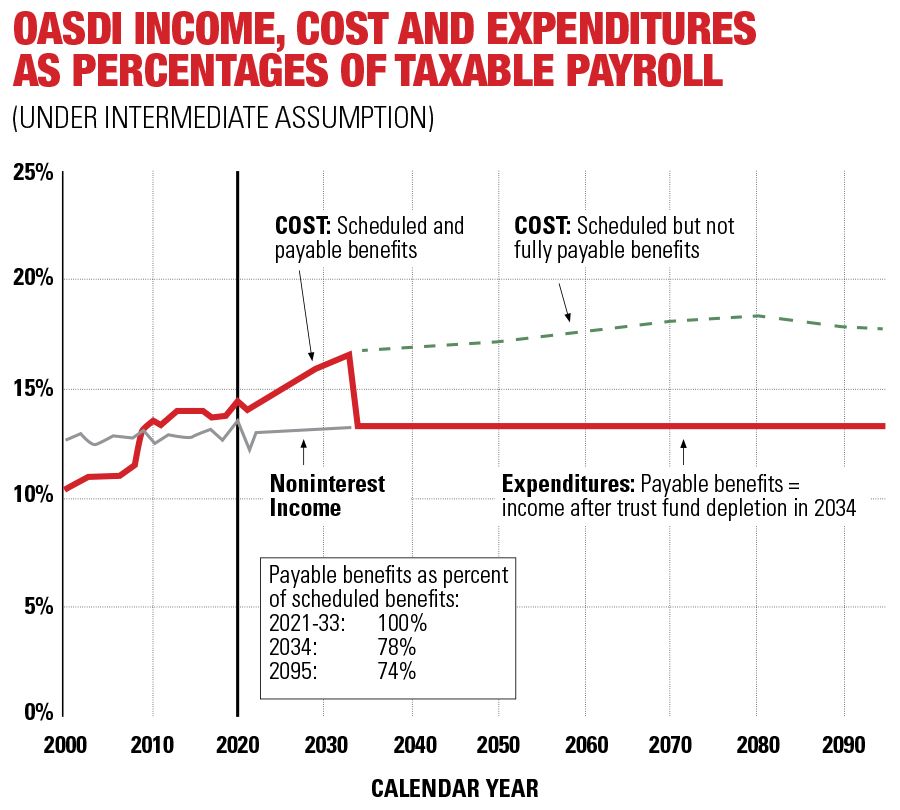

The Social Security Board of Trustees’ 2021 report shows the nation’s primary retirement program will be unable to pay full benefits beginning in 2034, one year sooner than previously forecast, because the combined trust fund reserves for retirement, survivor and disability benefits would be depleted.

But trust fund depletion doesn’t mean bankruptcy, despite headlines to the contrary. Ongoing revenue from payroll taxes would be sufficient to cover about 78% of scheduled benefits 13 years from now — unless Congress acts before then to shore up the system’s long-term finances and fully fund scheduled benefits.

A recent report from the Center for Retirement Research at Boston College found that workers who were shown headlines emphasizing the depletion date planned to begin claiming Social Security a year earlier on average than those in a control group.

“News coverage of the Trustees Report often emphasizes the trust fund depletion date and de-emphasizes the ability of ongoing revenue to support three-quarters of scheduled benefits,” authors Laura Quinby and Gal Wettstein wrote in the recently published paper. “If workers respond to their misperceptions, they might adjust their behavior in ways that could either harm or enhance their retirement security.”

A recent survey of more than 1,000 Americans 45 and older conducted by annuity provider PlanGap found 70% of respondents had “a lot” or “a great deal” of concern that they wouldn’t receive their full Social Security benefits, while 55% had little or no confidence that the government would solve the Social Security solvency problem without reducing their benefits.

Social Security’s long-range funding shortfall is driven largely by demographics. Declines in fertility and increases in longevity are resulting in a lower ratio of workers to beneficiaries as baby boomers retire. The ratio of workers paying into the system to support each beneficiary is expected to fall from 2.7 in 2021 to 2.3 in 2033 — a far cry from the 5-to-1 worker-to-beneficiary ratio in 1960, when today’s 62-year-olds were born. Given current tax rates and benefits, the system needs a worker-to-beneficiary ratio of about 2.8 to function at a pay-as-you-go level, meaning that tax revenue approximately equals benefit payments.

SELF-FINANCING PROGRAM

In addition, last year’s pandemic-induced recession led to massive job losses, reduced payroll tax collections and involuntary retirements of some older workers.

Social Security is self-financing. More than 93% of its income comes from payroll taxes paid by employers, employees and self-employed individuals, and federal income taxes paid by about half of the program’s beneficiaries on a portion of their benefits. It also receives interest income on the trust fund reserves.

For many years, Social Security took in more in taxes than it needed to pay benefits, resulting in the accumulation of trust fund reserves. In 2010, total expenditures began to exceed tax revenues, but interest on the trust fund reserves helped fund benefits while the trust fund balances continued to grow. Starting this year, however, Social Security’s cost is projected to exceed total income, including tax revenues and interest. As a result, trust fund reserves are projected to decline steadily from their current peak of $2.9 trillion to zero in 2034.

NEED FOR ACTION

Although Social Security’s expected shortfall has been forecast for decades, there have been no successful comprehensive reform efforts like that approved in 1983 — the last time it teetered on the brink of insolvency.

Since then, there have been two bipartisan commissions and one failed attempt by former President George W. Bush to privatize a portion of Social Security. Increased partisan squabbling on Capitol Hill over spending priorities and tax policies in the wake of the Covid-19 pandemic and the divisive 2020 election has left little room for debates over Social Security reforms.

A majority of House Democrats are expected to introduce a bill to expand Social Security benefits and pay for that by imposing payroll taxes on workers’ earning over $400,000 per year. The Social Security 2100 Act seems more a political document than a serious effort at improving trust fund solvency. Even if it wins House approval, it would likely be killed by a Republican filibuster in the Senate.

And each passing day without legislative action comes at a cost.

To illustrate the magnitude of changes needed to maintain Social Security solvency over the next 75 years, the latest trustees report points to two hypothetical options.

The first is an immediate 3.36-percentage-point increase in the payroll tax rate, from the current 12.4% to 15.76%, evenly divided between employers and employees. Self-employed workers pay the full rate.

Alternatively, the trustees said an immediate 21% reduction in scheduled benefits for all current and future beneficiaries or a 25% reduction for newly eligible beneficiaries only would also solve the long-range shortfall.

But if action is deferred for several years, the changes necessary to maintain Social Security solvency become concentrated in fewer years and fewer generations. If action were deferred until the combined trust fund reserves become depleted in 2034, it would require a 4.2-percentage-point increase in the payroll tax rate, to 16.6 %, or a 26% across-the-board reduction for all beneficiaries, the trustees report said.

Historically, most changes have been phased in over time to minimize the impact on current retirees. Future solutions will likely include both tax increases and benefit changes.

Lawmakers have a broad list of policy options to consider. The Social Security Administration Office of Chief Actuary provides cost estimates for more than 140 proposals, including increases in taxes or reductions in benefits to improve trust fund solvency or, in some cases, to expand benefits for vulnerable beneficiaries, which would increase the long-term trust fund deficit.

Some of the more commonly discussed proposals to improve trust fund solvency include raising the amount of earnings that are subject to the payroll tax, increasing the payroll tax rate, boosting the retirement age, modifying the benefits formula and changing the annual cost-of-living adjustment calculation. (See chart.)

8 ways to reform Social Security

| Legislative proposal | Portion of Social Security shortfall that would be eliminated |

|---|---|

| Immediately increase FICA tax, currently 12.4%, to 15.8% | 101% |

| Gradually raise FICA tax, currently 12.4%, by 0.1 percentage point each year until it reaches 14.8% in 2047 | 56% |

| Apply 12.4% FICA tax on earnings above $400,000 | 60% |

| Apply 12.4% FICA tax on all earnings | 65% |

| Use less generous chained CPI to calculate cost-of-living adjustment | 19% |

| Reduce Social Security benefits for higher-income retirees with adjusted gross income over $60,000 for singles, $120,000 married | 13% |

| Gradually raise full retirement age to 68 | 13% |

| Gradually raise full retirement age to 70 | 47% |

Source: 2021 Social Security Trustees Report

THE ADVISER’S ROLE

“Advisers should create retirement income plans under current Social Security rules but develop a contingency plan if Congress can’t agree on a funding solution,” said Joe Elsasser, president of Covisum, which focuses on optimizing Social Security claiming strategies and developing tax-efficient retirement withdrawals. “Put it in the context of an overall retirement income plan and stress-test it to make sure clients are still OK.”

Covisum offers a free calculator to demonstrate the impact of a future reduction in Social Security benefits.

For example, assume you have a 62-year-old single female client in average health with a full retirement age benefit of $2,500 per month. If she claims benefits at 70 and lives until 85, she will receive nearly $574,000 in lifetime Social Security benefits, more than $100,000 more than she would have received if she claimed reduced benefits at the early age of 62, assuming no future benefit cuts.

But even if benefits were cut by 26% in 2034, her lifetime benefits would still be larger if she waited until age 70 to claim them and died at 85, compared to claiming early at 62, although the difference would not be as large — about $60,000 more. The longer the client lives, the greater the value of delaying benefits.

“Of course, every situation is different, but the last thing any financial adviser wants is for their clients to make a poor retirement decision out of fear,” Elsasser said. “A reasoned decision that considers the client’s longevity, additional retirement income, and the potential for multiple benefits in the case of married couples can add thousands of dollars to a retirement strategy.”

(Questions about new Social Security rules? Find the answers in Mary Beth Franklin’s new 2022 ebook at Maximizing Social Security Benefits)

Learn more about reprints and licensing for this article.