Fiduciary standard not happening until mid-2012: Ketchum

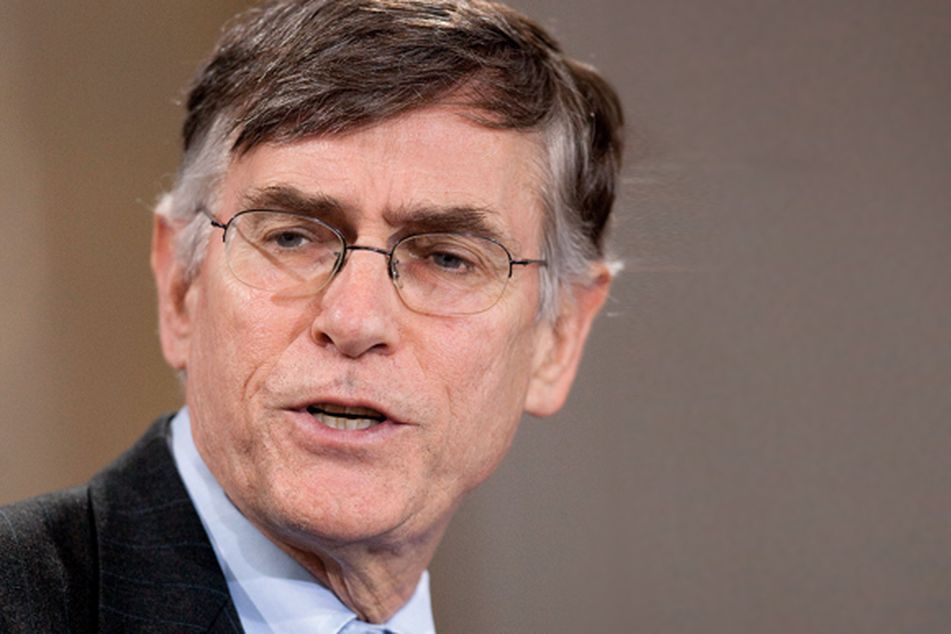

Richard Ketchum (Photo: Bloomberg)

Richard Ketchum (Photo: Bloomberg)

Finra boss Richard Ketchum says a fiduciary standard is unlikely to happen for another 18 months; regulator will have to build new staff and create a separate board – if it's chosen as advisory biz SRO

Registered representatives will operate under a fiduciary standard no earlier than the latter half of 2012, according to Richard Ketchum, chief executive of the Financial Industry Regulatory Authority Inc.

And that timeline is “quite aggressive,” he said. “If it occurs, the SEC would have to move through an implementation phase that would register one or more [self-regulatory organizations]. That process would take a period of time.”

On Jan. 21, the SEC released a report that calls for brokers and advisers to be held to a uniform fiduciary standard. The SEC also has proposed ways of strengthening the regulation of financial advisers, one of which is to designate Finra as the SRO for some investment advisers.

If that occurs, Finra will have to build a new staff to oversee investment advisers, Mr. Ketchum said.

“We would have to create a discrete board that would have responsibility for investment adviser issues, fill that board, staff up with people who are knowledgeable and understanding of investment adviser issues,” he said. “It would be difficult to imagine all that [happening] before the middle of 2012 or the latter parts of 2012.”

Mr. Ketchum made his comments Monday night after addressing more than 500 brokerage industry professionals in Phoenix at the annual meeting of the Financial Services Institute.

Right now, when reps sell securities to clients, they must make sure the investment is suitable for a client. According to the SEC, the broker must consider a client’s risk tolerance, other security holdings, financial situation, including income and net worth, financial needs and investment objectives.

Investment advisers already sell investment products under the fiduciary standard, meaning that they must operate in the best interests of their clients.

Some investment advisers have questioned Finra’s ability to regulate their profession. A common criticism from broker-dealer executives is that Finra’s staff lacks professionals with experience in the brokerage industry and relies on lawyers with little experience working for broker-dealers.

Mr. Ketchum acknowledges that criticism.

“We would be looking for very senior people as well as building a coterie of investment adviser oversight and responsible folks in the examination team that had experience in investment advisory firms, operating from a legal standpoint of advising investment advisers or compliance consultants,” he said.

Mr. Ketchum said he does not have a sense how of much a change to a fiduciary standard would cost an individual broker or registered rep, either in dollars or work hours. “There are too many ifs to come up with the answer” at the moment, he said.

Learn more about reprints and licensing for this article.