Sponsored Content from Ares Wealth Management Solutions

Out with the Old and in with the New: a 50% Private Markets Portfolio

A great man died recently, but this did not make headlines. In fact, it barely even made the news. Maybe it’s because many have already mourned the departure of his greatest legacy: the 60/40 portfolio.

Co-authors:

Carlin Calcaterra, Principal, Financial Advisor Solutions Team

Brendan McCurdy, Managing Director, Financial Advisor Solutions Team

Harry Markowitz may not be a household name, but among asset allocators he is the undisputed king. Considered the father of modern portfolio theory (MPT), his foundational work (mostly done in the late 1950s–1960s) on multi-asset portfolio construction influenced and underpins almost all models in use today.

At the heart of MPT is the belief that by combining asset classes that move differently from each other, we can create a portfolio with a total risk that is less than the sum of its parts. The simplicity of MPT is both its greatest strength and, arguably, its greatest weakness. The 60/40 portfolio reflects the belief that stocks and bonds are not highly correlated over the long term.

This is not an unreasonable thesis. Nor is it wrong, per se. It is simply highly dependent on the time horizon over which it is measured and on getting the risk, return and correlation assumptions right.

The principle has not changed, but both investors and markets themselves have, necessitating a new approach to portfolio construction.

Out with the old: from asset classes to risk factors

Portfolios of the past, constructed using the guiding principles of Markowitz’s 60/40, relied heavily on returns of public equity to accumulate wealth.

Over-reliance on equity risk is a byproduct of a fundamental misunderstanding of the difference between capital allocation and contribution to risk. Though public equities are 60% of a typical 60/40 portfolio, they contribute a far greater proportion of the portfolio’s risk.

Since risk tends to come along with return, these portfolios have been overwhelmingly dependent on public equities for their wealth generation.

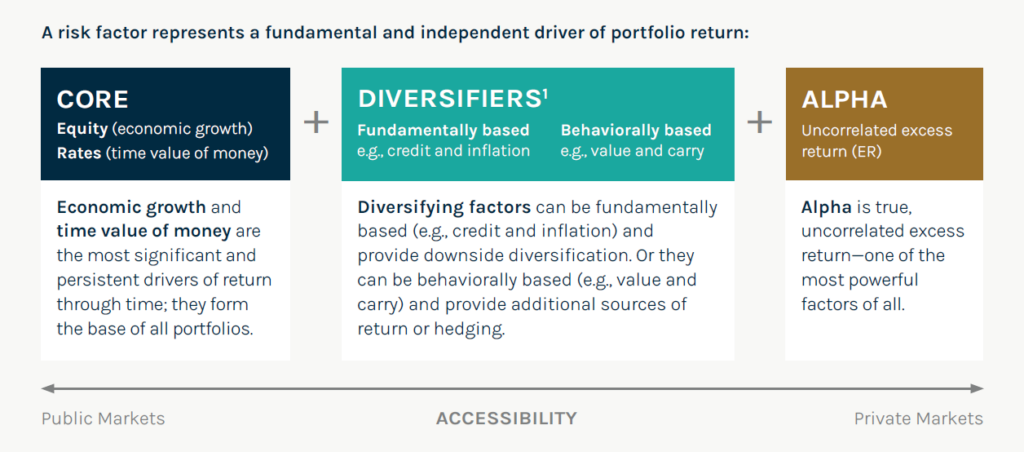

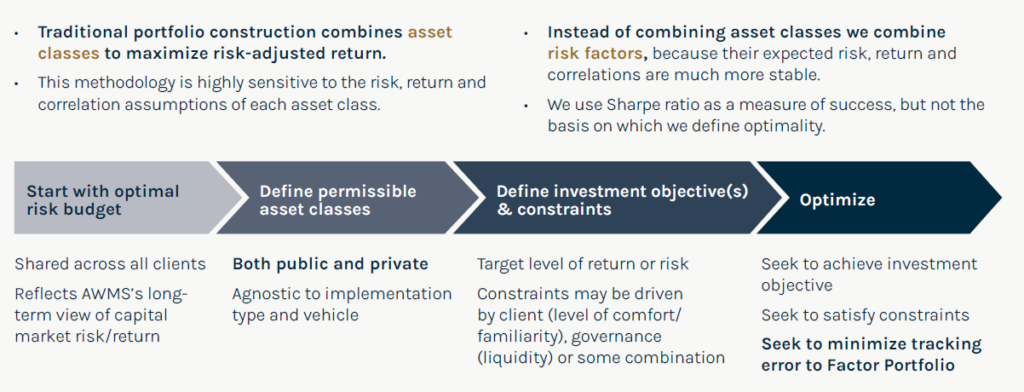

In order to build a more effective portfolio that takes into account the wide array of asset classes available to investors today, we need to look through the lens of return drivers (also called “risk factors”) before allocating among asset classes.

In with the new: risk-based diversification

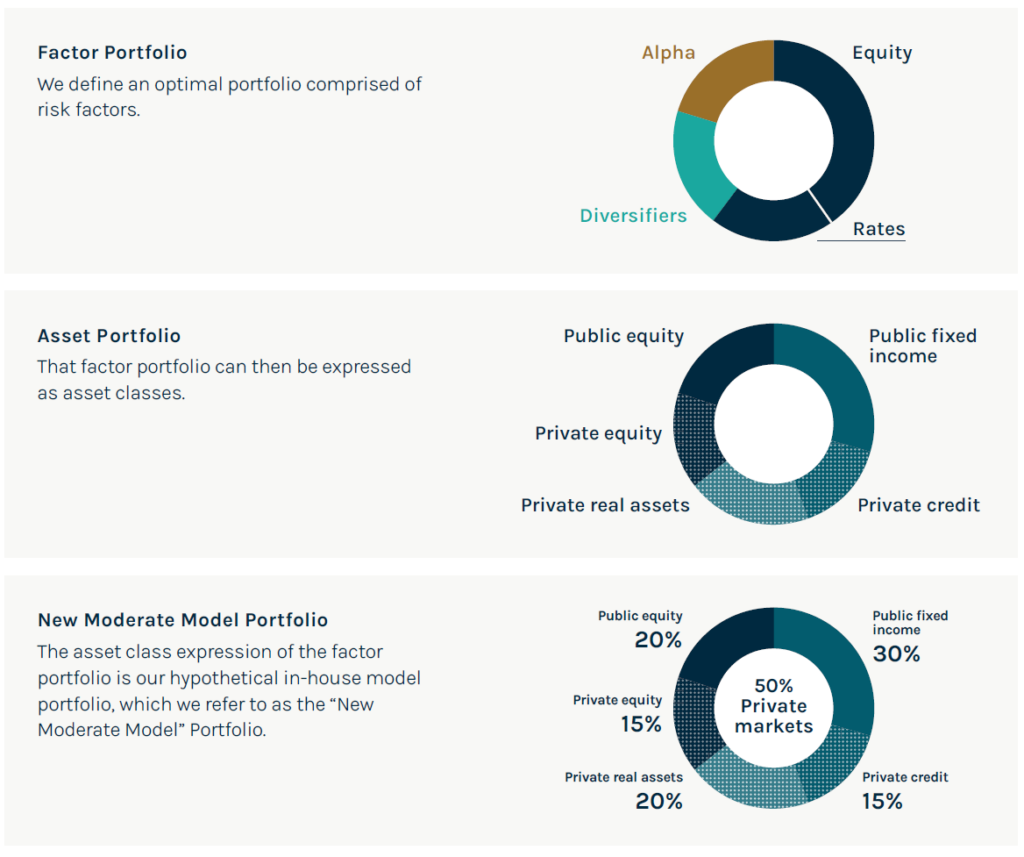

A 50% allocation to private markets is not an arbitrary choice.

It is the optimal outcome of a new approach.

Every risk factor, similar to an asset class, has a corresponding assumed return, risk and correlation. These assumptions are much more stable than asset class–specific assumptions. Balancing risk factors can help ensure diversified risk and avoid unintentional concentrations, most often in equity.

Fifty percent of this New Moderate Model is in private markets across the spectrum of private equity, private credit and private real assets.

1. Diversification does not assure profit or protect against market loss.

Harnessing the power of private markets

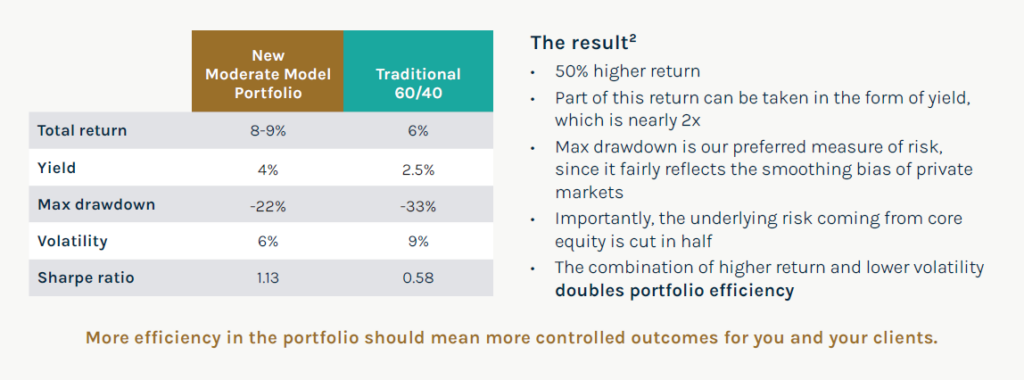

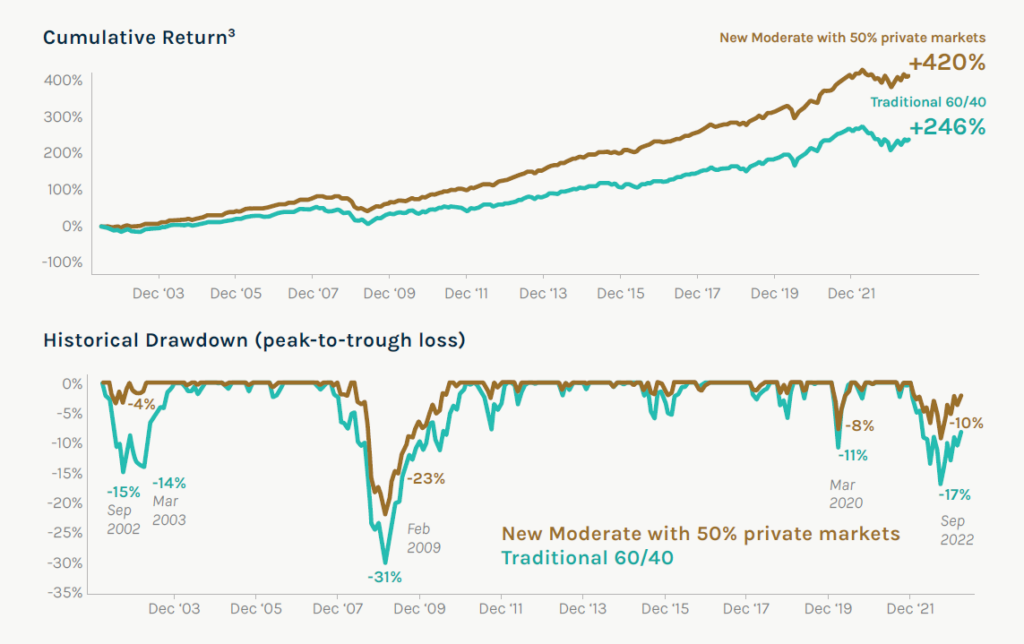

The power of a 50% allocation to private markets is in the historically higher returns and fewer and milder drawdowns specifically, nearly double the cumulative returns over the

past 20 years and meaningfully fewer drawdowns than the traditional 60/40.

2. Based on a hypothetical portfolio over a 20-year period using index returns. Public equity represented by MSCI ACWI NTR. Public fixed income represented by Bloomberg 7–10-year government bond index. Private equity represented by Burgiss Buyout index. Private credit represented by Burgiss 1L index. Real assets represented by a 50/50 split of Burgiss Infrastructure index and NCREIF-NFI ODCE real estate index. Historical performance March 2002–March 2023. Past performance is no guarantee of future returns.

3. Past performance does not guarantee future results.

A flexible approach that can be adjusted based on client goals

Now, this model is attractive in its simplicity and effectiveness. But it is built absent of knowing anything about an individual client. That is why this is more than just a model—it’s also a process.

And that process—using risk-based diversification and a focus on alpha—can be coupled with your portfolio construction process to create customized portfolios for different goals and outcomes.

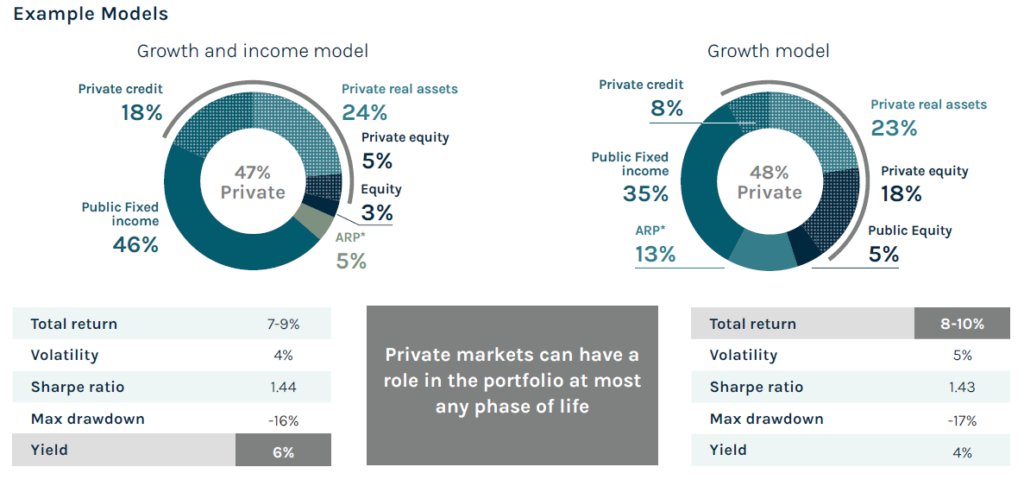

That goals-based portfolio might look something like a Growth & Income portfolio for retirement that emphasizes yield and smoother returns. For this objective, we lean into higher allocations to private credit and public fixed income, while de-emphasizing equities, both public and private.4

Or the desired outcome may lead to a Growth portfolio for longer investment timeframes, perhaps for a younger investor or a foundation or endowment with a multiple-decade time horizon. Here we emphasize higher returns by leaning more heavily on private equity, while maintaining the diversification benefits of real assets.

4. This material is for informational purposes only, and is not intended as investment advice. Investing in private markets investments may involve a high degree of risk. Private markets are less liquid than public markets, and may not be liquid at all at times.

Not dead, just different: An evolved approach

For all of Harry Markowitz’s brilliance, even he could not fully conceive of the breadth and depth with which capital markets would expand. His models of the past made no attempt to solve for private markets investments—and why would they? At the time, they simply didn’t exist in the form or size we see today.

If you were completely unburdened by and unanchored

to portfolios you built in the past, and there were new tools to help you build more intentional and potentially better outcomes for your clients, would you go about it the same way you did 30 years ago? Likely not. The nature of capital markets is changing. In all other aspects of our lives we demand more customization and flexibility. We believe investors would be prudent and wise to demand the same of their portfolios.

Disclaimer

Investing in private markets involves risk, including the loss of principal. Other risks include, but are not limited to, illiquidity risk, valuation risks and a number of other risks related to private companies in general.

Financial advisors must carefully consider the risks and other suitability details in determining appropriate investments for their individual clients’ portfolios.

Data contained herein from third-party providers is obtained from what are considered reliable sources. However, its accuracy, completeness or reliability cannot be guaranteed. Examples provided are for illustrative purposes only and not intended to be reflective of results an investor can expect to achieve. These materials may contain “forward-looking” information that is not purely historical in nature, and such information contained herein is based upon certain assumptions about future events or conditions and is intended only to illustrate hypothetical results under those assumptions (not all of which will be specified herein).

AccessAres is the thought-leadership and educational division of Ares Wealth Management Solutions. The materials distributed by AccessAres are for informational purposes only and do not constitute investment advice or a recommendation to buy, sell or hold any security, investment strategy or market sector. Ares Wealth Management Solutions is a global brand of Ares Management Corporation.

REF: AM-02900

Learn more about reprints and licensing for this article.

This content is made possible by Ares Wealth Management Solutions; it is not written by and does not necessarily reflect the views of InvestmentNews' editorial staff.