Can the 60/40 portfolio stage a comeback in 2023?

The allocation that's supposed to hedge against both assets dropping simultaneously didn't pan out in 2022, with an index tracking a 60/40 mix down about 17% for the year.

Putting 60% of a portfolio in stocks and 40% in bonds is supposed to hedge against both assets dropping simultaneously. But it didn’t pan out that way in 2022.

Inflation and rising interest rates whacked both asset classes, and a Bloomberg index tracking a 60/40 mix is down about 17% for the year. But some veteran investors say the classic approach to investing still makes long-term sense, and that bonds are positioned to regain their status as a good counterweight to stocks.

For long-term investors, the drop in stock valuations and the rise in bond yields in 2022 sets the stage for future average returns of 6.9% on the 60/40 mix, according to Leuthold Group, a market research and money management firm.

But those returns may come with more volatility than in the past, the report concluded.

Leuthold’s research used the S&P 500 as its stock proxy. But the stock portion of a 60/40 portfolio shouldn’t be entirely in U.S. stocks, said Christine Benz, director of personal finance at Morningstar Inc.

“I always think that’s how the mix is conventionally construed, but the experts don’t recommend that, and I certainly wouldn’t, either,” Benz said. “Most investors should have exposure to international equities and have some — not a lot, but some — cash on hand.”

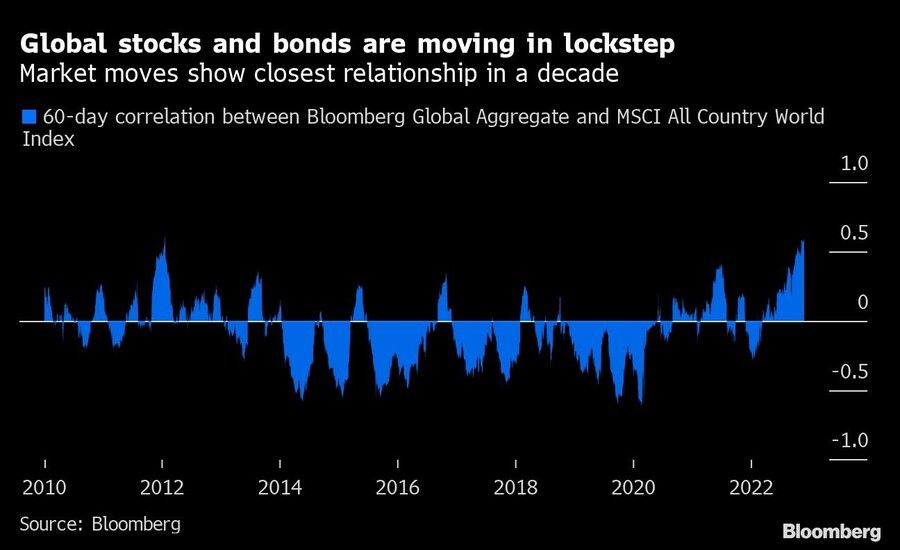

Vanguard Group is also counseling patience with a 60/40 strategy, noting in a report that over shorter time frames it’s not that unusual to see stocks and bonds decline in concert.

Since 1976 there have been, on average, a month of joint drops about every seven months, the research found. But during that same period, “investors never encountered a three-year span of losses in both asset classes,” according to the report.

[More: Investment Portfolio allocations: Is 70/30 the new 60/40?]

LASTING LOGIC

“For someone investing in a 60/40 portfolio for five years or more, the logic still holds,” said Roger Aliaga-Diaz, global head of portfolio construction at Vanguard and author of the report. “If you look at the last 10 years, including this year’s loss, the return is 6.5% for some 60/40 benchmarks, so on average it’s doing what it’s supposed to do — give you a 6% to 7% return.”

The equity portion of Vanguard’s benchmark 60/40 portfolio has 36% in U.S. stocks and 24% in international stocks; the bond portion has about 22% in currency-hedged international bonds and 19% in U.S. intermediate credit bonds.

Some investment firms advocate for a 60/40 mix to incorporate more asset classes, such as alternative assets. A recent report from private equity firm KKR & Co. proposed that investors devote 40% to stocks, 30% to bonds and then 30% to alternative assets, of which at least 10% should be private credit.

Investments such as private credit, real estate and infrastructure are more inflation-resilient, the report argued, and should provide better risk-adjusted returns over the long run. KKR found that the 40/30/30 portfolio outperformed a traditional 60/40 split by 2.6% over the 24-month period through June.

Learn more about reprints and licensing for this article.