Residential real estate is hot commodity for investors

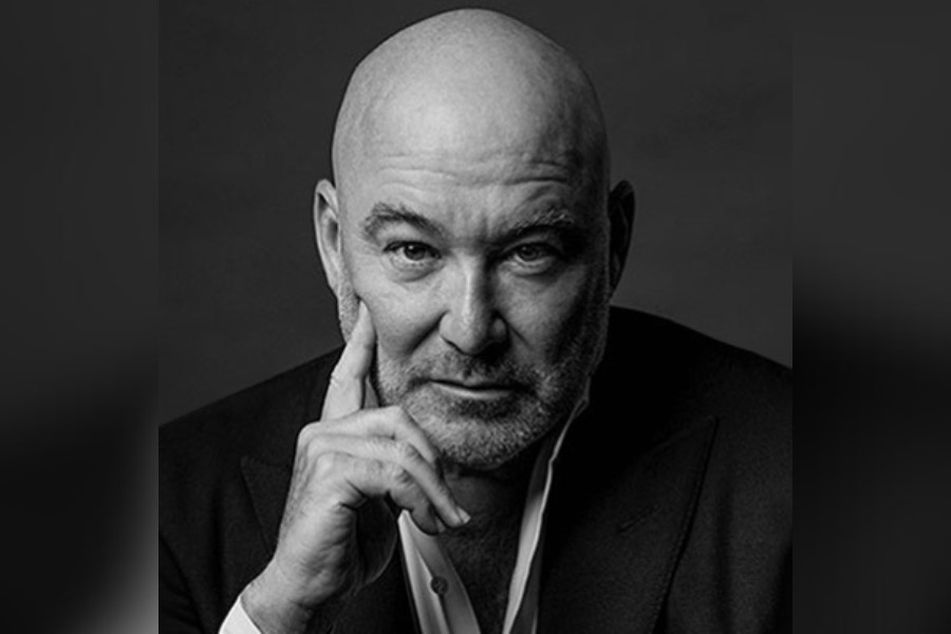

Paul Feinstein of Audent Global Asset Management

Paul Feinstein of Audent Global Asset Management

'Advisors have been looking for other areas to park some money for some time and real estate's a natural lateral move,' asset manager says.

With real estate ebbing and flowing on all fronts over the past several months, just how viable is it for advisors to consider the sector as part of their allocation arsenal?

Paul Feinstein, CEO and founder of Audent Global Asset Management, says multifamily housing and hospitality are the types of real estate that investors should be focusing on.

While there’s a tremendous amount of opportunity in commercial real estate, Feinstein says that it’s a challenging area that entails a lot of risk, given the uncertainty about the extent to which employees will make their way back to office spaces.

“Is it going to be some type of hybrid model where people are working two, three days in the office and then working at home for the remainder [of the week]? That’s obviously going to have an impact and effect on rates,” he said.

Compared to the commercial real estate space, Feinstein says residential real estate in multifamily settings lends itself to a much more predictable cash flow.

“You can underwrite it much more consistently and with a little bit more predictability,” he added. “As a fixed-income replacement, it really lends itself for that asset class.”

The primary reason advisors have been considering residential real estate more recently, Feinstein says, is because fixed-income investments haven’t been yielding much in recent years.

“Advisors have been looking for other areas to park some money for some time and real estate’s a natural lateral move,” he says. “When you look at the multifamily space, student housing, senior living, those are kind of the hot areas. [They’re] much more consistent and predictable than other forms of real estate, especially commercial. I think advisors have been a lot more constrained in the past.”

Meanwhile, more and more working clients are also demanding residential real estate.

“They’ve sat with very low interest rates on bond portfolios for a very long time and people are just looking outside the box now,” he says. “It’s another alternative and it’s very attractive considering where bond yields are right now.”

While hotels are not exactly classified as residential, Feinstein says they have been a hot commodity in the real estate market over the past four to five years as consumers sought out travel experiences during Covid.

“People were really looking for destinations or experiences where they can travel to by car, and still have that vacation or that time away that feels pretty luxurious,” he said. “With Covid, people weren’t traveling by airlines. They were traveling by car and they’re still maintaining that experience.”

Feinstein added a lot of money has been thrown into the hospitality real estate sector in response to the “stable cash flows, with vacancy rates down at the 50 percent level.”

“Everybody wants that experience,” he said. “San Ysido Ranch is a favorite hotel of mine on the West Coast, but it has that type of Class A experience. Class A restaurants, beautiful grounds, you have bungalows that are appointed very well and very homely. It’s really that delivery in that whole experience that you would expect.”

There’s been more private money entering real estate, along with banks, which previously withdrew from the marketplace, Feinstein noted.

“Audent’s involved with three developments in Florida right now and when we went to the market for a takeout, we had five banks who are actively bidding against each other for that space,” he said. “So we’re seeing the big banks starting to come back into that space, starting to see more traditional financing coming back into that space. That obviously really gives you a look at the next three to five years and it will be, I would say, a phenomenal period to be invested in real estate.”

As for RIAs, there’s also opportunities to be had for them to capitalize on exclusive real estate in hospitality as well, Feinstein says.

“They’ll have real estate funds, private equity deals that they can put capital to, and some of those private equity deals will have hospitality,” he says. “As an RIA, there are opportunities to seek out some of these developers or operators. It does take a lot more work to do it and you have to look at your resources, attend a lot more conferences, and know who the players are and really understand the space.”

Higher rates not a bad thing for annuity buyers, says Invesco strategist

Learn more about reprints and licensing for this article.