Expatriate advisor finds a home and client base in France

The Cours Saleya market in Nice, France

The Cours Saleya market in Nice, France

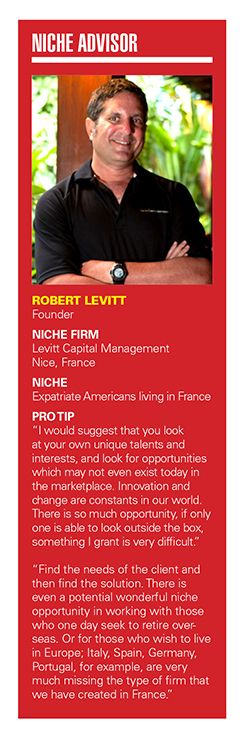

Robert Levitt has traded Florida for the French Riviera, where he sees a wide-open market in the 250,000 Americans living there who need financial advice.

Robert Levitt might not have moved to France 16 years ago to develop a niche of working with Americans living abroad, but now that he’s there it looks like a no-brainer strategy.

Levitt, 62, pulled up stakes from his home base in Boca Raton, Florida, in the midst of the financial crisis to create a branch of Levitt Capital Management on the French Riviera near Nice.

After spending seven years splitting his time between Europe and Asia, he shut down his advisory business in 2014 and went back to school to earn a doctorate in medieval history.

But two years ago, Levitt was drawn back into the wealth management business when he started to realize there was a dearth of financial advice geared toward expatriates and Americans with dual citizenship living in France.

“There are 250,000 U.S. citizens living in France and there are zero investment advisors that deal with Americans here,” he said. “What an opportunity.”

Thus the relaunch of Levitt Capital Management, located about 30 miles from the Italian border.

Levitt, who learned to speak French while he was living in France, said it took him about a year to get through the regulatory process to operate a financial planning firm in France.

As he describes it, there are likely as many differences as similarities between the financial services industries of France and the United States. But those distinctions are what create the opportunity for his niche practice.

“I started to realize a few years ago that Americans living in Europe face a lot of challenges because of laws in the U.S. that were created to catch people who might be hiding money,” he said. “I initially wanted to join a firm and just work as an advisor, but there are regulatory hurdles.”

Considering U.S. tax laws that prevent Americans from buying European investment products and European regulations preventing Europeans from buying U.S. investment products, Levitt’s niche was essentially ready-made.

Levitt was managing more than $550 million in client assets when he initially opened the branch in France in 2007, and he said the advisory business structure in France isn’t comparable to that of an RIA operating in the United States.

For example, while he said the advent of defined-contribution retirement plans has created a more sophisticated investor market in the U.S., in France advisors don’t take discretion over portfolios and all investments have to be executed by the clients.

In terms of marketing and building his business, Levitt said he hopes to take advantage of the existing network of Americans living in France.

“The network of Americans in France is relatively small, and the Americans know Americans,” he said. “There are a handful of U.S. CPAs who prepare U.S. tax returns in France for U.S. citizens, so that is a good target market. And I also speak at groups such as Democrats Abroad and other American-based clubs.”

In some respects, Levitt feels serving expats in France puts him back where the U.S. independent advisory business was in the 1990s, before “saturation led to large advisory firms buying other large firms.”

“From a niche perspective, I have chosen a relatively large and unserved market that has become too complex for those who want to do it themselves, that has seen in the recent past new legislation which has made navigating the system more and more complex to the point that previous competitors, financial advisors in the United States, have voluntarily left the market, and new regulation in Europe has made the choice of investment products more and more difficult to find,” Levitt said. “And I came to that market with years of experience as an investment advisor, mastery of the French language and the ability to create something which previously did not exist.”

Learn more about reprints and licensing for this article.