Which portfolio fees are tax deductible?

The TCJA enacted major changes on what expenses investors can claim on their tax returns. Find out which portfolio management fees are tax-deductible

Updated January 16, 2024

The implementation of the Tax Cuts and Jobs Act (TCJA) in 2018 has introduced major changes in terms of what investors can and cannot deduct from their tax returns. Among the most notable omissions are financial advisor fees.

In this client education article, InvestmentNews discusses which portfolio expenses can be claimed on your next tax return. In particular, we will answer the question “are portfolio management fees tax-deductible?”

If you’re an investor looking to maximize your tax savings, this guide can serve as a useful reference. Investment professionals can also share this piece with their clients to give them a deeper insight into how taxes work when it comes to their investment portfolios.

What are portfolio fees?

Industry professionals who are tasked to manage investments on their clients’ behalf charge a corresponding fee for their services. Also called portfolio fees or management fees, these are calculated as a percentage of the total assets under management.

The rate ranges between 0.2% and 2%, depending on several factors, including the size of your investment and management style. The total amount is quoted annually but you can pay for this in monthly or quarterly instalments.

Let’s say you have a $25,000 investment with a management fee of 1% per year. This means you will be charged an annual portfolio management fee of $250. Depending on the arrangement, you’re expected to pay $62.50 per quarter or around $21 monthly.

In exchange for the fees, you’re given access to these industry experts’ wealth of knowledge and resources. These professionals can provide you with personalized investment advice to assist you in balancing your portfolio and allocating risks, among others.

Generally, managers who use a more passive approach with their investments charge lower fees compared to their counterparts who manage investment portfolios more actively.

How can investment fees impact your portfolio?

Effective investment management entails a deep understanding of how fees and other expenses can potentially affect your portfolio’s returns.

“These fees may seem small, but over time they can have a major impact on your investment portfolio,” the US Securities and Exchange Commission (SEC) warns investors.

Research conducted by the agency has found that 1% charged in extra fees can reduce your investment returns by more than 25% in 20 years. The reason is that investment fees and expenses also cut down your portfolio’s net returns. Compounded over time, these charges can have a massive impact on your portfolio.

If your portfolio fees get out of hand and you’re overpaying for underperforming investments, these will also significantly eat into your returns.

Are portfolio management fees tax-deductible?

The TCJA passed in 2017 under the Trump Tax Reform Plan brought significant changes for investors in terms of tax policies, deductions, credits, and rates. Notably, the Act eliminated the deductibility of portfolio management fees and other investment-related expenses, including:

- Financial advisor fees

- Fees paid to brokers or trustees to manage individual retirement accounts (IRAs) and other investment accounts

- Accounting fees

- Fees paid for legal counsel and tax advice

- Rental fees for a safe deposit box

- Investment publication subscription costs

The TCJA took effect in January 2018. It is set to expire in 2025, so the tax cuts may be temporary. After this period, the changes may revert, allowing portfolio management fees to be tax-deductible. The tax cuts, however, may also be renewed.

Prior to the Act’s implementation, portfolio management fees were considered as miscellaneous itemized deductions if these exceeded 2% of your adjusted gross income (AGI).

Let’s say your AGI was $150,000. If you paid more than $3,000 – or 2% of your AGI – in portfolio management fees, you could deduct the excess amount from your tax returns. If you paid $4,000 in fees during the year, for instance, the exceeding $1,000 would have been tax-deductible.

Some experts say that there’s a way around it. If you could have claimed portfolio management fees but didn’t, you could go back and amend a tax return as long as:

- it’s within three years from the date you filed the tax return

- it’s within two years from the date any resulting tax was paid

While the three-year deadline has already lapsed, you can still amend a tax return if you made your last tax payment in the past two years.

Tax laws can change over time, so it’s advisable that you consult an experienced financial advisor or portfolio manager to find out your eligibility for making a tax claim.

Which portfolio fees are tax-deductible?

While the TCJA eliminated deductions on most investment-related expenses, there are a few that remain tax-deductible. This allows you to offset some of your investment costs. Here are some of them:

Investment interest expenses

When you borrow money to purchase assets, you may be able to claim the interest you paid on your tax return as an investment interest expense. This includes margin loans used to buy stocks or mortgage loans for purchasing an investment property.

The deductible amount, however, cannot exceed your net investment income. If the investment interest expense is greater than your investment income, the exceeding amount can be carried over the following year.

Let’s say you took out a $5,000 loan with an interest rate of 5% to purchase an investment that didn’t perform well, generating just 4% in returns. In this scenario, you would have paid $250 in investment interest expense but only $200 – equivalent to your investment income – would have been tax-deductible. You could claim the exceeding $50 on your next tax return.

Qualified dividends

These are dividends that meet certain requirements to be taxed at capital gains rate, which is lower than the ordinary income tax rate. As an investor, however, you have the option to treat qualified dividends as ordinary income.

Under the right circumstances, this approach can increase your investment interest expense deduction, reducing the tax you pay to up to 0%. This is significantly lower than the 15% to 20% rate qualified dividends are typically taxed for.

Capital losses

Losing money from your investments is never a good thing, but it’s not all that bad. You can use your capital losses to offset your capital gains.

The Internal Revenue Service (IRS) allows you to deduct up to $3,000 in capital losses from your ordinary income each year. If you’re married and filing separately from your spouse, you can both deduct $1,500 each. Any excess amount carries over to the succeeding years. You can claim this against your ordinary income for those years until it’s gone.

Each investor’s financial situation is unique. That’s why it’s important to consult an experienced tax advisor when working out the potential implications of these deductions.

How do you pay for portfolio management fees?

Portfolio management fees typically range from 0.2% to 2% of the total assets under management (AUM). The rate is influenced by different factors, the biggest of which is the portfolio manager’s management style.

More aggressive investment portfolios tend to have higher management fees as the higher turnover of securities requires more work. Passive funds often have lower fees because they stick with the assets within the portfolio.

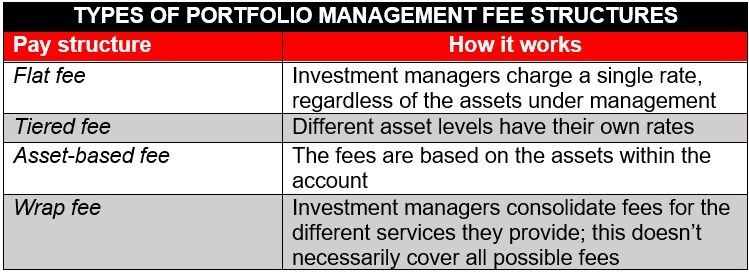

When partnering with a financial advisor or portfolio manager, you’ll encounter different pay structures, including:

- Flat management fees: This is the most straightforward pay structure where portfolio managers charge a single rate, regardless of the asset or investment type. Some portfolio managers may also choose to lower your fee as your portfolio increases.

- Tiered management fees: This is where different asset levels come with their own rates. Under this fee structure, all clients pay the same rate at the deposit level, regardless of the account’s size. For example, the portfolio manager may charge 1.75% on the first $500,000, 1.5% on the next $1 million, 1.25% on the next $5 million, and so on.

- Asset-based management fees: The fees are based on the assets within your account. This also means cash reserves on your portfolio may have little to no fees. Most value investors prefer this pay structure as they generally sit on cash reserves before using the money for other investments.

- Wrap management fees: This is where an investment manager consolidates the fees for the different services they provide. Apart from portfolio management, these can include investment advice, commissions, and trading fees. Wrap fees range between 1% and 3% of assets under management per year. They also don’t necessarily cover all possible fees.

Here’s a summary of how the different portfolio management fee structures work:

How can you find the best investment professionals to manage your portfolio?

Financial advisors and investment managers play an important role in shaping your portfolio. These industry professionals help you reach your investment goals faster, retain financial control, and understand the different assets within your portfolio.

Our Best in Wealth Page is the place to go if you’re searching for the best investment professionals to entrust the management of your portfolio. Here, we recognize those in the business who have shined the brightest in their respective fields. By partnering with these professionals, you can be sure that the management of your assets is in good hands.

Learn more about reprints and licensing for this article.