Florida-or-bust retirement prevails

Landon Buzzerd of Grant Street Asset Management and Nicole Sullivan of Prism Planning Partners

Landon Buzzerd of Grant Street Asset Management and Nicole Sullivan of Prism Planning Partners

Advisors help clients make sure they don’t experience both, as interest rates dip slightly and more homes go on the market.

A tight housing market and relatively high interest rates haven’t stopped people from flocking to Florida for retirement – although advisors say clients are exercising caution before deciding to relocate.

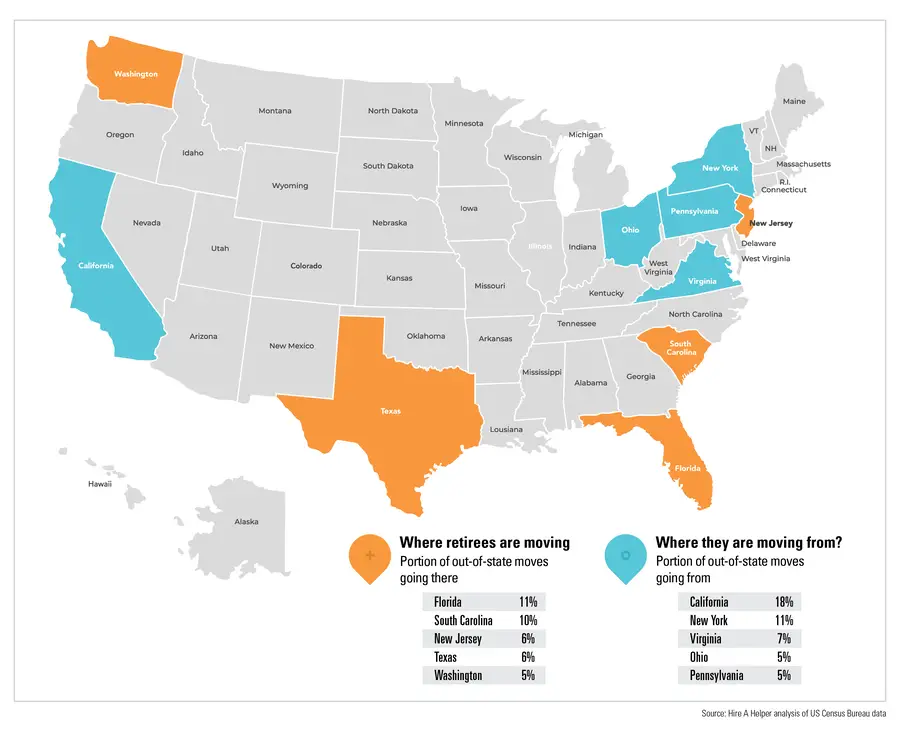

Last year, about 338,000 people in the US moved to a new home as part of a retirement plan, up 44 percent from about 235,000 in 2022 but down from 398,000 in 2020, according to Census Bureau data analyzed by Hire A Helper. Florida attracted more than any other state in 2023, with 11 percent of people moving there for retirement, while California had the biggest exodus (18 percent of movers), followed by New York (11 percent).

This year, interest rates have fallen slightly, and more homes are being listed for sale. Data this month from Zillow showed new listings were up 21 percent in February compared with a year earlier. Total inventory is up 12 percent, with cities in Florida seeing three of the four biggest increases. Inventory went up the most in Dallas (39 percent), followed by Tampa (31 percent), Orlando (30 percent), and Miami (29 percent).

When clients are considering a move, they should weigh their lifestyles, both pre- and post-retirement, including proximity to family, recreation, and health care, said Nicole Sullivan, co-founder of Prism Planning Partners.

“We see that clients who want to move for lifestyle reasons are generally taking action,” Sullivan said in an email. “While someone’s home may be worth more today, purchasing a different home will be more expensive than before – so people are being thoughtful. I observe fewer ‘impulse’ moves compared to several years ago.”

Increasingly, moves early in retirement are intended to be permanent – and more people say they want to age in place. Last year, data published by the National Association of Realtors showed that 43 percent of homebuyers aged 68 to 76 could not be convinced of any factors that would make them move again, compared with 30 percent in the same cohort in the same survey a year earlier. That was also the case for 31 percent of those 58 to 67, up from 26 percent for that group in the 2022 survey.

That aligns with sentiments people expressed in a survey in late February by Fannie Mae – among people 60 and up, 56 percent said they will never sell their homes, 27 percent indicated that they might, and 17 percent said they already had or are planning to. Seventy-two percent of people said they were confident about having enough income during retirement, and many people alluded to a “lock-in effect” with their current homes, or being happy with having paid the mortgage off, feeling attached to their communities, and being accustomed to the services available nearby, Fannie Mae found.

People early in retirement are the most likely to have moved far from home. Realtor data show that young baby boomers moved an average of 90 miles from their previous homes in 2022, while older boomers moved 60 miles away, and those in the Silent Generation moved 50 miles. When retirees do relocate, they’re most likely to move to small towns (35 percent), followed by suburbs (26 percent), rural areas (20 percent), or resort towns (15 percent).

Even as interest rates went up last year and home values remained at a high point, there were more first-time buyers in the market, and the average age of buyers decreased compared with 2022. Baby boomers accounted for the most sales of any generation in 2022, at 39 percent, compared with millennials, at 28 percent, according to the Realtor data.

“The combined share of younger and older boomers made up the largest share of homebuyers,” said Brandi Snowden, director of member and consumer survey research at the National Association of Realtors. “They’re more likely to have that equity built up that they can put toward their new home than first-time homebuyers and younger homebuyers.”

Even if near or current retirees are carrying mortgages, likely with interest rates of less than 4 percent, a move could still make sense if they’re relocating to a lower-cost area, said Landon Buzzerd, associate wealth advisor at Grant Street Asset Management.

“Many of the financial discussions revolve around the different taxes you are currently subject to versus what that might look like if you relocated,” Buzzerd said in an email. “Property taxes can vary greatly by state and even counties within states. You may be subject to more local taxes in one area over another, homeowners’ association fees may change, and the overall cost of living will vary. An increase in your mortgage from higher interest rates could be partially offset by these factors or make the potential move more prohibitive.”

Each case is unique, said Julie Bray, president and wealth manager at GW Financial.

“In a recent scenario where a client considered moving from California to Oregon, the initial plan was to leverage home equity to retire debt and reduce taxes. However, upon closer examination, factors like higher Oregon income and property taxes, increased mortgage interest rates, and Oregon’s state estate tax posed significant financial challenges. It’s a reminder that tax implications and cost-of-living adjustments must be thoroughly evaluated before finalizing relocation decisions,” Bray said in an email. “Meticulous financial planning and realistic cost projections are essential to ensure a successful relocation that aligns with long-term financial goals.”

First Watch, Federal Signal are smart small-cap picks, says Goldman manager

Learn more about reprints and licensing for this article.