Here’s why clients are stressing over their fixed-income holdings

Four big behavioral factors that are at play in investors' concerns about rising interest rates.

I’ve been on a kick about Daniel Kahneman’s ”Thinking, Fast and Slow” (Farrar Straus & Giroux, 2011) recently, not just because I enjoy his work, but also because I frequently encounter applications of behavioral biases in my daily life.

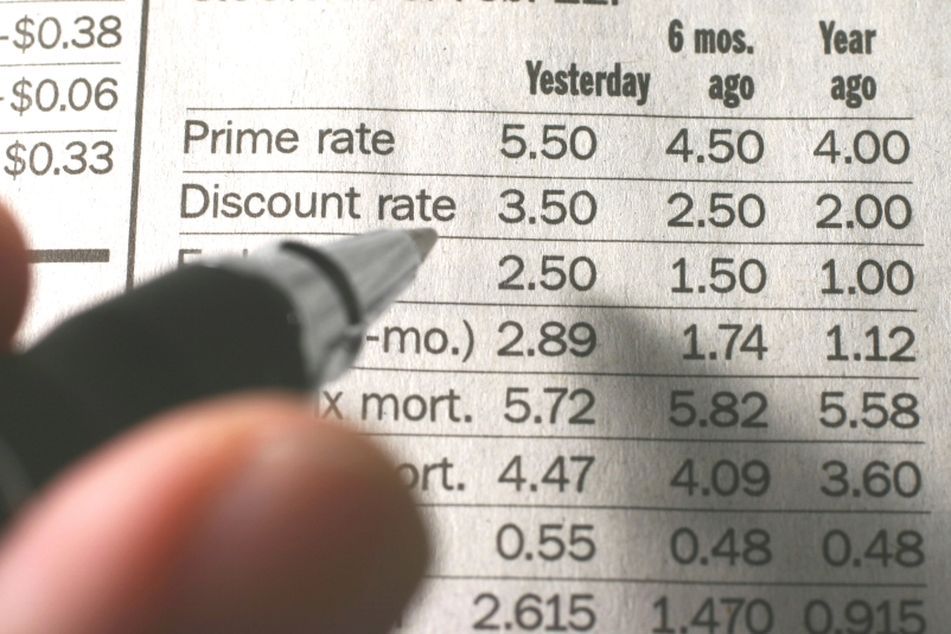

For instance, a major cause of investor stress recently is the threat of a Federal Reserve interest rate hike — and with it, renewed fears of rising interest rates. Of course, people have been predicting higher interest rates for a year or two now, but that does little to assuage clients’ fears of rising rates.

Interestingly, the lessons of behavioral finance have more frequently been applied to equity investing. In particular, behavioral finance seeks to understand systematic anomalies occurring in the equity markets that seem to defy the notion of a purely rational market. For example, the aptly named January effect is the phenomenon in which stocks historically have outperformed during the month of January. The equity risk premium is another example of an equity market anomaly; why is it that investors generally make a 6% premium on equity holdings over bonds, a figure that by many standards is just too high?

Because the equity markets provide such rich fodder for study, behavioral finance has largely been ignored within the context of fixed-income investing. This is also consistent with the fact that until recently, many fixed-income investors simply bought and held government securities until their maturity. This disciplined buy-and-hold mentality, in theory, meant that behavioral finance simply wasn’t as relevant. In other words, the fixed-income investor was too rational for behavioral biases.

BEHAVIORIAL FINANCE IN FIXED INCOME IS HERE

However, as the nature of fixed-income investing has changed, it has assumed many of the characteristics of equity investing. The new emphasis on fixed-income funds and ETFs promotes liquidity and more frequent trading. It is now much easier to ramp up or decrease one’s allocation to fixed income, which means short-term thinking can have a major influence on portfolio decisions.

Chances are that your clients are watching the news, seeing the debate about where interest rates are going and becoming stressed about their holdings. A number of behavioral factors are at play when it comes to talking to clients about this stress. Here are four big ones:

1. What you see is all there is. One of the most overarching mental tendencies involved in working with clients is that the brain has a tendency to form a cohesive story when supplied with insufficient information. In Mr. Kahneman’s words, “You will often find that knowing little makes it easier to fit everything you know into a coherent pattern.” In the case of interest rates, investors often don’t understand the nuances of the time value of money and how rising interest rates may impact their investments from a mathematical standpoint. So they receive just the information about rising rates being dangerous, and they form a story about the importance of getting out of fixed income “before it’s too late.”

2. Availability heuristic. The tendency described above to form a complete story from incomplete information is directly related to the notion of the availability heuristic. This is just what it sounds like; people form a story based on what information is available. This might be news, anecdotes from friends, etc. As an adviser, you have the opportunity to serve as an additional source of information, one that can help supplement incomplete knowledge.

3. Loss aversion. This is an important behavioral bias that explains why clients often hate losses more than they like gains. Simply put, this is the little voice in the back of their heads that tells them to run for the hills when there is the potential for price depreciation. Because it may cause clients to make poor asset allocation decisions, it can be important to remind clients that investments are meant to be held over the long run, and the potential for short-term loss shouldn’t be a major concern.

4. Mental accounting. In this case, loss aversion is directly related to a behavioral bias known as mental accounting, in which investors tend to separate their decisions for different accounts rather than regarding their holdings as one portfolio. This leads people to worry more about monetary losses incurred on individual securities rather than focusing on the purpose of holding the asset class in general, whether that is to lower volatility, increase diversification or generate income streams.

The bottom line is that when discussing interest rates with your clients, you may want to consider some of their behavioral biases when framing the discussion. Remind them that while interest rates may be rising, no one can predict where the market is going. Focusing on the whole portfolio over the long term and educating them about the nuances of fixed-income risks may help to alleviate some of the communication problems.

Mike West is senior partner and chief executive of BPV Capital Management.

Learn more about reprints and licensing for this article.