Why 2020 is a good year to give

Existing tax laws, the CARES Act, and election year uncertainty make it wise to be generous now in support of extraordinary needs

This year, we are living through a once-in-a-lifetime global pandemic, significant market volatility, and growing social concern and unrest. Despite these uncertain times, we are also witnessing truly historic levels of generosity from individuals who have significantly increased their giving to support those who have been most impacted by this challenging environment.

Schwab Charitable donors and their advisers have stepped up and responded in remarkable ways. During the first half of 2020, we saw a 46% increase in dollars granted and a 44% increase in the number of grants to charities compared to the prior year.

Other donor-advised funds have reported similar increases, and research has shown that giving from donor-advised funds tends to be resilient during economic downturns because dollars have already been set aside for a charitable purpose.

In addition, even with the recent market volatility, the S&P 500 index has roughly doubled in the last eight years and existing tax laws continue to encourage giving, providing additional benefits for clients who give appreciated noncash assets. Annual income tax deduction limits for gifts to public charities, including donor-advised funds, are 60% of adjusted gross income for contributions of cash, 30% of AGI for contributions of noncash assets held more than one year, and 50% of AGI for blended contributions of cash and noncash assets. Donation amounts in excess of these deduction limits may be carried over up to five tax years.

New tax incentives for charitable giving in 2020 came in March with passage of the CARES Act, which gives taxpayers who plan to take the standard deduction the option to claim an above-the-line deduction of up to $300 for cash contributions to operating charities. The CARES Act also gives donors who will itemize deductions an option to elect a 100% of AGI deduction limit for cash donations, and deduction amounts above this limit may be carried over for up to five years. With both options, the cash donations must be made directly to operating charities and cannot go to donor-advised funds, supporting organizations, or private foundations.

HOW TO HELP CLIENTS GIVE

While extraordinary needs will persist into 2021, the tax benefits of charitable giving may change after the presidential election, as the current administration and previous five administrations have overseen significant changes to the tax code. As clients contemplate how they might respond to the uncertainty of these unprecedented times during the remainder of 2020 and beyond, a few strategies are worth considering to help make their charitable giving both tax-smart and high-impact.

GIVE APPRECIATED NONCASH ASSETS

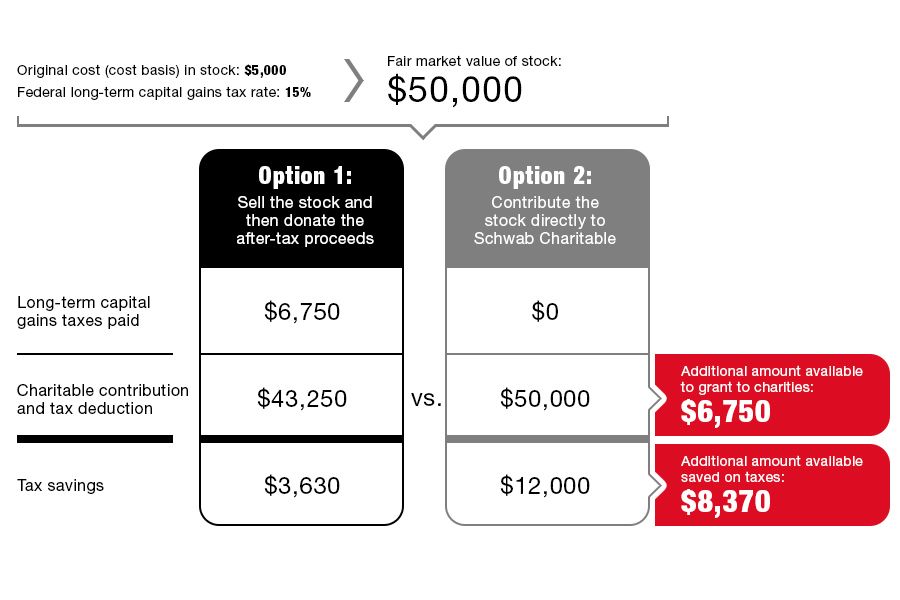

For clients who itemize deductions, appreciated noncash assets, such as stocks, ETFs and mutual funds held more than one year, may offer an additional tax benefit in comparison to cash donations. Beyond claiming a deduction for the fair market value of an asset, clients can potentially eliminate the capital gains tax they would incur if they sold the asset and donated the cash proceeds. This can mean even more going to charity and less to taxes, as shown in the example below.

The example above does not take into account any state or local taxes or the Medicare net investment income surtax. The tax savings shown is the tax deduction, multiplied by the donor’s income tax rate (24% in this example), minus the long-term capital gains taxes paid.

TAKE ADVANTAGE OF CHARITABLE DEDUCTION RULES, BUNCHING OPPORTUNITIES

Give up to and beyond existing limits and carry over the excess deduction. Donors who wish to itemize deductions for noncash assets, cash, or a combination of both may choose to give beyond the deduction limit and carry over the excess deduction for up to five years.

Bunch contributions. Some clients may find that the total of their itemized deductions is just below the level of the standard deduction. They may find it beneficial to bunch 2020 and 2021 charitable contributions into one year (2020), itemize their deductions on 2020 taxes, and take the standard deduction on 2021 taxes. In addition to achieving a large charitable impact in 2020, this strategy could produce a larger two-year deduction than two separate years of itemized charitable deductions, depending on income level, tax filing status and giving amounts each year.

Clients who bunched two or more years of contributions in 2019 and will subsequently take the standard deduction for 2020 may also consider taking the CARES Act’s $300 deduction for cash donations made to operating charities.

GIVE MORE BY LOOKING AT RETIREMENT ASSETS

Make a qualified charitable distribution of IRA assets. Whether they’re itemizing or claiming the standard deduction, individuals age 70 ½ and older can direct up to $100,000 per year tax-free from their individual retirement accounts to operating charities through QCDs. By reducing the IRA balance, a QCD may also reduce the donor’s taxable income in future years, lower the donor’s taxable estate and limit the IRA beneficiaries’ tax liability.

Use a charitable deduction to help offset the tax liability of a retirement account withdrawal. Those over age 59 ½ (to avoid an early withdrawal penalty) who take withdrawals from retirement plan accounts in 2020 may use deductions for their charitable donations to help offset income tax liability on the withdrawals. As with the above strategy, this offers the additional benefits of potentially reducing a client’s taxable estate and limiting tax liability for account beneficiaries.

Convert retirement accounts to Roth IRAs. Clients who have tax-deferred retirement accounts, such as traditional IRAs, can use charitable deductions to help offset the tax liability on the amount converted to a Roth IRA. The primary benefits of a Roth IRA are tax-free growth, potentially tax-free withdrawals (if holding period and age requirements are met), no annual required minimum distribution, and the elimination of tax liability for beneficiaries (depending on the timing). Financial advisers are well-positioned to help clients determine whether these benefits make sense for their individual situation.

WHAT TO DO NEXT

Advisers play an important role in helping their clients plan tax-smart giving that can increase a client’s charitable impact. At Schwab Charitable, three-quarters of donor-advised fund account assets are associated with a professional investment adviser.

There are plenty of resources and tools available online and in communities to help advisers throughout a client’s philanthropic journey. These include assistance with defining a charitable mission to making tax-smart account contributions, investing account assets for tax-free potential growth, and researching charities for grant recommendations.

A few potential starting points include the following:

- Charities recommended by the Center for Disaster Philanthropy for COVID-19 relief.

- A search tool for identifying community foundation-sponsored COVID-19 funds across the U.S.

- Schwab Charitable’s Giving with Impact podcast, where leading voices from across the charitable ecosystem engage in conversations about achieving more effective philanthropy.

Kim Laughton is president of Schwab Charitable.

Learn more about reprints and licensing for this article.